Region:Global

Author(s):Shubham

Product Code:KRAC0642

Pages:89

Published On:August 2025

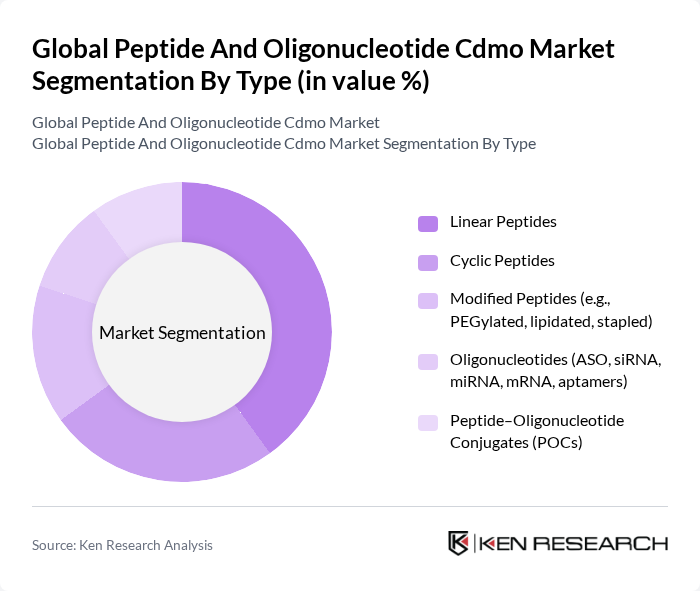

By Type:The market is segmented into various types, including Linear Peptides, Cyclic Peptides, Modified Peptides, Oligonucleotides, and Peptide-Oligonucleotide Conjugates. Among these, Linear Peptides are currently the most dominant segment due to their extensive applications in therapeutics and diagnostics. The simplicity of their synthesis and the growing demand for peptide-based drugs contribute to their market leadership. Cyclic Peptides and Modified Peptides are also gaining traction, driven by their enhanced stability and efficacy in drug formulations .

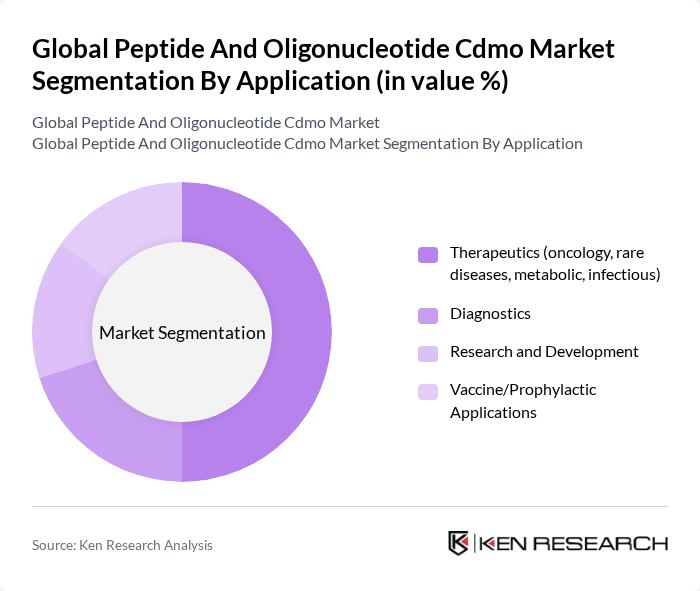

By Application:The applications of peptides and oligonucleotides span across Therapeutics, Diagnostics, Research and Development, and Vaccine/Prophylactic Applications. The Therapeutics segment is the largest, driven by the increasing incidence of chronic diseases and the need for targeted therapies. The demand for personalized medicine is also propelling growth in this segment. Diagnostics and Research and Development are significant contributors as well, with a focus on innovative solutions for disease detection and treatment .

The Global Peptide And Oligonucleotide Cdmo Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lonza Group AG, WuXi AppTec, Bachem Holding AG, Cambrex Corporation, PeptiDream Inc., CordenPharma, PolyPeptide Group, Evonik Industries AG, Agilent Technologies (formerly Bioautomation/MBI assets), GenScript Biotech Corporation, Nitto Avecia Inc., Ajinomoto Bio-Pharma Services, Eurofins CDMO Alphora, Thermo Fisher Scientific (Patheon), Syngene International Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the peptide and oligonucleotide CDMO market appears promising, driven by ongoing technological advancements and increasing demand for personalized medicine. As the industry shifts towards sustainable manufacturing practices, companies are likely to invest in eco-friendly technologies. Additionally, the integration of artificial intelligence in drug development processes is expected to enhance efficiency and reduce time-to-market for new therapeutics, positioning CDMOs favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Linear Peptides Cyclic Peptides Modified Peptides (e.g., PEGylated, lipidated, stapled) Oligonucleotides (ASO, siRNA, miRNA, mRNA, aptamers) Peptide–Oligonucleotide Conjugates (POCs) |

| By Application | Therapeutics (oncology, rare diseases, metabolic, infectious) Diagnostics Research and Development Vaccine/Prophylactic Applications |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic and Research Institutions Virtual/Small Biotech and Start-ups |

| By Delivery Method | Injectable (IV/SC) Oral Transdermal Inhalation/Intranuclear/Other Targeted Delivery |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Manufacturing Process | Solid-Phase Peptide Synthesis (SPPS) Liquid-Phase Peptide Synthesis (LPPS) Hybrid SPPS/LPPS Oligonucleotide Phosphoramidite Synthesis Enzymatic/Recombinant Technologies |

| By Service Scope | Preclinical & Process Development cGMP Manufacturing (Clinical to Commercial) Analytical & QC/QA Services Fill-Finish & Lyophilization Regulatory & Tech Transfer |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Peptide Manufacturing Processes | 100 | Production Managers, Process Engineers |

| Oligonucleotide Synthesis Techniques | 80 | R&D Scientists, Lab Managers |

| Regulatory Compliance in CDMO | 70 | Quality Control Officers, Regulatory Affairs Specialists |

| Market Trends in Biopharmaceuticals | 90 | Market Analysts, Business Development Managers |

| Investment in Biotech Startups | 60 | Venture Capitalists, Industry Consultants |

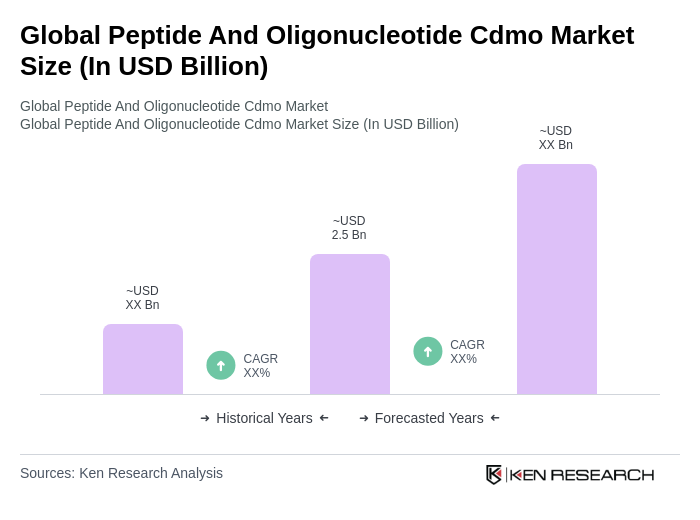

The Global Peptide and Oligonucleotide CDMO market is valued at approximately USD 2.5 billion, reflecting a significant growth trend driven by the increasing outsourcing of complex therapeutics and advancements in manufacturing technologies.