Region:Global

Author(s):Geetanshi

Product Code:KRAB0053

Pages:89

Published On:August 2025

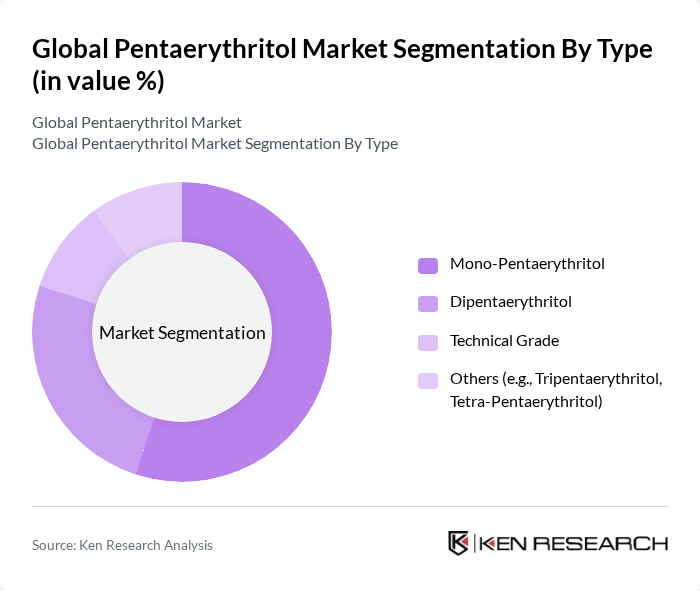

By Type:

The pentaerythritol market is segmented into four main types: Mono-Pentaerythritol, Dipentaerythritol, Technical Grade, and Others (including Tripentaerythritol and Tetra-Pentaerythritol). Among these, Mono-Pentaerythritol is the leading subsegment due to its extensive use in the production of alkyd resins, which are widely utilized in paints and coatings. The demand for high-performance coatings in the automotive and construction sectors continues to propel the growth of this subsegment. Dipentaerythritol follows closely, primarily used in the production of high-quality varnishes and adhesives, making it a significant contributor to the market as well .

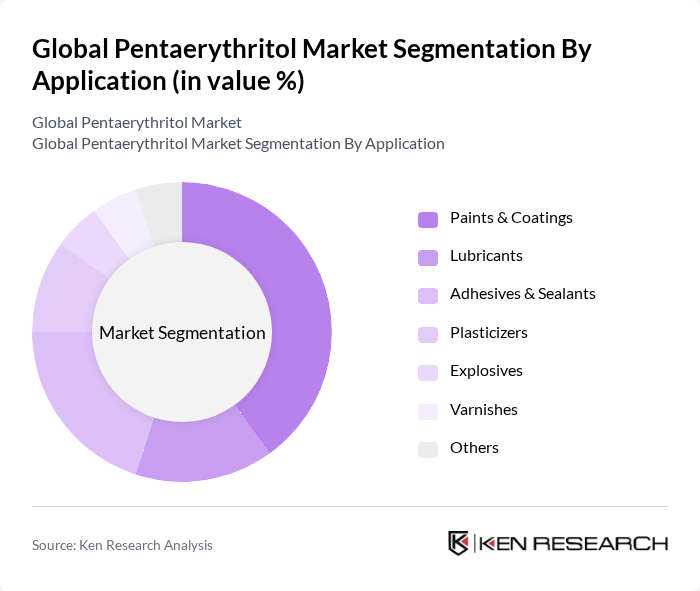

By Application:

The applications of pentaerythritol are diverse, including Paints & Coatings, Lubricants, Adhesives & Sealants, Plasticizers, Explosives, Varnishes, and Others. The Paints & Coatings segment holds the largest market share, driven by the increasing demand for high-performance and environmentally friendly coatings in industries such as automotive and construction. The trend towards durable, low-VOC, and sustainable coatings has further enhanced the growth of this segment. Adhesives & Sealants also represent a significant portion of the market, as they are essential in various applications, including construction and automotive manufacturing .

The Global Pentaerythritol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Perstorp Holding AB, BASF SE, Eastman Chemical Company, Mitsubishi Gas Chemical Company, Inc., Evonik Industries AG, Ercros S.A., Hubei Yihua Chemical Industry Co., Ltd., Jiangsu Jiujiu Chemical Co., Ltd., Shandong Huachang Chemical Co., Ltd., Zhejiang Jianye Chemical Co., Ltd., Anhui Jinhe Industrial Co., Ltd., Hunan Jisheng Chemical Co., Ltd., TCI Chemicals (India) Pvt. Ltd., Hubei Jusheng Technology Co., Ltd., Kanoria Chemicals & Industries Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pentaerythritol market appears promising, driven by increasing demand across various sectors, particularly coatings and automotive. Innovations in production technology are expected to enhance efficiency and reduce costs, while the shift towards sustainable practices will likely open new avenues for growth. As companies invest in research and development, the market is poised to adapt to changing consumer preferences, ensuring a robust trajectory in the coming years, particularly in emerging markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Mono-Pentaerythritol Dipentaerythritol Technical Grade Others (e.g., Tripentaerythritol, Tetra-Pentaerythritol) |

| By Application | Paints & Coatings Lubricants Adhesives & Sealants Plasticizers Explosives Varnishes Others |

| By End-User | Automotive Construction Chemicals Pharmaceuticals Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada) Europe (Germany, France, UK, Spain, Italy, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Australia, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Packaging Type | Bulk Packaging Small Packaging Others |

| By Purity | Up to 95% Purity %–98% Purity Above 98% Purity |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pentaerythritol in Coatings | 100 | Product Managers, R&D Chemists |

| Pentaerythritol in Plastics | 80 | Manufacturing Engineers, Quality Control Managers |

| Pentaerythritol in Pharmaceuticals | 70 | Regulatory Affairs Specialists, Formulation Scientists |

| Pentaerythritol in Explosives | 40 | Safety Officers, Production Supervisors |

| Pentaerythritol in Adhesives | 90 | Application Engineers, Product Development Managers |

The Global Pentaerythritol Market is valued at approximately USD 2.8 billion, driven by increasing demand in applications such as paints, coatings, and adhesives, particularly in the construction and automotive industries.