Global Pc And Laptops Mlcc Market Overview

- The Global PC and Laptops MLCC market is valued at USD 840 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for high-performance computing devices, rapid advancements in miniaturization and power efficiency, and the rising trend of remote work and online education. The proliferation of smart devices, 5G technology, and the need for efficient power management solutions have further fueled the market's expansion.

- Key players in this market include the United States, China, Japan, South Korea, and Taiwan. These countries dominate the market due to their advanced technological infrastructure, significant investments in research and development, robust manufacturing bases, and the presence of major electronics companies. High consumer demand for innovative products and continuous innovation in electronic component design further contribute to their market leadership.

- In 2023, the European Union implemented regulations aimed at enhancing the energy efficiency of electronic devices, including PCs and laptops. These regulations require manufacturers to comply with strict energy consumption standards, promoting the use of energy-efficient components such as MLCCs. The initiative is designed to reduce the overall carbon footprint of electronic devices and encourage sustainable practices within the industry.

Global Pc And Laptops Mlcc Market Segmentation

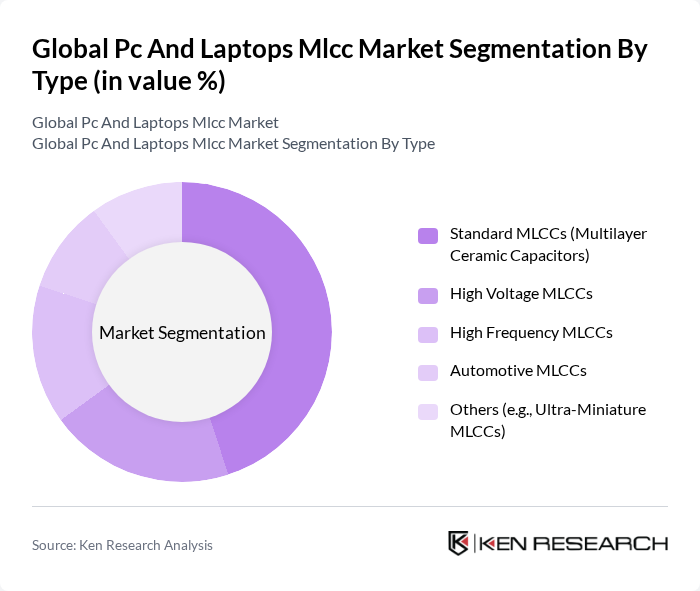

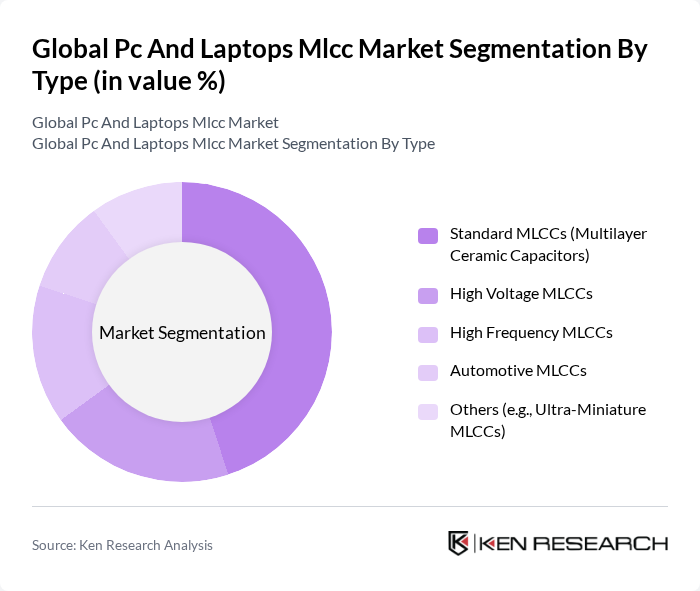

By Type:The market is segmented into various types of MLCCs, including Standard MLCCs, High Voltage MLCCs, High Frequency MLCCs, Automotive MLCCs, and Others (such as Ultra-Miniature MLCCs). Standard MLCCs hold the largest share due to their broad application in consumer electronics and personal computing devices. Their versatility, cost-effectiveness, and reliability make them the preferred choice for manufacturers. High Voltage and High Frequency MLCCs are gaining traction, especially in applications requiring enhanced performance and miniaturization, such as 5G-enabled laptops and advanced workstations.

