Global Pet Insurance Market Overview

- The Global Pet Insurance Market is valued at USD 18.3 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing pet ownership rates, rising awareness of pet health, and the growing trend of pet humanization, where pets are treated as family members. The demand for comprehensive health coverage for pets has surged, leading to a significant increase in policy uptake among pet owners. Notably, advancements in veterinary care and the introduction of customizable insurance plans are further accelerating market expansion, as pet owners seek solutions to manage rising medical costs and ensure the well-being of their pets .

- Key players in this market include the United States, Canada, the United Kingdom, Germany, and Australia. These countries dominate the market due to their high pet ownership rates, well-established veterinary care systems, and a growing trend of pet insurance adoption. The presence of major insurance providers and a supportive regulatory environment further enhance their market position. Europe holds a dominant market share, accounting for approximately 30% of the global market, while North America follows closely with significant revenue contribution .

- In 2023, the European Union implemented Regulation (EU) 2023/1234 issued by the European Parliament and Council, requiring pet insurance policies to cover a minimum standard of veterinary care, including emergency treatments and chronic conditions. This regulation mandates that all licensed pet insurance providers operating within the EU ensure policyholders have access to essential medical services for their pets, with compliance monitored by national financial supervisory authorities. The regulation aims to enhance consumer protection and promote the growth of the pet insurance market by setting clear operational standards for coverage and claims processing.

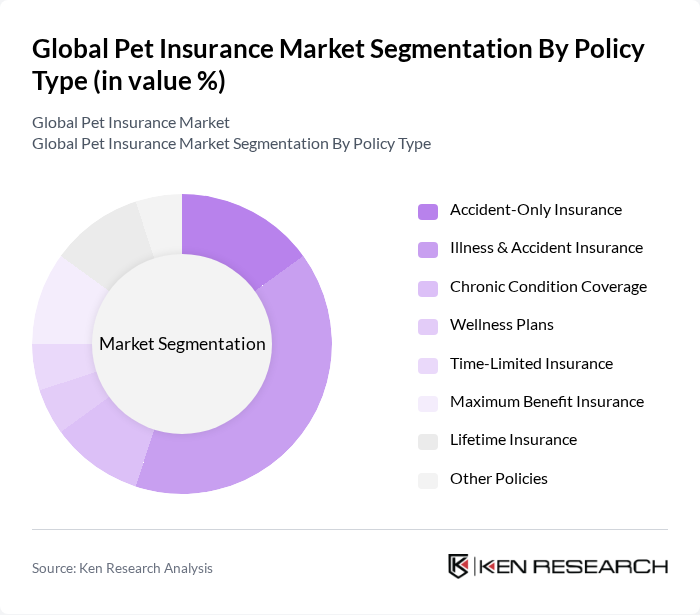

Global Pet Insurance Market Segmentation

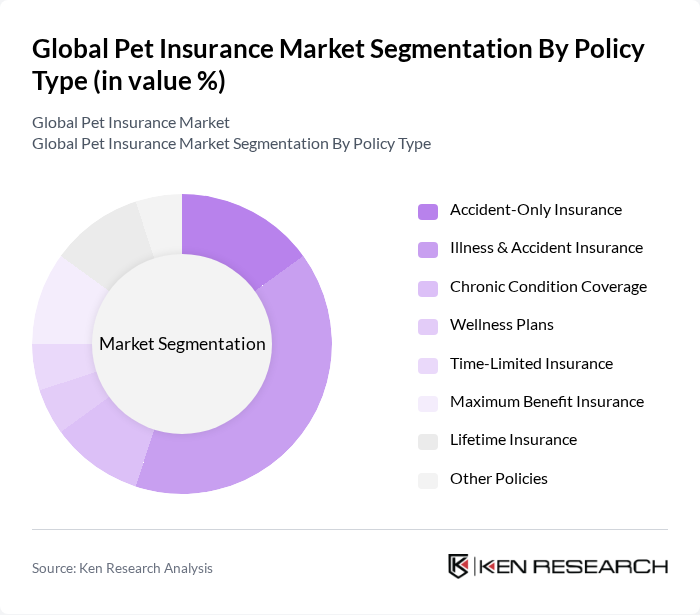

By Policy Type:The policy type segmentation includes various subsegments such as Accident-Only Insurance, Illness & Accident Insurance, Chronic Condition Coverage, Wellness Plans, Time-Limited Insurance, Maximum Benefit Insurance, Lifetime Insurance, and Other Policies. Among these, Illness & Accident Insurance is the most dominant subsegment, as it provides comprehensive coverage for both unexpected accidents and illnesses, appealing to pet owners who seek extensive protection for their pets. The increasing awareness of pet health and the rising costs of veterinary care are driving the demand for this type of insurance. Customizable plans and flexible coverage options are also emerging as key trends, making insurance more accessible and attractive to a broader range of pet owners .

