Region:Global

Author(s):Geetanshi

Product Code:KRAD0096

Pages:88

Published On:August 2025

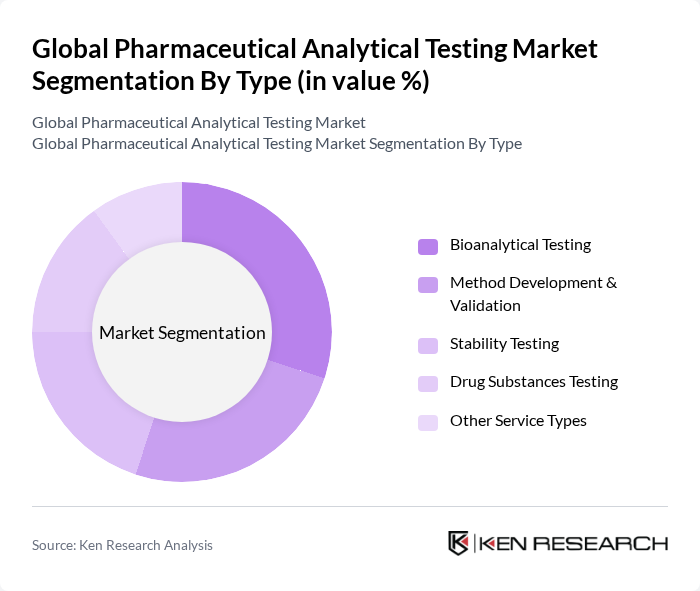

By Type:The market is segmented into various types of analytical testing services, including Bioanalytical Testing, Method Development & Validation, Stability Testing, Drug Substances Testing, and Other Service Types. Each of these segments plays a crucial role in ensuring the quality and safety of pharmaceutical products. Bioanalytical Testing remains the largest segment, driven by the need for precise measurement of drug concentrations in biological samples, especially for biologics, biosimilars, and personalized therapies. Method Development & Validation and Stability Testing are also critical, reflecting the increasing complexity of drug formulations and regulatory scrutiny .

Among these segments, Bioanalytical Testing is the leading sub-segment, driven by the increasing demand for drug development and the need for precise measurement of drug concentrations in biological samples. The rise in chronic diseases and the growing focus on personalized medicine have further propelled the demand for bioanalytical services, making it a critical component of the pharmaceutical development process .

By End-User:The market is categorized based on end-users, including Pharmaceutical Companies, Biopharmaceutical Companies, Contract Research Organizations (CROs), Contract Manufacturing Organizations (CMOs), Academic and Research Institutions, Medical Device Companies, and Others. Each end-user segment has unique requirements and contributes to the overall market dynamics. Pharmaceutical and Biopharmaceutical Companies are the primary consumers, reflecting their ongoing need for comprehensive testing throughout the drug development and manufacturing lifecycle. CROs and CMOs are also significant, as outsourcing analytical testing continues to rise .

Pharmaceutical Companies dominate the end-user segment due to their extensive need for analytical testing throughout the drug development lifecycle. The increasing complexity of drug formulations and the stringent regulatory environment necessitate comprehensive testing services, making pharmaceutical companies the largest consumers of analytical testing services .

The Global Pharmaceutical Analytical Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Merck KGaA, SGS S.A., Eurofins Scientific SE, Charles River Laboratories International, Inc., Intertek Group plc, Pace Analytical Services, LLC, LabCorp, BioReliance Corporation, Alcami Corporation, WuXi AppTec, Catalent, Inc., ARL Bio Pharma, Inc., Frontage Laboratories, Inc., Recipharm AB, Quotient Sciences Ltd., Metrics Contract Services, Ascendia Pharmaceuticals LLC, Aztech Sciences, ENCO Pharmaceutical Development, Inc., Recro Gainesville LLC, Frontida Biopharm, Inc., Nelson Labs contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceutical analytical testing market is poised for significant transformation, driven by technological advancements and evolving regulatory landscapes. As companies increasingly adopt automation and AI-driven solutions, efficiency and accuracy in testing processes will improve. Additionally, the growing emphasis on personalized medicine will necessitate tailored analytical approaches, fostering innovation. The market is expected to witness a surge in collaborations between pharmaceutical companies and testing laboratories, enhancing capabilities and expanding service offerings to meet diverse client needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Bioanalytical Testing Method Development & Validation Stability Testing Drug Substances Testing Other Service Types |

| By End-User | Pharmaceutical Companies Biopharmaceutical Companies Contract Research Organizations (CROs) Contract Manufacturing Organizations (CMOs) Academic and Research Institutions Medical Device Companies Others |

| By Application | Quality Control Research and Development Regulatory Compliance Others |

| By Service Type | Testing Services Consulting Services Training Services Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Quality Control | 120 | Quality Control Managers, Laboratory Directors |

| Regulatory Compliance Testing | 90 | Regulatory Affairs Specialists, Compliance Officers |

| Stability Testing Services | 60 | Stability Study Coordinators, R&D Scientists |

| Method Development and Validation | 50 | Analytical Chemists, Method Development Managers |

| Contract Analytical Testing Services | 70 | Business Development Managers, Laboratory Operations Heads |

The Global Pharmaceutical Analytical Testing Market is valued at approximately USD 9.1 billion, driven by the increasing demand for high-quality pharmaceuticals, stringent regulatory requirements, and advancements in testing methodologies to ensure drug safety and efficacy.