Region:Global

Author(s):Shubham

Product Code:KRAC0793

Pages:92

Published On:August 2025

Market.png)

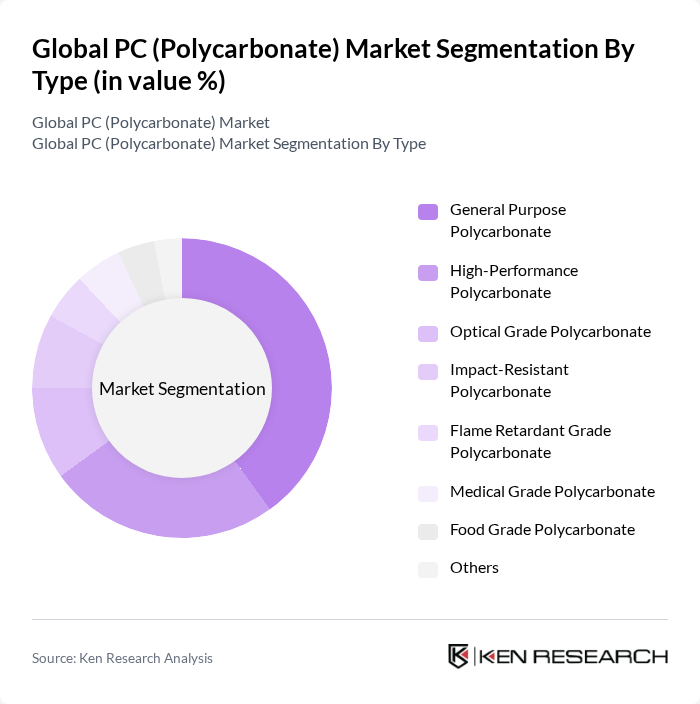

By Type:The polycarbonate market is segmented into General Purpose Polycarbonate, High-Performance Polycarbonate, Optical Grade Polycarbonate, Impact-Resistant Polycarbonate, Flame Retardant Grade Polycarbonate, Medical Grade Polycarbonate, Food Grade Polycarbonate, and Others. General Purpose Polycarbonate is the most widely used due to its cost-effectiveness and versatility in applications such as consumer goods, automotive components, and construction materials. High-Performance Polycarbonate is increasingly adopted in specialized applications requiring enhanced durability, flame resistance, and thermal stability, particularly in electronics, aerospace, and medical sectors .

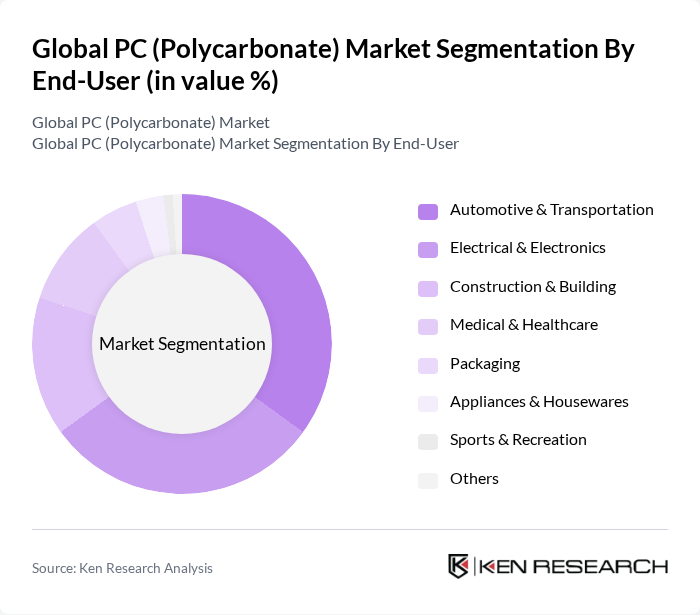

By End-User:The end-user segments of the polycarbonate market include Automotive & Transportation, Electrical & Electronics, Construction & Building, Medical & Healthcare, Packaging, Appliances & Housewares, Sports & Recreation, and Others. Automotive & Transportation is the leading end-user, driven by the demand for lightweight materials that improve fuel efficiency, safety, and design flexibility. The Electrical & Electronics segment is also significant, as polycarbonate is widely used in the production of housings, connectors, and battery enclosures due to its high impact resistance and thermal stability. The construction sector is experiencing increased adoption of polycarbonate in glazing, roofing, and insulation applications .

The Global PC (Polycarbonate) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Covestro AG, SABIC, Teijin Limited, Mitsubishi Engineering-Plastics Corporation, LG Chem, Trinseo S.A., Idemitsu Kosan Co., Ltd., Chi Mei Corporation, LOTTE Chemical Corporation, Plaskolite LLC, Palram Industries Ltd., Polygal Plastics Industries Ltd., Polycasa N.V., Samyang Corporation, and Thai Polycarbonate Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polycarbonate market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in recycling technologies are expected to enhance the lifecycle of polycarbonate products, making them more appealing to environmentally conscious consumers. Additionally, the integration of smart technologies in manufacturing processes will likely improve efficiency and reduce waste, positioning polycarbonate as a key material in future applications across various industries, including automotive and construction.

| Segment | Sub-Segments |

|---|---|

| By Type | General Purpose Polycarbonate High-Performance Polycarbonate Optical Grade Polycarbonate Impact-Resistant Polycarbonate Flame Retardant Grade Polycarbonate Medical Grade Polycarbonate Food Grade Polycarbonate Others |

| By End-User | Automotive & Transportation Electrical & Electronics Construction & Building Medical & Healthcare Packaging Appliances & Housewares Sports & Recreation Others |

| By Application | Safety Equipment Automotive Parts Electrical Components Optical Media Lenses & Lighting Fixtures Packaging Materials Medical Devices Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Sheets Films Blends Tubes Rods Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Managers, Procurement Specialists |

| Electronics Manufacturing | 80 | Supply Chain Managers, Design Engineers |

| Construction Industry Usage | 70 | Project Managers, Architects |

| Medical Device Applications | 50 | Regulatory Affairs Specialists, Quality Control Managers |

| Consumer Goods Sector | 90 | Marketing Managers, Product Development Leads |

The Global PC (Polycarbonate) Market is valued at approximately USD 15 billion, reflecting a five-year historical analysis. This growth is driven by the increasing demand for lightweight and durable materials across various industries, including automotive, electronics, and construction.