Region:Global

Author(s):Geetanshi

Product Code:KRAB0164

Pages:88

Published On:August 2025

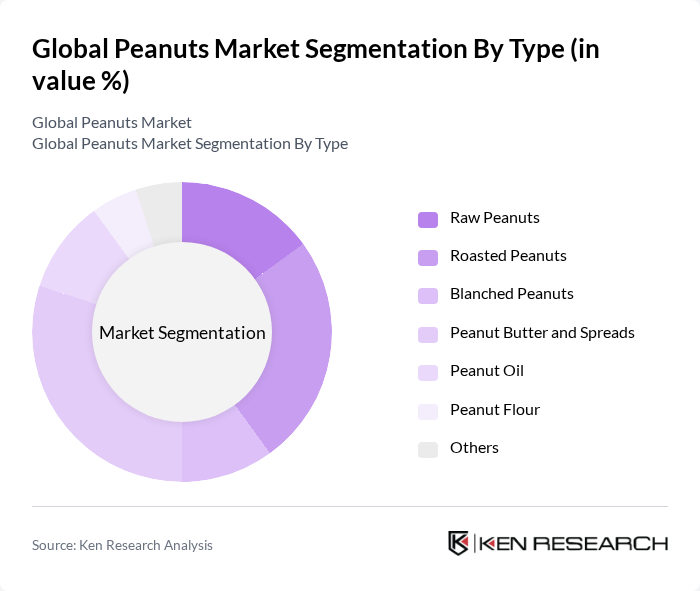

By Type:The market is segmented into Raw Peanuts, Roasted Peanuts, Blanched Peanuts, Peanut Butter and Spreads, Peanut Oil, Peanut Flour, and Others. Each of these subsegments caters to different consumer preferences and applications, with specific trends influencing their market performance. Raw and roasted peanuts are primarily consumed as snacks and ingredients in culinary dishes, while peanut butter and spreads have seen robust growth due to rising health consciousness and demand for plant-based protein. Peanut oil is widely used in cooking and food processing, and peanut flour is gaining traction as a gluten-free ingredient in bakery and snack products.

By End-User:The end-user segmentation includes the Food Industry, Snack Manufacturers, Confectionery Producers, Retail Consumers, and the Animal Feed Industry. Each segment plays a crucial role in the overall demand for peanuts, with varying consumption patterns and preferences. The food industry and snack manufacturers represent the largest share, driven by the incorporation of peanuts in processed foods, snacks, and confectionery products. Retail consumers are increasingly seeking healthier snack alternatives, while the animal feed industry utilizes peanut byproducts for livestock nutrition.

The Global Peanuts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company, Olam International Limited, Golden Peanut and Tree Nuts, LLC, The J.M. Smucker Company, Intersnack Group GmbH & Co. KG, Wilco Peanut Company, LLC, Select Harvests Limited, Agri-Export, LLC, Sun Valley Foods (Pty) Ltd, American Peanut Council, Cargill, Incorporated, Bunge Limited, Hain Celestial Group, Inc., Conagra Brands, Inc., Marico Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the peanut market appears promising, driven by increasing health awareness and the demand for sustainable food sources. Innovations in peanut-based products, such as flavored snacks and fortified options, are expected to attract a broader consumer base. Additionally, the expansion of e-commerce channels will facilitate access to peanut products, enhancing market penetration. As consumers prioritize nutrition and convenience, the peanut market is well-positioned for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Raw Peanuts Roasted Peanuts Blanched Peanuts Peanut Butter and Spreads Peanut Oil Peanut Flour Others |

| By End-User | Food Industry Snack Manufacturers Confectionery Producers Retail Consumers Animal Feed Industry |

| By Application | Direct Consumption/Culinary Purpose Bakery and Confectionery Peanut Butter and Spreads Peanut Bars and Snacks Dairy Products Oil Production Nutraceuticals Cosmetics Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Specialty Stores E-Commerce/Online Retail Direct Sales |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Peanut Farmers | 100 | Farm Owners, Agricultural Managers |

| Processing Facilities | 60 | Plant Managers, Quality Control Supervisors |

| Retail Distributors | 50 | Distribution Managers, Sales Executives |

| Exporters and Importers | 40 | Trade Compliance Officers, Logistics Coordinators |

| Consumer Insights | 80 | Health-conscious Consumers, Food Industry Analysts |

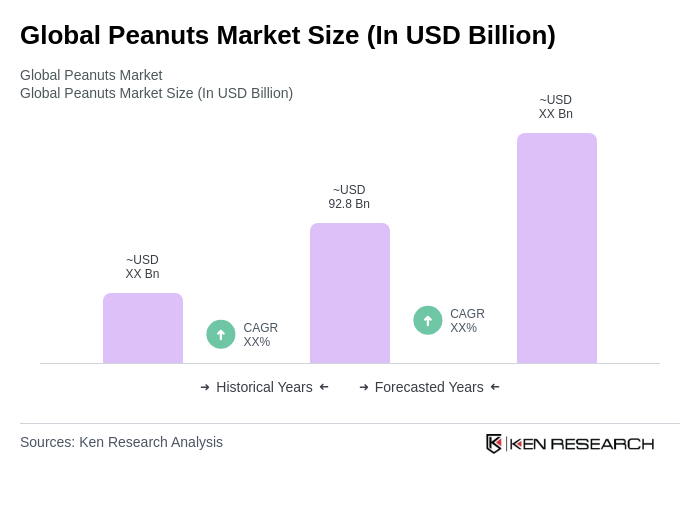

The Global Peanuts Market is valued at approximately USD 92.8 billion, driven by increasing consumer demand for healthy snacks and the rising popularity of peanut-based products. This growth reflects a significant trend towards nutritious and versatile food options.