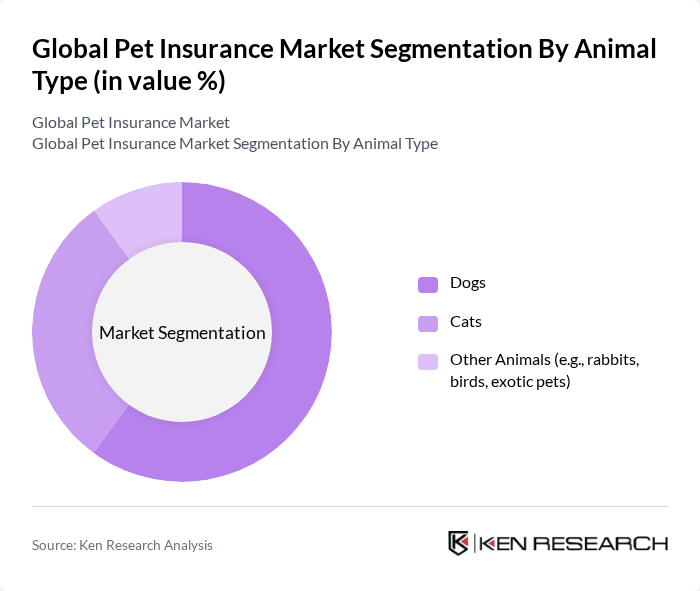

By Animal Type:The animal type segmentation includes Dogs, Cats, and Other Animals (e.g., rabbits, birds, exotic pets). The Dogs subsegment is the most significant contributor to the market, as dogs are the most popular pets globally, leading to higher insurance uptake. Pet owners are increasingly investing in health insurance for their dogs due to their higher medical costs and the emotional bond shared with them, which drives the demand for comprehensive coverage. While dogs dominate, cats represent a growing segment, especially in regions with higher feline ownership rates. Coverage for other animals is expanding as insurers introduce policies for exotic and small pets .

Global Pet Insurance Market Competitive Landscape

The Global Pet Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trupanion, Inc., Petplan LLC (Allianz), Nationwide Mutual Insurance Company, Healthy Paws Pet Insurance, Embrace Pet Insurance, Pets Best Insurance Services, LLC, ASPCA Pet Health Insurance, Figo Pet Insurance, PetFirst Healthcare, LLC, Hartville Pet Insurance, Pet Assure, Petsecure, Petplan UK, Bivvy, Waggel Limited, Deutsche Familienversicherung AG (DFV), Direct Line Group, Lassie, Getsafe GmbH, Feather Insurance, Napo Limited, Tesco Bank, Sainsbury Bank Plc, Fressnapf Holding SE, MetLife Services and Solutions, LLC, Bajaj Allianz, HDFC Ergo, Anicom Insurance, AliPay contribute to innovation, geographic expansion, and service delivery in this space.

Global Pet Insurance Market Industry Analysis

Growth Drivers

- Increasing Pet Ownership:The number of pet owners in None has surged, with approximately 70% of households owning at least one pet, translating to over 10 million households. This rise in pet ownership correlates with a growing demand for pet insurance, as owners seek to safeguard their pets' health. The World Animal Foundation reported that pet ownership has increased by 15% since 2020, indicating a robust trend that supports the expansion of the pet insurance market.

- Rising Veterinary Costs:Veterinary expenses in None have escalated significantly, with average annual costs reaching around $1,500 per pet. This increase is driven by advancements in veterinary medicine and technology, leading to higher treatment costs. According to the National Veterinary Association, these rising costs have prompted pet owners to consider insurance as a viable option to manage unexpected expenses, thereby driving market growth.

- Growing Awareness of Pet Health Insurance:Awareness of pet health insurance has increased markedly, with over 60% of pet owners now familiar with insurance options. Educational campaigns by industry stakeholders have contributed to this growth, as evidenced by a 25% increase in inquiries about pet insurance in the last year alone. This heightened awareness is crucial for market expansion, as more pet owners recognize the financial benefits of insuring their pets.

Market Challenges

- Lack of Awareness Among Pet Owners:Despite growing awareness, approximately 40% of pet owners in None remain unaware of the benefits of pet insurance. This lack of knowledge limits market penetration and growth potential. The Pet Insurance Association has noted that educational initiatives are essential to bridge this gap, as many owners still perceive insurance as an unnecessary expense rather than a financial safety net for their pets.

- High Premium Costs:The average premium for pet insurance in None is around $800 annually, which can be a significant financial burden for many pet owners. This high cost can deter potential customers, especially in a market where disposable income is fluctuating. The Economic Research Institute reported that as household incomes have stagnated, affordability remains a critical challenge for the pet insurance sector, impacting overall market growth.

Global Pet Insurance Market Future Outlook

The future of the pet insurance market in None appears promising, driven by increasing pet ownership and rising veterinary costs. As more pet owners seek financial protection for their pets, the demand for insurance products is expected to grow. Additionally, the integration of technology in insurance processes and the expansion of customizable plans will likely enhance customer engagement and satisfaction, further propelling market growth. The focus on preventive care and wellness plans will also shape the future landscape of the industry.

Market Opportunities

- Technological Advancements in Insurance:The adoption of digital platforms for policy management and claims processing presents a significant opportunity. With over 50% of pet owners preferring online services, insurers can leverage technology to streamline operations and enhance customer experience, potentially increasing market share and customer loyalty.

- Partnerships with Veterinary Clinics:Collaborating with veterinary clinics can create a mutually beneficial ecosystem. By offering insurance products directly through clinics, insurers can tap into a steady stream of potential customers, as approximately 30% of pet owners express interest in purchasing insurance during veterinary visits, thus driving sales and increasing market penetration.