Region:Global

Author(s):Shubham

Product Code:KRAC0728

Pages:98

Published On:August 2025

By Service:The service segmentation of the CSO market includes various subsegments that cater to different aspects of pharmaceutical sales and marketing. The primary subsegments are Personal Promotion, Non-Personal Promotion, Market Access & Patient Support, Medical Affairs & MSL Services, Training, Analytics & Sales Operations, and Multichannel/Omnichannel Campaign Management. Each of these subsegments plays a crucial role in enhancing the effectiveness of pharmaceutical sales strategies. Notably, industry analyses indicate that personal promotion remains the largest service category within CSO offerings.

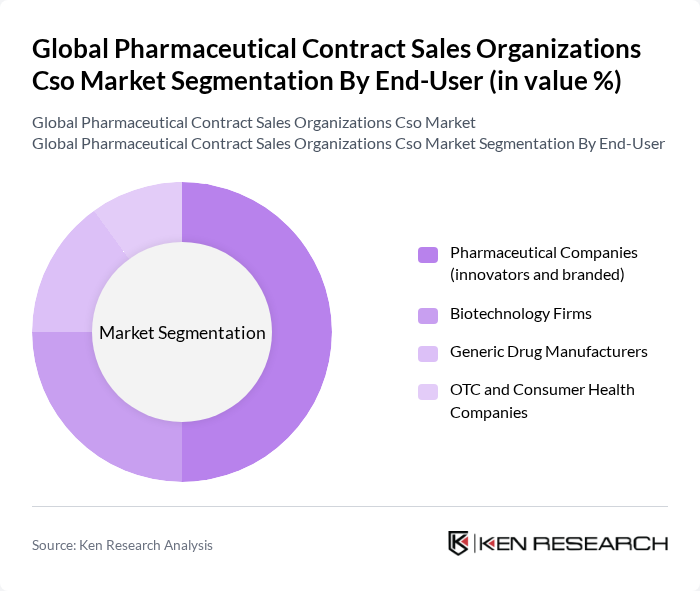

By End-User:The end-user segmentation of the CSO market includes Pharmaceutical Companies, Biotechnology Firms, Generic Drug Manufacturers, and OTC and Consumer Health Companies. Each of these end-users has distinct needs and requirements, influencing their choice of contract sales services. Pharmaceutical companies, particularly innovators and branded firms, dominate the market due to their extensive product portfolios and need for specialized sales strategies; analyst coverage also notes strong demand from biopharma broadly as commercialization complexity rises.

The Global Pharmaceutical Contract Sales Organizations Cso Market is characterized by a dynamic mix of regional and international players. Leading participants such as IQVIA, Syneos Health, Ashfield Engage (UDG Healthcare, part of Inizio), EVERSANA, TMS Health, A Syneos Health Company, ICON plc (including legacy PRA Health Sciences commercialization services), CMIC Holdings Co., Ltd., EPS Corporation, Axxelus, QFR Solutions, IQVIA Japan (CMIC-IQVIA contract promotion in Japan), Promoveo Health, Star OUTiCO, Peak Pharma Solutions Inc., MaBico contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceutical contract sales organization market appears promising, driven by technological advancements and evolving market dynamics. As companies increasingly adopt digital tools and data analytics, CSOs will enhance their sales strategies, improving efficiency and effectiveness. Furthermore, the growing emphasis on patient-centric approaches will likely reshape service offerings, aligning them more closely with patient needs and preferences. This evolution will create new avenues for growth and innovation within the industry.

| Segment | Sub-Segments |

|---|---|

| By Service | Personal Promotion (In-person detailing, field sales representatives) Non-Personal Promotion (Inside sales, remote/virtual detailing, email/web) Market Access & Patient Support (payer engagement, reimbursement, hub services) Medical Affairs & MSL Services Training, Analytics & Sales Operations (CRM enablement, field force analytics) Multichannel/Omnichannel Campaign Management |

| By End-User | Pharmaceutical Companies (innovators and branded) Biotechnology Firms Generic Drug Manufacturers OTC and Consumer Health Companies |

| By Service Model | Full-Service CSOs Specialized/Niche CSOs (e.g., rare disease, oncology) Hybrid/Build-Operate-Transfer (BOT) Models |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Client Type | Large Pharma Mid-Sized Pharma Emerging/Small Pharma & Biotech |

| By Sales Channel | Field Sales (face-to-face) Inside/Remote Sales Digital Channels (email, webinars, programmatic, social) |

| By Pricing & Commercial Model | Fixed-Fee Contracts Performance-Based/Outcome-Linked Pricing Retainer + Incentive Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Sales Strategies | 120 | Sales Directors, Marketing Managers |

| CSO Service Utilization | 100 | Procurement Managers, Business Development Executives |

| Market Trends in Contract Sales | 80 | Market Analysts, Industry Consultants |

| Healthcare Professional Engagement | 100 | Physicians, Pharmacists |

| Regulatory Impact on CSOs | 60 | Compliance Officers, Regulatory Affairs Specialists |

The Global Pharmaceutical Contract Sales Organizations (CSO) market is valued at approximately USD 11 billion, reflecting a significant growth trend driven by the increasing demand for outsourced sales services in the pharmaceutical industry.