Region:Global

Author(s):Geetanshi

Product Code:KRAD0018

Pages:99

Published On:August 2025

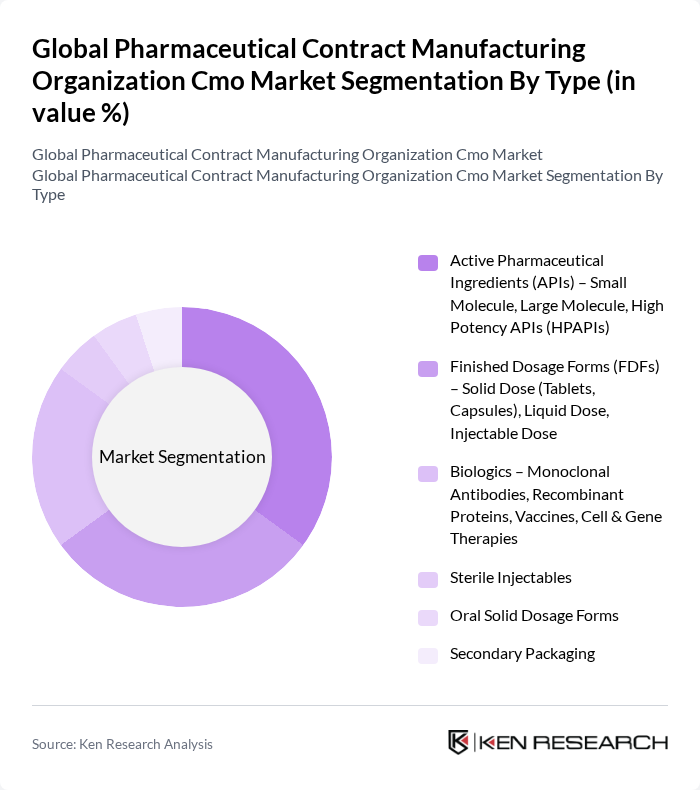

By Type:The market is segmented into various types, including Active Pharmaceutical Ingredients (APIs), Finished Dosage Forms (FDFs), Biologics, Sterile Injectables, Oral Solid Dosage Forms, and Secondary Packaging. Each of these segments plays a crucial role in the overall market dynamics.

By End-User:The end-user segmentation includes Pharmaceutical Companies (Large, Mid, Small), Biotechnology Firms, Generic Drug Manufacturers, Contract Research Organizations (CROs), Research Institutions, and Others. This segmentation highlights the diverse applications of CMO services across different sectors.

The Global Pharmaceutical Contract Manufacturing Organization CMO Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lonza Group AG, Catalent, Inc., Samsung Biologics, WuXi AppTec, Recipharm AB, Patheon (Thermo Fisher Scientific), Siegfried Holding AG, Aenova Group, Famar Health, Piramal Pharma Solutions, Alcami Corporation, Jubilant HollisterStier, Bachem Holding AG, CordenPharma, Vetter Pharma International GmbH, Boehringer Ingelheim BioXcellence, Fujifilm Diosynth Biotechnologies, Baxter BioPharma Solutions, AMRI (Albany Molecular Research Inc.), Cambrex Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceutical contract manufacturing organization market appears promising, driven by the increasing complexity of drug formulations and the need for specialized manufacturing capabilities. As the industry embraces digital transformation, CMOs are expected to leverage data analytics and automation to enhance operational efficiency. Additionally, the growing focus on personalized medicine will likely create new avenues for CMOs to innovate and expand their service offerings, positioning them as critical partners in the pharmaceutical supply chain.

| Segment | Sub-Segments |

|---|---|

| By Type | Active Pharmaceutical Ingredients (APIs) – Small Molecule, Large Molecule, High Potency APIs (HPAPIs) Finished Dosage Forms (FDFs) – Solid Dose (Tablets, Capsules), Liquid Dose, Injectable Dose Biologics – Monoclonal Antibodies, Recombinant Proteins, Vaccines, Cell & Gene Therapies Sterile Injectables Oral Solid Dosage Forms Secondary Packaging |

| By End-User | Pharmaceutical Companies (Large, Mid, Small) Biotechnology Firms Generic Drug Manufacturers Contract Research Organizations (CROs) Research Institutions Others |

| By Product Type | Generic Drugs Branded Drugs Over-the-Counter (OTC) Products Biopharmaceuticals Others |

| By Service Type | API Manufacturing FDF Manufacturing Packaging Services Analytical & Quality Control Services Clinical Manufacturing Others |

| By Region | North America (U.S., Canada) Europe (U.K., Germany, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of Asia-Pacific) Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa) |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Model | Cost-Plus Pricing Fixed Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing Services | 120 | Production Managers, Quality Control Analysts |

| Biopharmaceutical Contract Services | 90 | R&D Directors, Regulatory Affairs Specialists |

| API Manufacturing and Supply | 60 | Procurement Managers, Supply Chain Directors |

| Packaging and Labeling Services | 50 | Operations Managers, Compliance Officers |

| Clinical Trial Material Production | 70 | Clinical Operations Managers, Project Managers |

The Global Pharmaceutical Contract Manufacturing Organization (CMO) market is valued at approximately USD 160 billion, reflecting significant growth driven by increased outsourcing, chronic disease prevalence, and the demand for cost-effective production solutions.