Region:Global

Author(s):Dev

Product Code:KRAC0514

Pages:95

Published On:August 2025

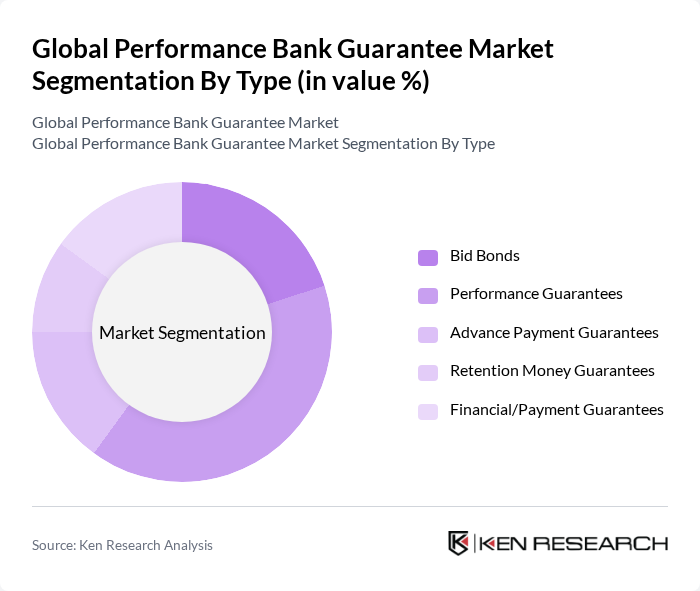

By Type:The market is segmented into various types of guarantees, including Bid Bonds, Performance Guarantees, Advance Payment Guarantees, Retention Money Guarantees, and Financial/Payment Guarantees. Among these, Performance Guarantees are the most dominant, driven by their critical role in ensuring project completion and compliance with contractual obligations. The construction and infrastructure sectors heavily rely on these guarantees to mitigate risks associated with project delays and non-performance.

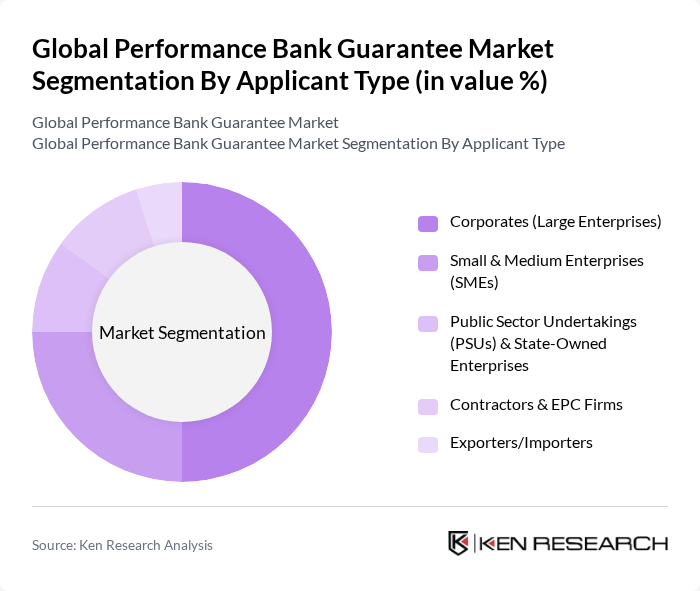

By Applicant Type:This segmentation includes Corporates (Large Enterprises), Small & Medium Enterprises (SMEs), Public Sector Undertakings (PSUs) & State-Owned Enterprises, Contractors & EPC Firms, and Exporters/Importers. Corporates dominate this segment due to their extensive project portfolios and higher financial capabilities, which necessitate the use of performance bank guarantees to secure contracts and manage risks effectively.

The Global Performance Bank Guarantee Market is characterized by a dynamic mix of regional and international players. Leading participants such as HSBC Holdings plc, JPMorgan Chase & Co., Citigroup Inc., Deutsche Bank AG, BNP Paribas S.A., Standard Chartered PLC, Wells Fargo & Company, Barclays PLC, Bank of America Corporation, UBS Group AG, Crédit Agricole Group, DBS Bank Ltd., Australia and New Zealand Banking Group Limited (ANZ), NatWest Group plc, Banco Santander, S.A., Société Générale S.A., Industrial and Commercial Bank of China (ICBC), MUFG Bank, Ltd., Mizuho Bank, Ltd., Crédit Suisse (acquired by UBS Group AG) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the performance bank guarantee market appears promising, driven by technological advancements and evolving market needs. The increasing digitization of banking services is expected to streamline the issuance process, enhancing efficiency and accessibility. Additionally, the growing emphasis on sustainable projects will likely create new opportunities for performance guarantees tailored to green initiatives. As financial institutions adapt to these trends, the market is poised for significant transformation, fostering innovation and improved service delivery in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bid Bonds Performance Guarantees Advance Payment Guarantees Retention Money Guarantees Financial/Payment Guarantees |

| By Applicant Type | Corporates (Large Enterprises) Small & Medium Enterprises (SMEs) Public Sector Undertakings (PSUs) & State-Owned Enterprises Contractors & EPC Firms Exporters/Importers |

| By Beneficiary Industry | Construction & Infrastructure Energy & Utilities (Power, Oil & Gas, Renewables) Transportation & Logistics (Road, Rail, Ports, Airports) Telecommunications & IT Projects Government & Defense Procurement |

| By Issuer Type | Commercial Banks Development & Multilateral Banks Export Credit Agencies (ECAs) Non-Bank Financial Institutions (NBFIs) Fintech/Online Platforms (Digital Guarantees) |

| By Instrument Tenor | Short-Term (?12 months) Medium-Term (1–3 years) Long-Term (>3 years) Project-Lifecycle Guarantees |

| By Collateralization | Secured (Cash Margin/Asset-Backed) Partially Secured Unsecured (Credit-Based) Counter-Guaranteed/Confirmed |

| By Distribution Channel | Direct (Bank Relationship Managers) Brokers & Corporate Finance Advisors Digital & API-Based Platforms Trade Finance Platforms & Marketplaces |

| By Geography | North America Europe Asia-Pacific Middle East & Africa Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Bank Guarantees | 100 | Project Managers, Financial Controllers |

| Manufacturing Sector Performance Bonds | 80 | Operations Managers, Compliance Officers |

| IT Services Contract Guarantees | 70 | IT Managers, Procurement Specialists |

| Public Sector Project Guarantees | 90 | Government Contract Managers, Financial Analysts |

| Energy Sector Performance Guarantees | 75 | Energy Project Managers, Risk Assessment Officers |

The Global Performance Bank Guarantee Market is valued at approximately USD 20 billion, reflecting a significant increase driven by the demand for financial security across various sectors, particularly construction, energy, and logistics.