Region:Global

Author(s):Geetanshi

Product Code:KRAC4494

Pages:91

Published On:October 2025

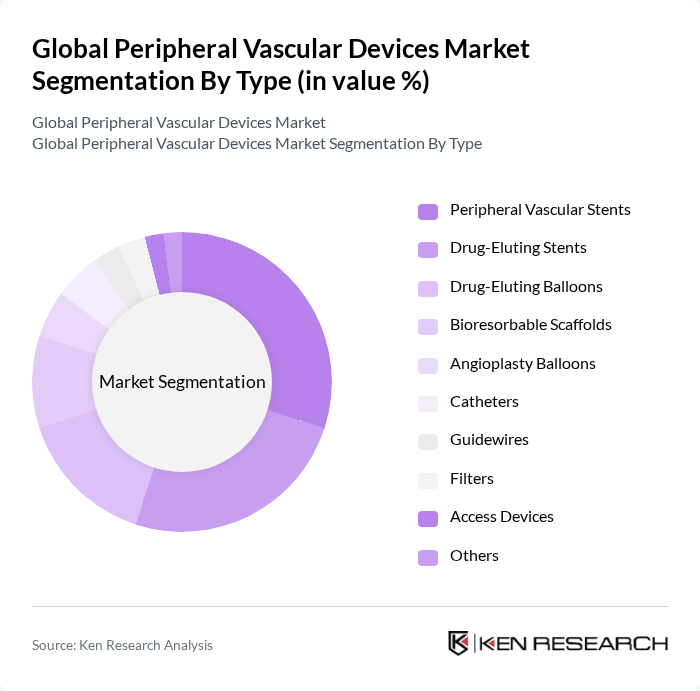

By Type:The market is segmented into various types of devices, including Peripheral Vascular Stents, Drug-Eluting Stents, Drug-Eluting Balloons, Bioresorbable Scaffolds, Angioplasty Balloons, Catheters, Guidewires, Filters, Access Devices, and Others. Among these, Peripheral Vascular Stents and Drug-Eluting Stents are leading the market due to their widespread use in treating peripheral arterial diseases. The increasing adoption of drug-eluting technologies is driven by their ability to reduce restenosis rates, making them a preferred choice for both healthcare providers and patients.

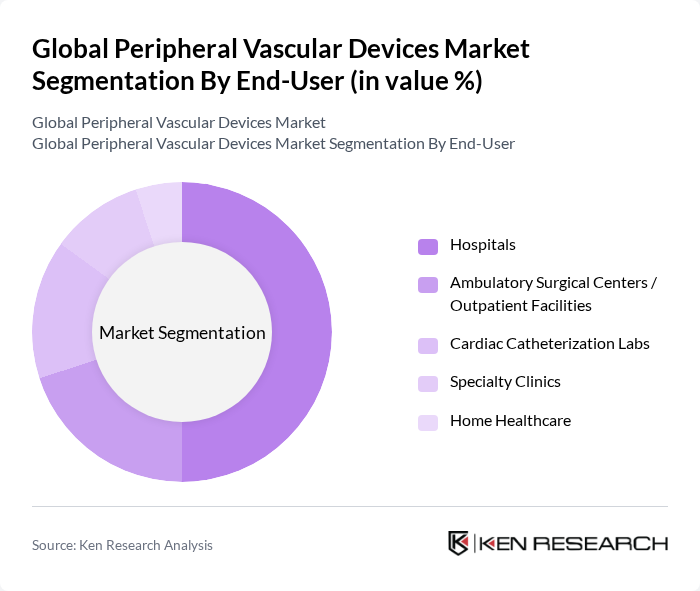

By End-User:The end-user segmentation includes Hospitals, Ambulatory Surgical Centers/Outpatient Facilities, Cardiac Catheterization Labs, Specialty Clinics, and Home Healthcare. Hospitals are the dominant end-user segment, primarily due to the high volume of procedures performed and the availability of advanced medical technologies. The increasing number of outpatient procedures is also driving growth in Ambulatory Surgical Centers, as they offer cost-effective and efficient care.

The Global Peripheral Vascular Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, Johnson & Johnson (including Cordis), Terumo Corporation, B. Braun Melsungen AG, Cook Medical Incorporated, Cardinal Health, Inc., Koninklijke Philips N.V. (Philips Healthcare), W. L. Gore & Associates, Inc. (Gore Medical), Merit Medical Systems, Inc., Siemens Healthineers AG, Stryker Corporation, Edwards Lifesciences Corporation, Asahi Intecc Co., Ltd., Becton, Dickinson and Company (BD), AngioDynamics, Inc., Teleflex Incorporated, iVascular S.L.U., Endologix LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the peripheral vascular devices market appears promising, driven by technological advancements and an increasing focus on patient-centric care. As healthcare systems evolve, there will be a greater emphasis on minimally invasive procedures and home healthcare solutions. Additionally, the integration of digital health technologies is expected to enhance patient monitoring and engagement, further supporting the growth of this market. The ongoing investment in healthcare infrastructure will also play a crucial role in shaping future developments.

| Segment | Sub-Segments |

|---|---|

| By Type | Peripheral Vascular Stents Drug-Eluting Stents Drug-Eluting Balloons Bioresorbable Scaffolds Angioplasty Balloons Catheters Guidewires Filters Access Devices Others |

| By End-User | Hospitals Ambulatory Surgical Centers / Outpatient Facilities Cardiac Catheterization Labs Specialty Clinics Home Healthcare |

| By Application | Peripheral Arterial Disease (PAD) Target Artery Instability (TAI) Access Artery Injury (AAI) Arteriovenous Fistulas Peripheral Aneurysms Deep Vein Thrombosis Varicose Veins Others |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America Latin America Western Europe Eastern Europe Balkan & Baltic Countries Russia & Belarus Central Asia East Asia South Asia & Pacific Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Product Lifecycle Stage | Introduction Growth Maturity Decline |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiovascular Device Usage | 120 | Vascular Surgeons, Interventional Cardiologists |

| Hospital Procurement Practices | 100 | Procurement Managers, Supply Chain Directors |

| Market Trends in Vascular Devices | 80 | Medical Device Sales Representatives, Product Managers |

| Patient Outcomes and Device Efficacy | 70 | Clinical Researchers, Healthcare Analysts |

| Regulatory Impact on Device Adoption | 60 | Regulatory Affairs Specialists, Compliance Officers |

The Global Peripheral Vascular Devices Market is valued at approximately USD 10 billion, driven by the rising prevalence of peripheral vascular diseases, technological advancements, and an increasing geriatric population. This market is expected to grow further as demand for minimally invasive procedures rises.