Region:Global

Author(s):Shubham

Product Code:KRAD0692

Pages:80

Published On:August 2025

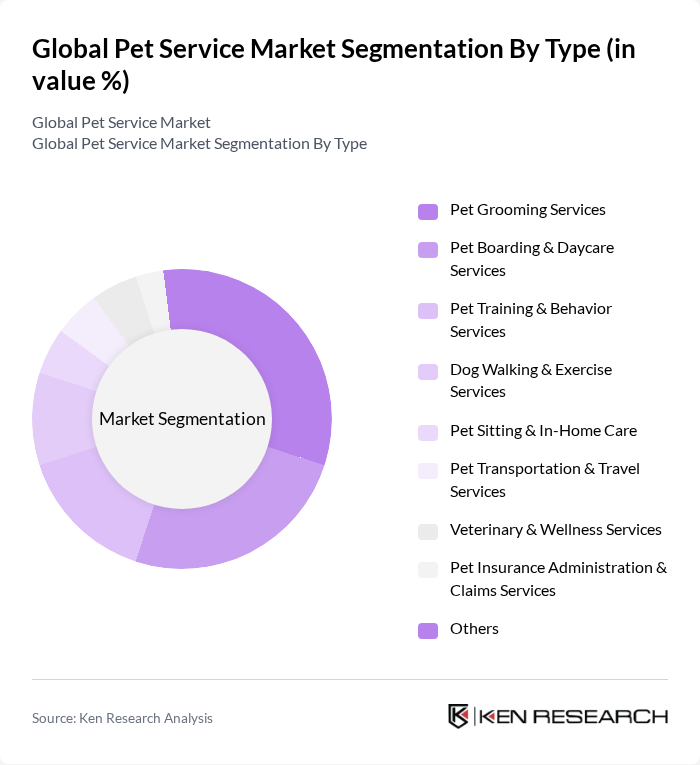

By Type:The pet service market is segmented into various types, including grooming, boarding, training, and more. Among these, pet grooming services have gained significant traction due to the increasing awareness of pet hygiene and aesthetics. Pet owners are increasingly investing in grooming services to maintain their pets' health and appearance, leading to a surge in demand for professional grooming services. Pet boarding and daycare services also see substantial growth as pet owners seek reliable care options while they are away.

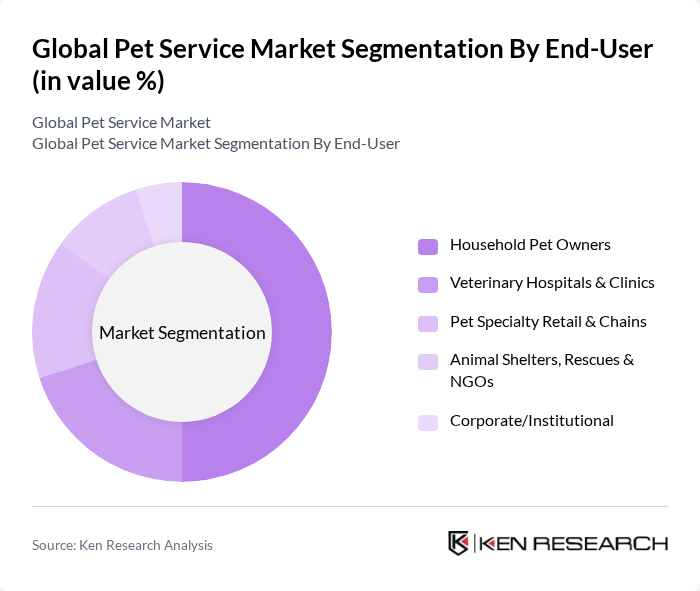

By End-User:The end-user segmentation includes household pet owners, veterinary hospitals, and corporate institutions. Household pet owners represent the largest segment, driven by the increasing number of pet adoptions and the willingness to spend on pet care services. Veterinary hospitals and clinics also play a crucial role, as they often collaborate with service providers for grooming and wellness services. Animal shelters and NGOs are increasingly utilizing pet services to enhance the care provided to rescued animals.

The Global Pet Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as PetSmart LLC, Petco Health and Wellness Company, Inc., Rover Group, Inc., Wag! Group Co., Chewy, Inc., Camp Bow Wow (a Mars, Incorporated brand), VCA Animal Hospitals (Mars, Incorporated), Banfield Pet Hospital (Mars, Incorporated), BluePearl Specialty + Emergency Pet Hospital (Mars, Incorporated), CVS Group plc, IVC Evidensia, Greencross Pet Wellness Company (Greencross Vets, Petbarn), Pets at Home Group plc, Pet Paradise, Destination Pet, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pet service market in None appears promising, driven by ongoing trends in pet ownership and health awareness. As disposable incomes rise, consumers are likely to invest more in premium services, enhancing overall market growth. Additionally, the integration of technology in pet care, such as telehealth services and smart pet products, is expected to reshape service delivery. Companies that adapt to these trends will likely capture significant market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Pet Grooming Services Pet Boarding & Daycare Services Pet Training & Behavior Services Dog Walking & Exercise Services Pet Sitting & In-Home Care Pet Transportation & Travel Services Veterinary & Wellness Services (non-medical wellness, preventive care add-ons) Pet Insurance Administration & Claims Services Others (photography, pet funerary/cremation, concierge) |

| By End-User | Household Pet Owners Veterinary Hospitals & Clinics Pet Specialty Retail & Chains Animal Shelters, Rescues & NGOs Corporate/Institutional (apartment communities, hotels, employers) |

| By Service Delivery Model | Brick-and-Mortar Facilities Mobile & In-Home Services Online Platforms & Marketplaces |

| By Pricing/Contract Type | Pay-Per-Service (à la carte) Memberships & Subscriptions Bundled Packages Insurance-Linked/Wellness Plans |

| By Pet Type | Dogs Cats Small Mammals (rabbits, hamsters, etc.) Birds Aquatic & Reptiles Equine & Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| By Customer Demographics | Millennials Gen X Baby Boomers Gen Z |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Grooming Services | 120 | Grooming Salon Owners, Pet Groomers |

| Pet Training Services | 100 | Dog Trainers, Training Facility Managers |

| Pet Boarding Facilities | 80 | Boarding Facility Owners, Pet Care Managers |

| Pet Sitting Services | 70 | Pet Sitters, Pet Care Agency Owners |

| Pet Health and Wellness Services | 90 | Veterinarians, Pet Wellness Coaches |

The Global Pet Service Market is valued at approximately USD 24 billion, driven by increasing pet ownership, rising disposable incomes, and the trend of treating pets as family members. This market is expected to continue growing as demand for quality pet services rises.