Region:Global

Author(s):Shubham

Product Code:KRAC0597

Pages:88

Published On:August 2025

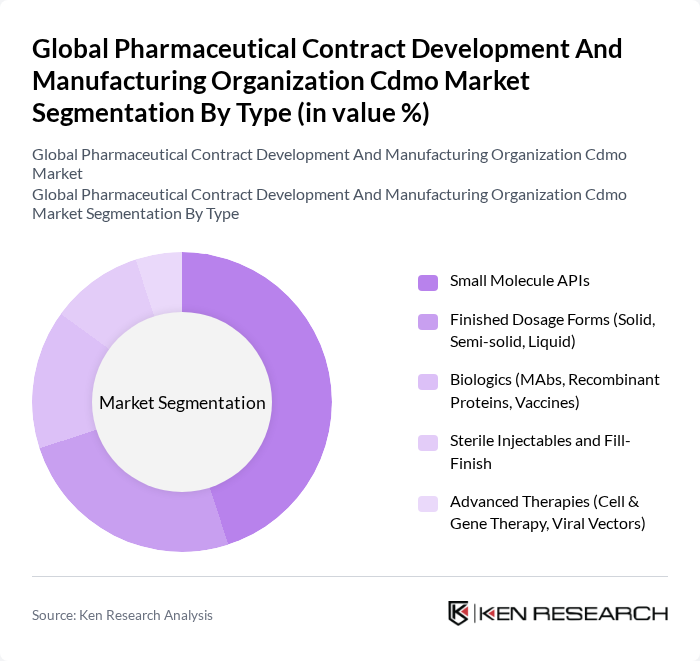

By Type:The market is segmented into various types, including Small Molecule APIs, Finished Dosage Forms, Biologics, Sterile Injectables, and Advanced Therapies. Among these, Small Molecule APIs continue to comprise a large share given their widespread use and the strong base of generic and branded small-molecule products, while growth in Biologics and Advanced Therapies is accelerating due to demand for monoclonal antibodies, recombinant proteins, vaccines, and cell and gene therapies. The trend toward personalized medicine and complex modalities is driving investment in sterile fill-finish and advanced therapy manufacturing capabilities within CDMOs.

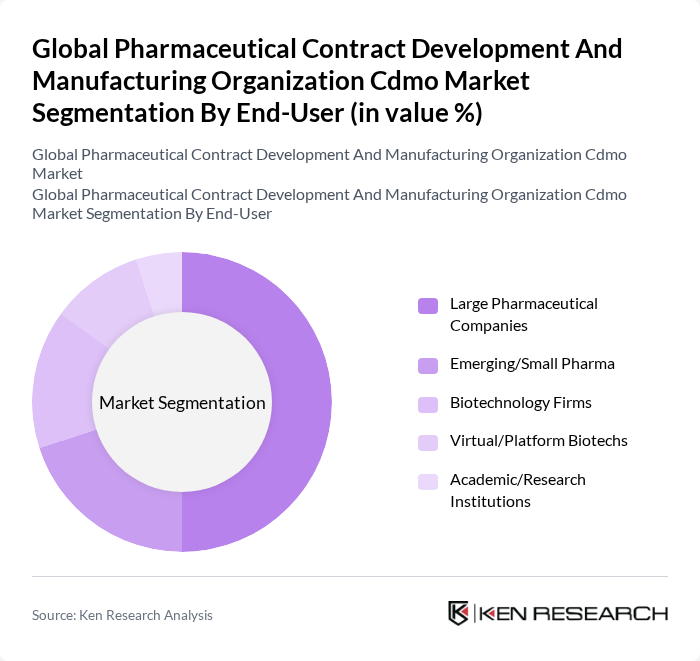

By End-User:The end-user segmentation includes Large Pharmaceutical Companies, Emerging/Small Pharma, Biotechnology Firms, Virtual/Platform Biotechs, and Academic/Research Institutions. Large Pharmaceutical Companies dominate this segment due to their extensive resources and established relationships with CDMOs, enabling scale, quality, and time-to-market advantages, while emerging and small pharma as well as biotechs increasingly rely on external partners for specialized capabilities and flexible capacity.

The Global Pharmaceutical Contract Development And Manufacturing Organization Cdmo Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lonza Group AG, Catalent, Inc., Samsung Biologics, WuXi AppTec, Thermo Fisher Scientific (Patheon), Recipharm AB, Aenova Group, Siegfried Holding AG, Famar Health Care Services, Alcami Corporation, Piramal Pharma Solutions, CordenPharma, Bachem Holding AG, Vetter Pharma International GmbH, Jubilant HollisterStier, Boehringer Ingelheim BioXcellence, Fujifilm Diosynth Biotechnologies, Sterling Pharma Solutions, Curia (formerly AMRI), Evonik Health Care (Evonik Industries AG) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the CDMO market appears promising, driven by the increasing complexity of drug development and the growing trend of outsourcing. As pharmaceutical companies seek to streamline operations and reduce costs, CDMOs will play a pivotal role in facilitating innovation. The integration of advanced technologies, such as AI and automation, will enhance operational efficiency and quality control. Additionally, the expansion into emerging markets will provide new growth avenues, allowing CDMOs to tap into previously underserved regions and diversify their service offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Small Molecule APIs Finished Dosage Forms (Solid, Semi-solid, Liquid) Biologics (MAbs, Recombinant Proteins, Vaccines) Sterile Injectables and Fill-Finish Advanced Therapies (Cell & Gene Therapy, Viral Vectors) |

| By End-User | Large Pharmaceutical Companies Emerging/Small Pharma Biotechnology Firms Virtual/Platform Biotechs Academic/Research Institutions |

| By Service Type | Drug Substance (API/DS) Development & Manufacturing Drug Product (DP) Development & Manufacturing Analytical & QC/Release Testing Fill-Finish & Aseptic Processing Packaging & Serialization Regulatory & CMC Services |

| By Therapeutic Area | Oncology Cardiovascular & Metabolic Immunology & Inflammation Central Nervous System (CNS) Infectious Diseases & Vaccines |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Engagement Model | Fee-for-Service Full-Service/End-to-End (One-Stop CDMO) Dedicated/Strategic Partnerships Build-to-Suit/Capacity Reservation |

| By Technology Platform | Small Molecule (Oral Solid Dose, HPAPI) Biologics (Mammalian, Microbial) Steriles (Prefilled Syringes, Vials, Cartridges) Advanced Therapies (Cell Therapy, Gene Therapy, mRNA/LNP) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical CDMO Services | 120 | R&D Directors, Procurement Managers |

| Biopharmaceutical Manufacturing | 100 | Operations Managers, Quality Control Heads |

| Small Molecule Production | 80 | Project Managers, Regulatory Affairs Specialists |

| Contract Packaging Services | 60 | Supply Chain Managers, Packaging Engineers |

| Clinical Trial Material Supply | 90 | Clinical Operations Managers, Trial Coordinators |

The Global Pharmaceutical Contract Development and Manufacturing Organization (CDMO) market is valued at approximately USD 170175 billion, reflecting significant growth driven by the increasing demand for outsourcing in the pharmaceutical industry.