Region:Global

Author(s):Geetanshi

Product Code:KRAB0078

Pages:95

Published On:August 2025

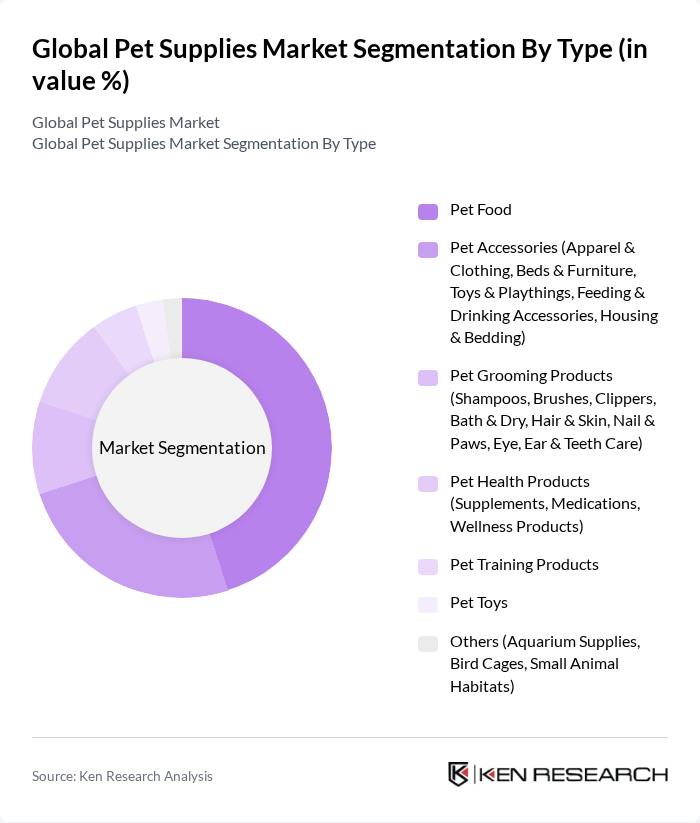

By Type:The market is segmented into various types, including Pet Food, Pet Accessories, Pet Grooming Products, Pet Health Products, Pet Training Products, Pet Toys, and Others. Among these, Pet Food is the leading segment, driven by the increasing demand for high-quality and nutritious food options for pets. Consumers are increasingly opting for premium and specialized diets, reflecting a growing awareness of pet health and nutrition .

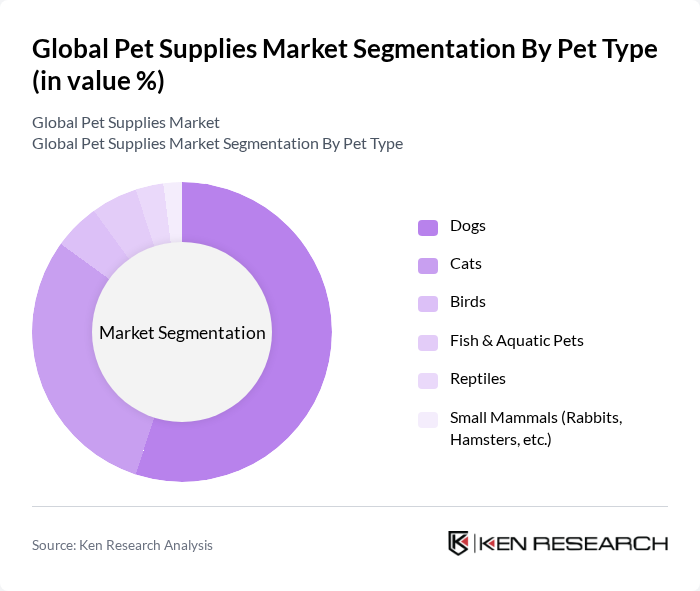

By Pet Type:The market is segmented by pet type, including Dogs, Cats, Birds, Fish & Aquatic Pets, Reptiles, and Small Mammals. Dogs and Cats dominate the market, accounting for the majority of pet supplies sales. The increasing trend of pet humanization has led to higher spending on dogs and cats, as owners seek to provide the best care and products for their beloved pets .

The Global Pet Supplies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Purina PetCare, Mars Petcare, Hill's Pet Nutrition, Spectrum Brands Holdings, Inc., PetSmart, Inc., Chewy, Inc., Petco Animal Supplies, Inc., Central Garden & Pet Company, Blue Buffalo Pet Products, Inc., WellPet LLC, Tuffy's Pet Foods, Inc., The Hartz Mountain Corporation, KONG Company, PetSafe Brand (Radio Systems Corporation), Freshpet, Inc., Zesty Paws (H&H Group), Rolf C. Hagen Inc., Rosewood Pet Products Ltd., Ferplast S.p.A., Ancol Pet Products Limited, Designer Pet Products, Blueberry Pet, Muttluks Inc., Platinum Pets LLC, Simply Fido LLC, Honest Pet Products, The Honest Kitchen contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pet supplies market in None appears promising, driven by evolving consumer preferences and technological advancements. As pet owners increasingly seek premium and health-focused products, companies are likely to innovate in product offerings. Additionally, the rise of e-commerce platforms will facilitate easier access to a wider range of products, enhancing customer convenience. The market is expected to adapt to these trends, ensuring sustained growth and resilience against economic fluctuations.

| Segment | Sub-Segments |

|---|---|

| By Type | Pet Food Pet Accessories (Apparel & Clothing, Beds & Furniture, Toys & Playthings, Feeding & Drinking Accessories, Housing & Bedding) Pet Grooming Products (Shampoos, Brushes, Clippers, Bath & Dry, Hair & Skin, Nail & Paws, Eye, Ear & Teeth Care) Pet Health Products (Supplements, Medications, Wellness Products) Pet Training Products Pet Toys Others (Aquarium Supplies, Bird Cages, Small Animal Habitats) |

| By Pet Type | Dogs Cats Birds Fish & Aquatic Pets Reptiles Small Mammals (Rabbits, Hamsters, etc.) |

| By End-User | Individual Pet Owners Veterinary Clinics Pet Grooming Salons Pet Shelters and Rescues |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Specialty Pet Stores Veterinary Clinics Convenience Stores |

| By Price Range | Budget Mid-range Premium |

| By Product Formulation | Dry Products Wet Products Treats and Chews |

| By Brand Type | National Brands Private Labels Local Brands |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Food Retailers | 100 | Store Managers, Category Buyers |

| Pet Accessories Manufacturers | 80 | Product Development Managers, Sales Directors |

| Veterinary Clinics | 60 | Veterinarians, Clinic Managers |

| Pet Care Service Providers | 50 | Service Owners, Operations Managers |

| Pet Owners | 120 | Pet Owners across various demographics |

The Global Pet Supplies Market is valued at approximately USD 321 billion, reflecting significant growth driven by increasing pet ownership, rising disposable incomes, and a trend towards premium pet products.