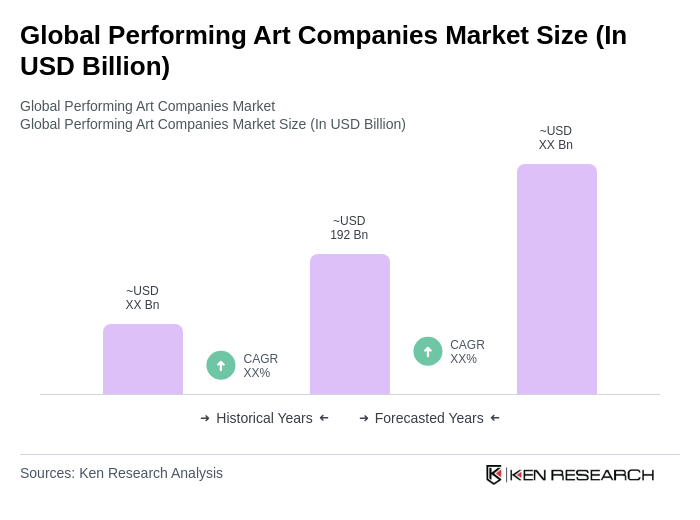

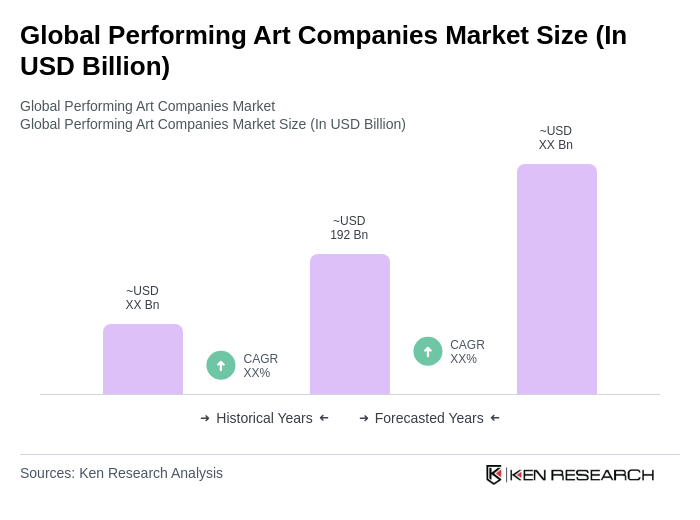

Global Performing Art Companies Market Overview

- The Global Performing Art Companies Market is valued at USD 192 billion, based on a five-year historical analysis. This valuation reflects the latest available industry consensus and includes both independent artists and performing art companies. Growth is primarily driven by increasing consumer demand for live entertainment, the expansion of digital platforms enabling broader access to performances, and a robust resurgence in cultural events post-pandemic. The market has seen significant recovery as audiences return to theatres, concert halls, and other venues, contributing to its strong valuation. Additional growth drivers include rising disposable incomes in developing economies, innovation in immersive and interactive performances, and the proliferation of online ticketing and streaming services, which have broadened audience reach and engagement .

- Key players in this market are concentrated in major cities such as New York, London, and Tokyo. These cities dominate due to their rich cultural heritage, extensive infrastructure for performing arts, and a high concentration of audiences willing to spend on entertainment. The presence of renowned institutions and festivals further enhances their status as global hubs for performing arts. Asia-Pacific is also emerging as a fast-growing region, driven by increasing investments and audience engagement .

- In 2023, the European Union implemented regulations supporting the performing arts sector, including a funding initiative of EUR 300 million under the Creative Europe Programme 2021–2027, issued by the European Commission. This regulation aims to promote cultural diversity, accessibility, and sustainability, requiring companies to comply with reporting standards and eligibility criteria for funding. The initiative fosters cultural exchange and strengthens the operational resilience of performing arts companies across member states .