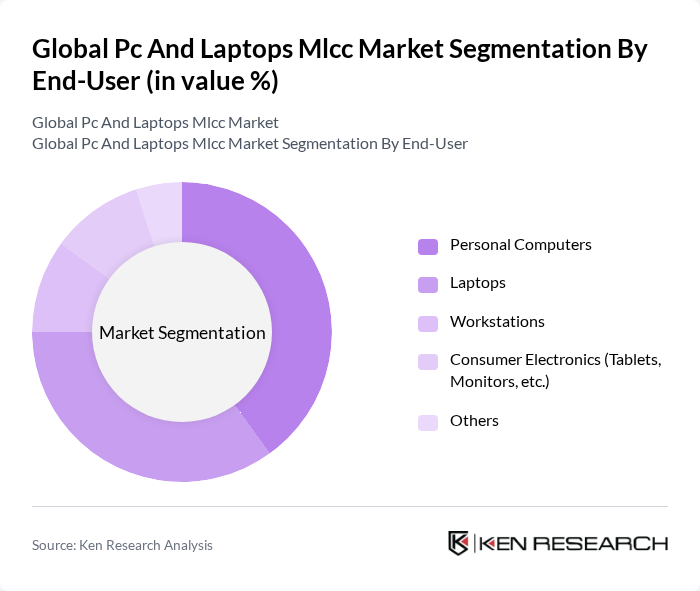

By End-User:The end-user segmentation includes Personal Computers, Laptops, Workstations, Consumer Electronics (Tablets, Monitors, etc.), and Others. Personal Computers and Laptops are the leading segments, driven by the increasing demand for personal and professional computing solutions. The surge in remote work, online learning, and gaming has significantly boosted the sales of these devices, leading to a higher demand for MLCCs. Consumer electronics also represent a growing segment, as manufacturers focus on enhancing device performance, energy efficiency, and miniaturization.

Global Pc And Laptops Mlcc Market Competitive Landscape

The Global PC and Laptops MLCC market is characterized by a dynamic mix of regional and international players. Leading participants such as Murata Manufacturing Co., Ltd., TDK Corporation, Samsung Electro-Mechanics, Yageo Corporation, Taiyo Yuden Co., Ltd., Vishay Intertechnology, Inc., KEMET Corporation, AVX Corporation (now Kyocera AVX Components Corporation), Panasonic Corporation, Nichicon Corporation, Walsin Technology Corporation, Chaozhou Three-Circle (Group) Co., Ltd., Nitto Denko Corporation, ROHM Co., Ltd., Kyocera Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Global Pc And Laptops Mlcc Market Industry Analysis

Growth Drivers

- Increasing Demand for High-Performance Electronics:The global demand for high-performance electronics is projected to reach $1.5 trillion, driven by advancements in computing power and consumer preferences for faster devices. This surge is particularly evident in sectors like gaming and professional computing, where MLCCs are essential for efficient power management. The rise in remote work and online education has further accelerated this demand, with a notable increase in laptop sales, which reached 240 million units, highlighting the need for advanced electronic components.

- Technological Advancements in MLCC Manufacturing:Innovations in MLCC manufacturing processes have led to a significant increase in production efficiency, with output rising by 20% annually. The introduction of automated production lines and advanced materials has reduced manufacturing costs, allowing companies to meet the growing demand for compact and high-capacity capacitors. In future, the global MLCC production capacity is expected to exceed 1 trillion units, driven by these technological advancements, which enhance product reliability and performance in electronic devices.

- Rising Adoption of Electric Vehicles:The electric vehicle (EV) market is anticipated to grow to 30 million units, significantly boosting the demand for MLCCs used in battery management systems and power electronics. As EV manufacturers increasingly integrate advanced electronic components to enhance vehicle performance and safety, the need for high-quality MLCCs becomes critical. This trend is supported by government incentives for EV adoption, with over $7 billion allocated in future for infrastructure development, further driving the demand for reliable electronic components.

Market Challenges

- Supply Chain Disruptions:The MLCC market faces significant supply chain challenges, exacerbated by geopolitical tensions and the COVID-19 pandemic. In future, disruptions are expected to result in a 15% decrease in component availability, impacting production timelines across various sectors. Companies are struggling to secure raw materials, leading to increased lead times and production costs. This instability poses a risk to manufacturers who rely on timely access to MLCCs for their electronic products, potentially affecting overall market growth.

- Fluctuating Raw Material Prices:The prices of key raw materials for MLCC production, such as tantalum and nickel, have seen significant volatility, with increases of up to 30%. This fluctuation is driven by supply constraints and rising global demand, particularly from the electronics and automotive sectors. In future, manufacturers may face challenges in maintaining profit margins as they navigate these price changes, which could lead to higher costs for consumers and impact the overall competitiveness of MLCC products in the market.

Global Pc And Laptops Mlcc Market Future Outlook

The future of the MLCC market in the PC and laptops sector appears promising, driven by ongoing technological advancements and increasing consumer demand for high-performance devices. As manufacturers continue to innovate, the integration of AI in production processes is expected to enhance efficiency and product quality. Additionally, the shift towards sustainable practices will likely lead to the development of eco-friendly MLCCs, aligning with global sustainability goals. These trends indicate a robust growth trajectory for the MLCC market, with significant opportunities for investment and expansion.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia and Africa, present significant growth opportunities for MLCC manufacturers. With increasing urbanization and rising disposable incomes, the demand for consumer electronics is expected to surge, creating a market potential of over $200 billion. Companies that strategically enter these markets can capitalize on the growing need for advanced electronic components, positioning themselves for long-term success.

- Development of Eco-Friendly MLCCs:The growing focus on sustainability is driving the development of eco-friendly MLCCs, which utilize recyclable materials and environmentally friendly manufacturing processes. This trend is supported by regulatory incentives, with governments worldwide investing over $5 billion in green technology initiatives in future. Companies that prioritize sustainability in their product offerings can enhance their market appeal and meet the increasing consumer demand for environmentally responsible electronics.