Region:Global

Author(s):Rebecca

Product Code:KRAA1403

Pages:85

Published On:August 2025

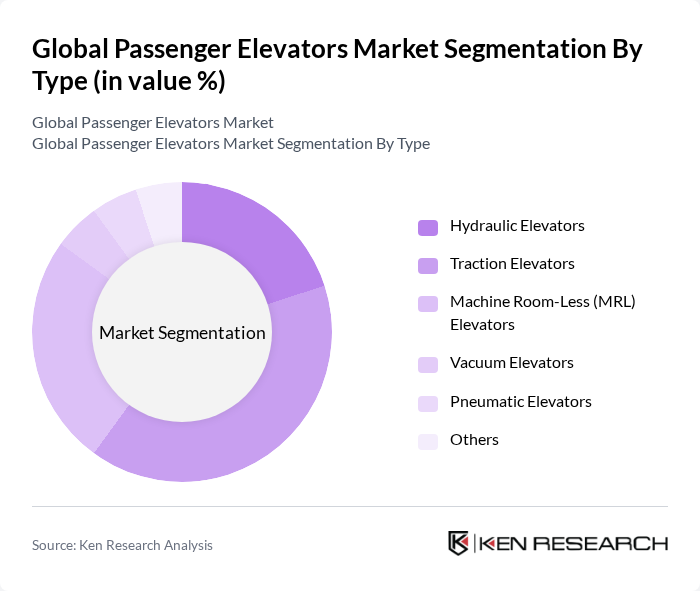

By Type:The passenger elevators market is segmented into various types, including **hydraulic elevators**, **traction elevators**, **machine room-less (MRL) elevators**, **vacuum elevators**, **pneumatic elevators**, and others. Each type serves different applications and consumer needs. Traction elevators are the most popular due to their efficiency, speed, and suitability for high-rise buildings. Machine room-less elevators are gaining traction for their space-saving design and energy efficiency, especially in modern urban developments. Hydraulic elevators are preferred for low- to mid-rise buildings due to their cost-effectiveness and ease of installation. Vacuum and pneumatic elevators are niche segments, primarily used in residential and low-rise applications for their minimal structural requirements and innovative design .

By End-User:The market is also segmented by end-user categories, including **residential**, **commercial**, **industrial**, **healthcare**, **government & utilities**, and **transportation hubs**. The residential segment is witnessing significant growth due to the increasing urban population and demand for multi-story buildings. Commercial and transportation hub segments are also expanding, driven by the need for efficient vertical transportation in office complexes, shopping malls, airports, and metro stations. Healthcare and industrial sectors require specialized elevator solutions for accessibility and operational efficiency .

The Global Passenger Elevators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Otis Elevator Company, Schindler Group, KONE Corporation, Thyssenkrupp AG, Mitsubishi Electric Corporation, Hitachi, Ltd., Fujitec Co., Ltd., Hyundai Elevator Co., Ltd., Toshiba Elevator and Building Systems Corporation, Sigma Elevator Company, Stannah Lifts Holdings Ltd., Orona S. Coop., TK Elevator GmbH, Cibes Lift Group AB, Hitachi Elevator (China) Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the passenger elevators market in Viet Nam appears promising, driven by technological advancements and a focus on sustainability. As urbanization continues to rise, the demand for efficient vertical transportation solutions will increase. Furthermore, the integration of smart technologies and energy-efficient systems will likely reshape the market landscape. Stakeholders must adapt to evolving consumer preferences and regulatory requirements to capitalize on emerging trends and maintain competitive advantages in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydraulic Elevators Traction Elevators Machine Room-Less (MRL) Elevators Vacuum Elevators Pneumatic Elevators Others |

| By End-User | Residential Commercial Industrial Healthcare Government & Utilities Transportation Hubs |

| By Application | High-Rise Buildings Shopping Malls Hospitals Airports Metro/Railway Stations Hotels Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Domestic Distribution International Distribution E-commerce Platforms Others |

| By Price Range | Economy Mid-Range Premium |

| By Maintenance Type | Preventive Maintenance Predictive Maintenance Corrective Maintenance Remote Monitoring & Diagnostics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Elevator Installations | 90 | Homeowners, Real Estate Developers |

| Commercial Building Elevators | 80 | Facility Managers, Building Owners |

| Industrial Elevator Solutions | 50 | Operations Managers, Plant Engineers |

| Smart Elevator Technologies | 40 | Technology Managers, Innovation Managers |

| Elevator Maintenance Services | 60 | Service Managers, Maintenance Supervisors |

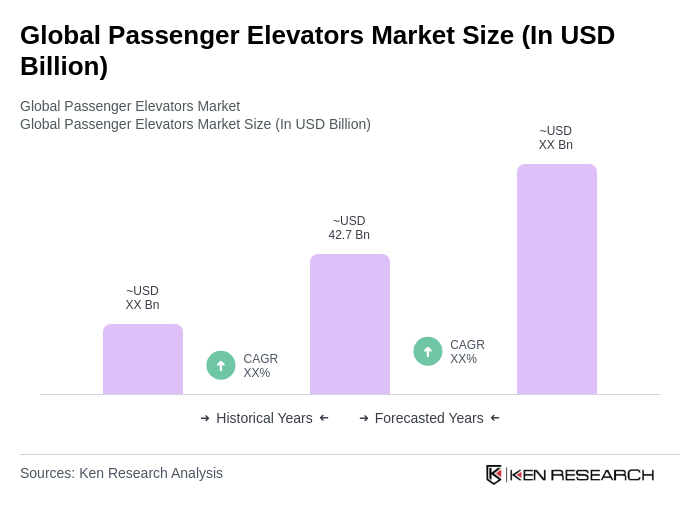

The Global Passenger Elevators Market is valued at approximately USD 42.7 billion, driven by urbanization, increasing construction activities, and the demand for high-rise buildings. This growth reflects significant investments in infrastructure, particularly in developing regions.