Region:Global

Author(s):Geetanshi

Product Code:KRAD0039

Pages:80

Published On:August 2025

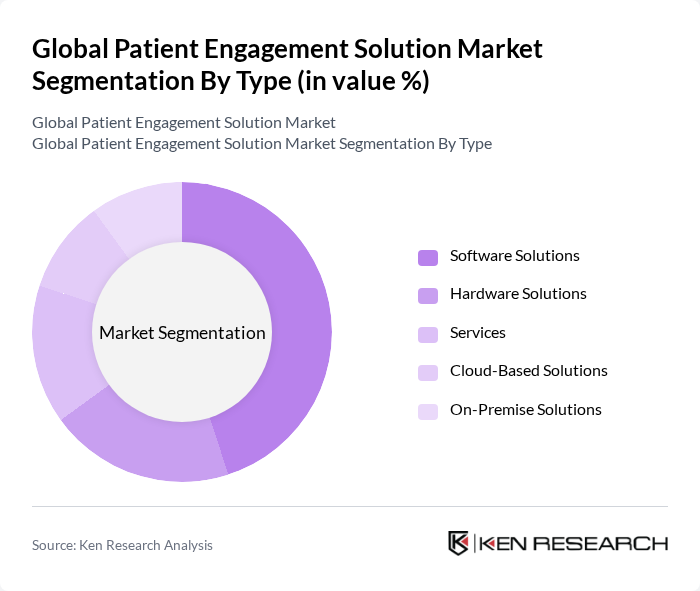

By Type:The market is segmented into Software Solutions, Hardware Solutions, Services, Cloud-Based Solutions, and On-Premise Solutions. Among these, Software Solutions dominate the market due to their ability to provide comprehensive patient engagement functionalities, including communication, scheduling, and health management. The increasing reliance on digital platforms for healthcare delivery has led to a surge in demand for software solutions that enhance patient-provider interactions. Cloud-based solutions are also witnessing rapid growth, driven by their scalability, cost-effectiveness, and ease of integration with existing healthcare IT systems .

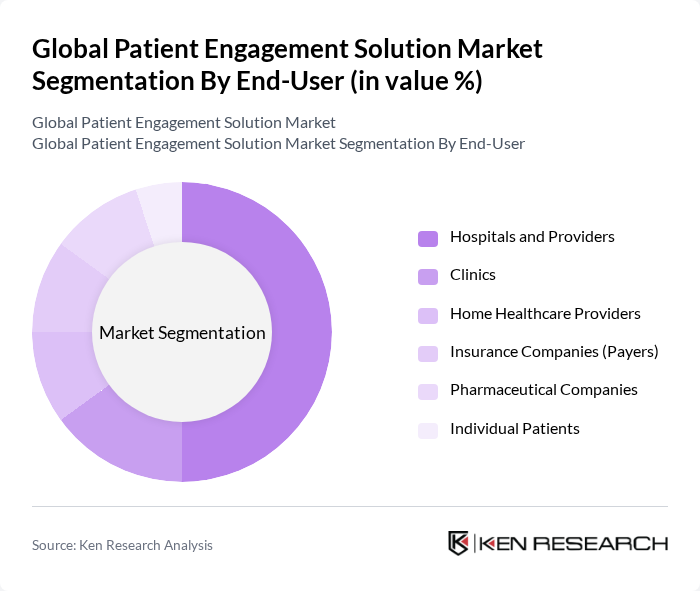

By End-User:The end-user segmentation includes Hospitals and Providers, Clinics, Home Healthcare Providers, Insurance Companies (Payers), Pharmaceutical Companies, and Individual Patients. Hospitals and Providers are the leading end-users, driven by the need for efficient patient management systems that improve care delivery and operational efficiency. The increasing focus on patient-centered care, regulatory mandates for digital health record adoption, and the need for seamless patient communication have further solidified their position as the primary consumers of patient engagement solutions. Home healthcare providers and payers are also increasing their adoption to support remote monitoring and value-based care initiatives .

The Global Patient Engagement Solution Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Cerner, Allscripts Healthcare, LLC, McKesson Corporation, Koninklijke Philips N.V. (Philips Healthcare), Epic Systems Corporation, Medtronic plc, athenahealth, Inc., Health Catalyst, Inc., NextGen Healthcare, Inc., IBM (Watson Health), Siemens Healthineers AG, GE HealthCare Technologies Inc., Oracle Corporation, Microsoft Corporation, Salesforce, Inc., ResMed Inc., Solutionreach, Inc., Klara Technologies, Inc., CPSI, Ltd., Nuance Communications, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of patient engagement solutions in the None region is poised for significant transformation, driven by technological advancements and evolving healthcare models. As value-based care becomes more prevalent, healthcare providers will increasingly prioritize patient engagement to improve outcomes and reduce costs. Additionally, the integration of artificial intelligence and machine learning will enhance personalized care, enabling more effective patient interactions. These trends will create a dynamic landscape for patient engagement solutions, fostering innovation and collaboration among stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Software Solutions Hardware Solutions Services Cloud-Based Solutions On-Premise Solutions |

| By End-User | Hospitals and Providers Clinics Home Healthcare Providers Insurance Companies (Payers) Pharmaceutical Companies Individual Patients |

| By Application | Appointment Scheduling Medication Management Patient Education Remote Monitoring Health Management Social and Behavioral Management Financial Health Management |

| By Distribution Channel | Direct Sales Online Sales Third-Party Distributors |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Customer Type | Individual Patients Healthcare Providers Corporate Clients |

| By Therapeutic Area | Chronic Diseases Women’s Health Fitness & Wellness Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Provider Engagement Strategies | 60 | Healthcare Administrators, Patient Experience Officers |

| Patient Engagement Technology Adoption | 50 | IT Managers, Digital Health Coordinators |

| Telehealth Service Utilization | 40 | Telehealth Program Directors, Clinical Staff |

| Patient Feedback Mechanisms | 45 | Quality Improvement Managers, Patient Advocacy Representatives |

| Health Information Exchange Participation | 55 | Health Information Managers, Data Analysts |

The Global Patient Engagement Solution Market is valued at approximately USD 25 billion, driven by the increasing adoption of digital health technologies and the need for improved healthcare outcomes. This growth reflects a significant trend towards enhancing patient-provider communication and engagement.