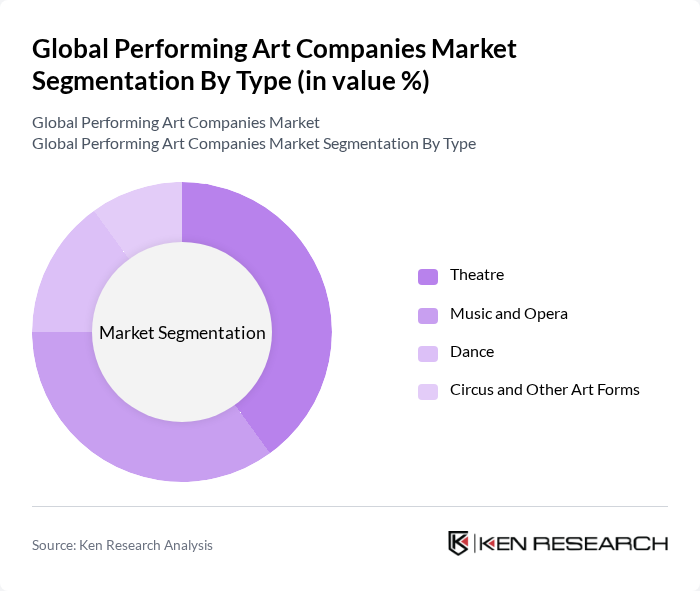

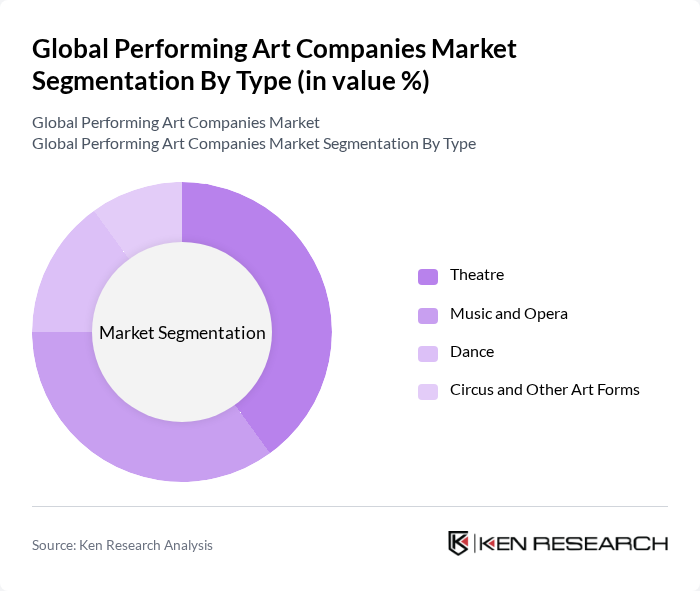

Global Performing Art Companies Market Segmentation

By Type:The market is segmented into Theatre, Music and Opera, Dance, and Circus and Other Art Forms. Each segment reflects distinct audience preferences and cultural expressions. Theatre remains a dominant segment due to its historical significance, diversity of genres, and established audience base. Music and Opera attract large audiences through concerts, festivals, and operatic performances, supported by strong ticket sales and digital streaming. Dance companies are increasingly leveraging multimedia and cross-disciplinary collaborations, while Circus and Other Art Forms continue to innovate with immersive and experiential formats .

By Venue Type:The market is categorized by venue types, including Concert Halls, Theatres, and Stadiums. Concert Halls are preferred for music performances and orchestral events, offering acoustically optimized environments. Theatres are essential for dramatic arts and stage productions, supporting a wide range of genres and audience sizes. Stadiums host large-scale events, concerts, and festivals, attracting significant audiences and enhancing market appeal through their capacity and versatility .

Global Performing Art Companies Market Competitive Landscape

The Global Performing Art Companies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Live Nation Entertainment, Cirque du Soleil, The Royal Shakespeare Company, The National Theatre, Broadway Across America, AEG Presents, The Walt Disney Company, Nederlander Organization, The Second City, The Old Globe, The Public Theater, Goodman Theatre, Sydney Opera House, Royal Opera House, Bolshoi Theatre, The Madison Square Garden Company contribute to innovation, geographic expansion, and service delivery in this space .

Global Performing Art Companies Market Industry Analysis

Growth Drivers

- Increasing Demand for Live Performances:The global market for live performances is projected to reach $30 billion in future, driven by a resurgence in audience interest post-pandemic. According to the National Endowment for the Arts, attendance at live events increased by 18% in future, reflecting a growing consumer preference for in-person experiences. This trend is supported by a 12% rise in ticket sales across major cities, indicating a robust recovery and sustained demand for live entertainment.

- Growth of Digital Streaming Platforms:The digital streaming sector is expected to generate $60 billion in revenue in future, significantly impacting the performing arts. Platforms like Netflix and Amazon Prime have expanded their offerings to include live performances, attracting a broader audience. A report from PwC indicates that 65% of consumers are willing to pay for live-streamed events, showcasing a shift in how audiences engage with performing arts, thus creating new revenue streams for companies.

- Government Support for Arts and Culture:In future, government funding for the arts is projected to exceed $6 billion, reflecting a commitment to cultural development. Initiatives such as the National Endowment for the Arts' grants have increased by 25% since 2022, providing essential financial support to performing arts organizations. This funding not only helps sustain existing companies but also encourages the creation of new projects, fostering innovation and diversity in the arts sector.

Market Challenges

- Competition from Digital Entertainment:The rise of digital entertainment poses a significant challenge, with the global video streaming market expected to reach $160 billion in future. This growth diverts audiences from traditional live performances, as consumers increasingly prefer the convenience of on-demand content. A survey by Deloitte found that 50% of respondents prioritize streaming services over attending live events, highlighting the competitive pressure on performing arts companies to innovate and adapt.

- High Operational Costs:Performing arts companies face escalating operational costs, with average expenses rising by 10% annually. Factors such as venue rental, staffing, and production costs contribute to this trend. According to the Arts Council, 75% of organizations report financial strain due to these rising costs, which can limit their ability to produce high-quality performances and invest in marketing efforts, ultimately affecting audience reach and engagement.

Global Performing Art Companies Market Future Outlook

The future of the performing arts industry appears promising, driven by technological advancements and evolving consumer preferences. As audiences increasingly seek immersive experiences, companies are likely to adopt hybrid models that blend live and digital formats. Additionally, the emphasis on sustainability will shape production practices, with organizations prioritizing eco-friendly initiatives. These trends suggest a dynamic landscape where innovation and adaptability will be crucial for success in the coming years.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets, particularly in Asia and Africa, present significant growth opportunities. With a combined population of over 3 billion, these regions are witnessing a rising middle class with increased disposable income. This demographic shift is expected to drive demand for live performances, providing a lucrative avenue for performing arts companies to expand their reach and diversify their audience base.

- Collaborations with Technology Companies:Collaborations with technology firms can enhance the audience experience through innovative solutions. By integrating augmented reality and virtual reality into performances, companies can create unique, engaging experiences that attract tech-savvy audiences. This partnership potential is underscored by a 35% increase in consumer interest in tech-enhanced events, indicating a ripe opportunity for performing arts organizations to leverage technology for growth.