Region:Global

Author(s):Rebecca

Product Code:KRAB0186

Pages:88

Published On:August 2025

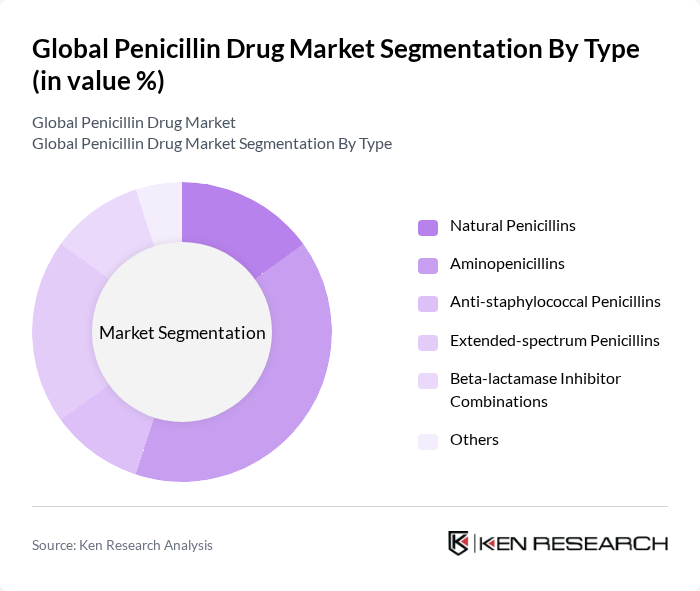

By Type:The penicillin drug market is segmented into Natural Penicillins, Aminopenicillins, Anti-staphylococcal Penicillins, Extended-spectrum Penicillins, Beta-lactamase Inhibitor Combinations, and Others. Among these, Aminopenicillins are currently leading the market due to their broad-spectrum efficacy and frequent use in treating a wide range of infections. The increasing awareness of antibiotic resistance has also led to a rise in demand for these drugs, as they are often prescribed for their effectiveness against resistant bacterial strains .

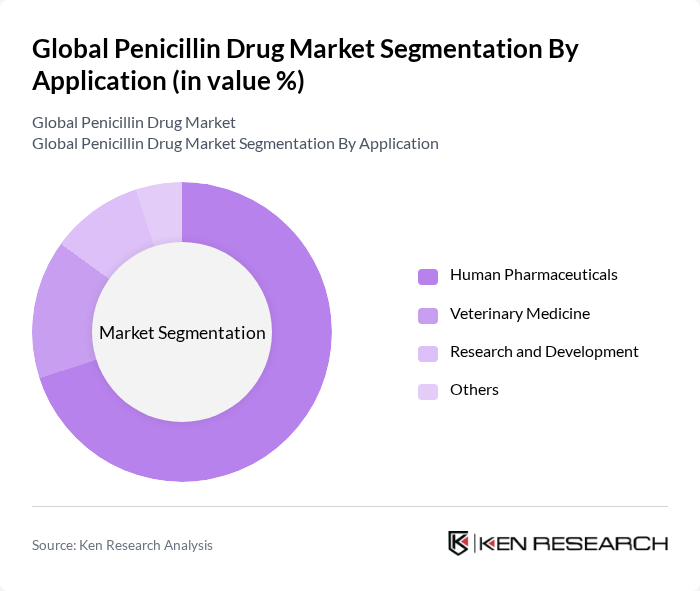

By Application:The applications of penicillin drugs are primarily categorized into Human Pharmaceuticals, Veterinary Medicine, Research and Development, and Others. The Human Pharmaceuticals segment is the dominant application area, driven by the high incidence of bacterial infections and the widespread prescription of antibiotics in healthcare settings. The growing focus on preventive healthcare and increased awareness of antibiotic treatments among patients further contribute to the dominance of this segment .

The Global Penicillin Drug Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., GlaxoSmithKline plc, Novartis AG, Sanofi S.A., Merck & Co., Inc., AstraZeneca plc, Johnson & Johnson, Teva Pharmaceutical Industries Ltd., Sandoz International GmbH, Hikma Pharmaceuticals PLC, Aurobindo Pharma Ltd., Cipla Ltd., Sun Pharmaceutical Industries Ltd., Lupin Limited, Zhejiang Huahai Pharmaceutical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the penicillin drug market appears promising, driven by increasing investments in research and development, particularly in antibiotic innovation. As healthcare systems globally prioritize combating antibiotic resistance, there will be a greater emphasis on developing new penicillin derivatives. Additionally, the expansion into emerging markets will provide significant growth opportunities, as these regions continue to enhance their healthcare infrastructure and access to essential medications, fostering a more robust demand for penicillin products.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Penicillins Aminopenicillins Anti-staphylococcal Penicillins Extended-spectrum Penicillins Beta-lactamase Inhibitor Combinations Others |

| By Application | Human Pharmaceuticals Veterinary Medicine Research and Development Others |

| By End-User | Hospitals Clinics Research Institutes Veterinary Clinics Home Healthcare Others |

| By Distribution Channel | Retail Pharmacies Online Pharmacies Hospital Pharmacies Drug Stores & Chemical Stores Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Packaging Type | Bottles Blister Packs Vials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Pharmacy Management | 100 | Pharmacy Directors, Clinical Pharmacists |

| General Practitioner Insights | 60 | General Practitioners, Family Medicine Doctors |

| Antibiotic Resistance Research | 50 | Infectious Disease Specialists, Microbiologists |

| Pharmaceutical Manufacturing | 70 | Production Managers, Quality Control Analysts |

| Regulatory Affairs in Pharmaceuticals | 40 | Regulatory Affairs Managers, Compliance Officers |

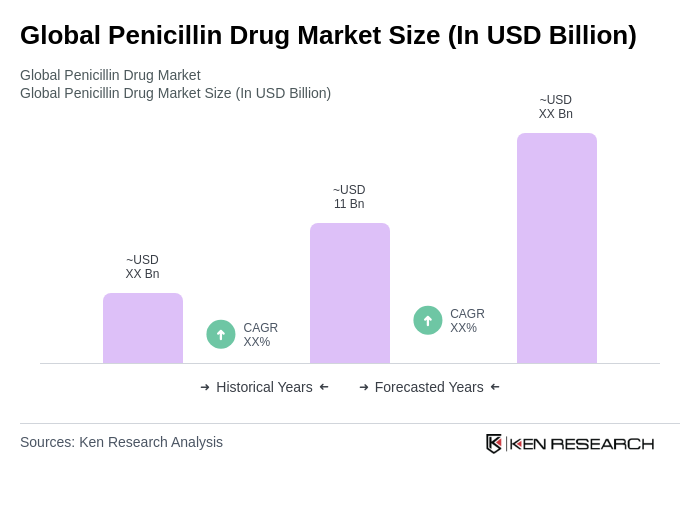

The Global Penicillin Drug Market is valued at approximately USD 11 billion, reflecting a significant increase driven by the rising prevalence of bacterial infections and the demand for effective antibiotics.