Region:Global

Author(s):Rebecca

Product Code:KRAA1363

Pages:89

Published On:August 2025

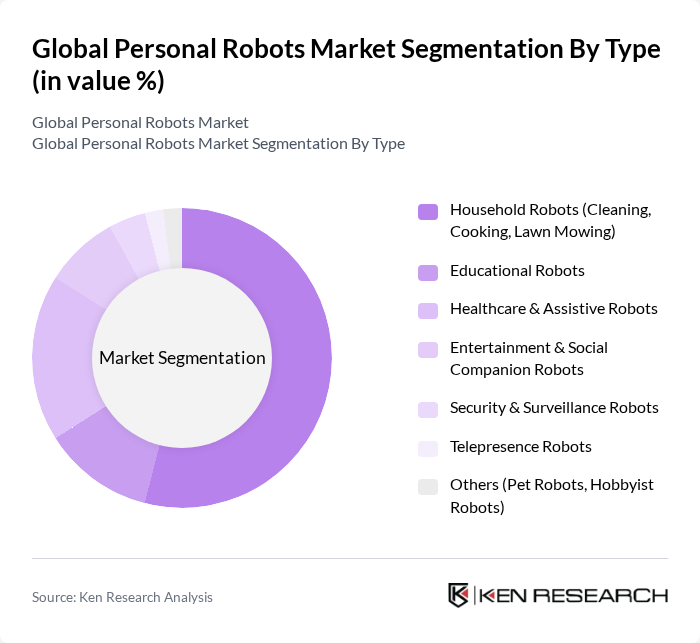

By Type:The market is segmented into various types of personal robots, including household robots, educational robots, healthcare and assistive robots, entertainment and social companion robots, security and surveillance robots, telepresence robots, and others such as pet and hobbyist robots. Among these, household robots, particularly vacuum cleaners and lawn mowers, have gained significant traction due to their convenience and efficiency in managing household chores. The increasing adoption of smart home technologies and integration with high-speed connectivity (such as WiFi 6 and Bluetooth 5.2) have further fueled the demand for these robots. Social companion robots and healthcare assistants are also experiencing increased adoption, especially in regions with aging populations .

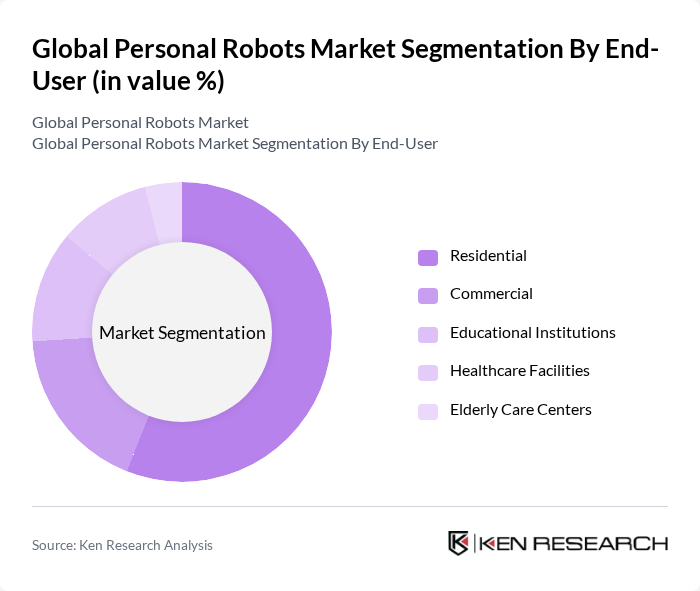

By End-User:The personal robots market is categorized by end-users, including residential, commercial, educational institutions, healthcare facilities, and elderly care centers. The residential segment is the largest, driven by the increasing adoption of smart home devices and the growing need for convenience in daily tasks. Consumers are increasingly investing in robots that can assist with cleaning, cooking, and companionship, leading to a surge in demand within this segment. Healthcare facilities and elderly care centers are also increasing adoption due to the need for assistive technologies for aging populations and patient monitoring .

The Global Personal Robots Market is characterized by a dynamic mix of regional and international players. Leading participants such as iRobot Corporation, SoftBank Robotics, Samsung Electronics Co., Ltd., LG Electronics Inc., Amazon.com, Inc. (Astro), Neato Robotics, Inc., Robomow (A Friendly Robotics Brand), Ecovacs Robotics Co., Ltd., Xiaomi Corporation, Blue Frog Robotics, Sony Corporation (Aibo), Anki (Legacy), UBTECH Robotics Corp., Ltd., Temi (Robotemi Ltd.), AsusTek Computer Inc. (Zenbo) contribute to innovation, geographic expansion, and service delivery in this space. These companies are recognized for pioneering advancements in mobility, AI-driven personalization, and integration with smart home ecosystems .

The future of the personal robots market appears promising, driven by technological advancements and increasing consumer acceptance. As automation becomes more prevalent, personal robots are likely to evolve, offering enhanced functionalities tailored to individual needs. The integration of AI and IoT will further facilitate seamless interactions between devices, creating a more cohesive smart home ecosystem. Additionally, as manufacturers address consumer concerns regarding safety and privacy, adoption rates are expected to rise, paving the way for innovative applications in various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Household Robots (Cleaning, Cooking, Lawn Mowing) Educational Robots Healthcare & Assistive Robots Entertainment & Social Companion Robots Security & Surveillance Robots Telepresence Robots Others (Pet Robots, Hobbyist Robots) |

| By End-User | Residential Commercial Educational Institutions Healthcare Facilities Elderly Care Centers |

| By Application | Home Cleaning (Vacuuming, Mopping, Window Cleaning) Personal Assistance & Companionship Education & Tutoring Security Monitoring & Surveillance Entertainment & Gaming Health Monitoring & Therapy Others |

| By Distribution Channel | Online Retail Offline Retail (Electronics Stores, Specialty Retailers) Direct Sales Distributors & System Integrators |

| By Price Range | Budget Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By User Demographics | Age Group Income Level Urban vs Rural |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Assistance Robots | 100 | Homeowners, Family Caregivers |

| Educational Robots | 80 | Teachers, Educational Administrators |

| Healthcare Support Robots | 60 | Healthcare Professionals, Care Facility Managers |

| Entertainment Robots | 50 | Parents, Tech Enthusiasts |

| Industrial Personal Robots | 40 | Operations Managers, Manufacturing Engineers |

The Global Personal Robots Market is valued at approximately USD 11 billion, driven by advancements in artificial intelligence, increasing consumer demand for automation, and the rising trend of smart homes. This growth reflects a significant expansion in various sectors, including healthcare and education.