Region:Global

Author(s):Geetanshi

Product Code:KRAA2342

Pages:81

Published On:August 2025

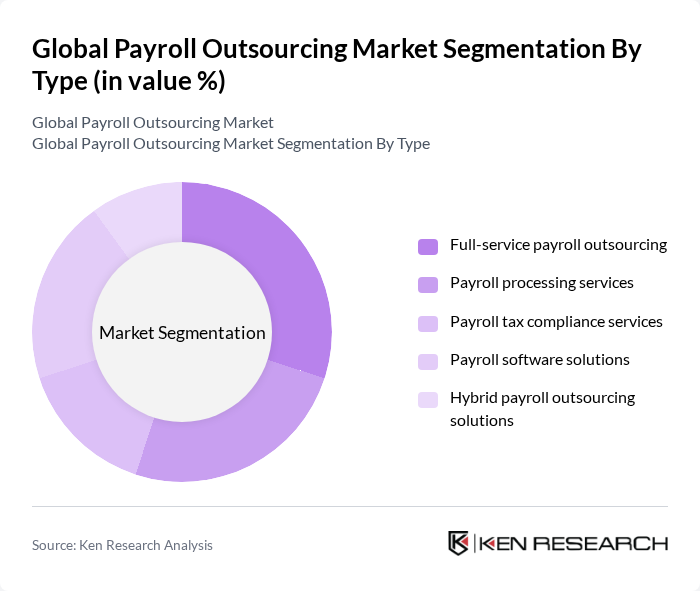

By Type:The market is segmented into various types of payroll outsourcing services, including full-service payroll outsourcing, payroll processing services, payroll tax compliance services, payroll software solutions, and hybrid payroll outsourcing solutions. Each of these sub-segments caters to different business needs and operational scales. Cloud-based payroll solutions and integrated payroll and benefits administration are increasingly prominent, reflecting the market’s shift toward digital transformation and holistic HR management .

The full-service payroll outsourcing segment is currently dominating the market due to its comprehensive nature, which appeals to businesses looking for a one-stop solution for all payroll needs. This segment is particularly favored by large enterprises that require extensive payroll management, including tax compliance and reporting. The increasing complexity of payroll regulations and the need for accuracy in payroll processing further drive the demand for full-service solutions .

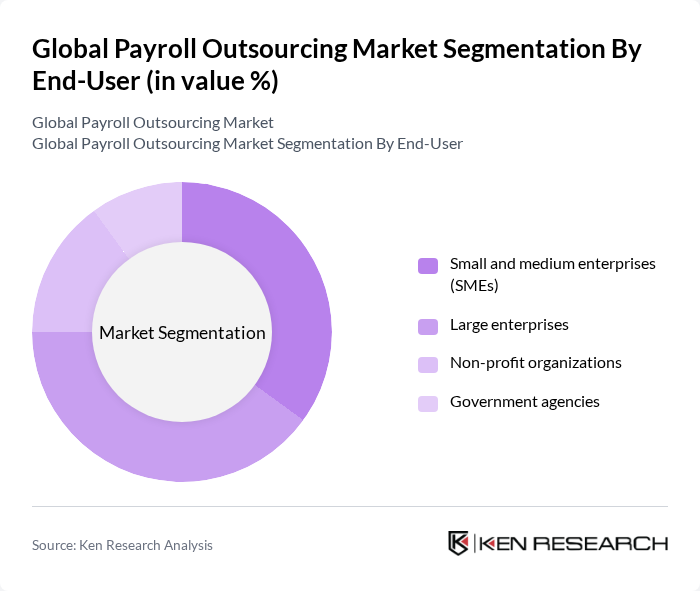

By End-User:The market is segmented by end-users, including small and medium enterprises (SMEs), large enterprises, non-profit organizations, and government agencies. Each segment has unique requirements and preferences for payroll outsourcing services. SMEs are increasingly adopting cloud-based payroll solutions for flexibility and scalability, while large enterprises demand robust compliance and multi-jurisdictional capabilities .

Large enterprises are the leading end-user segment in the payroll outsourcing market. Their complex payroll needs, often involving multiple jurisdictions and compliance requirements, necessitate specialized services that can handle large volumes of data efficiently. Additionally, large companies are more likely to invest in comprehensive payroll solutions to ensure accuracy and compliance, which further solidifies their dominance in this segment .

The Global Payroll Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ADP, Inc., Paychex, Inc., Ceridian HCM Holding Inc., UKG Inc. (Ultimate Kronos Group), Gusto, Inc., Paycor HCM, Inc., TriNet Group, Inc., Insperity, Inc., Zenefits (now part of TriNet), CloudPay Inc., Xero Limited, Intuit Inc., SAP SE, Workday, Inc., Deloitte Touche Tohmatsu Limited, IBM Corporation, Infosys Ltd., HCL Technologies Ltd., KPMG International Limited, HRMantra Software Private Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the payroll outsourcing market is poised for significant transformation, driven by technological advancements and evolving workforce dynamics. As businesses increasingly adopt cloud-based solutions, the demand for real-time payroll processing will rise, enhancing employee satisfaction. Furthermore, the integration of AI and machine learning technologies will streamline payroll operations, allowing for greater accuracy and efficiency. Companies will also prioritize data security, ensuring compliance with stringent regulations while adapting to the complexities of a global workforce.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-service payroll outsourcing Payroll processing services Payroll tax compliance services Payroll software solutions Hybrid payroll outsourcing solutions |

| By End-User | Small and medium enterprises (SMEs) Large enterprises Non-profit organizations Government agencies |

| By Service Model | On-premise solutions Cloud-based solutions Hybrid solutions |

| By Industry | Healthcare Retail Manufacturing Technology Banking, Financial Services, and Insurance (BFSI) Others |

| By Geographic Scope | North America Europe Asia Pacific Latin America Middle East & Africa |

| By Payment Frequency | Monthly payroll Bi-weekly payroll Weekly payroll |

| By Compliance Type | Tax compliance Labor law compliance Data protection compliance Multi-country compliance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Payroll Outsourcing | 100 | HR Managers, Business Owners |

| Large Enterprise Payroll Solutions | 90 | Chief Financial Officers, Payroll Directors |

| Industry-Specific Payroll Services | 70 | Industry Specialists, Compliance Officers |

| Global Payroll Management | 80 | Global HR Directors, Payroll Administrators |

| Payroll Technology Adoption | 60 | IT Managers, Payroll Software Developers |

The Global Payroll Outsourcing Market is valued at approximately USD 12 billion, reflecting a significant growth trend driven by the increasing complexity of payroll regulations and the demand for cost-effective payroll solutions among businesses of all sizes.