Region:Global

Author(s):Geetanshi

Product Code:KRAA2340

Pages:90

Published On:August 2025

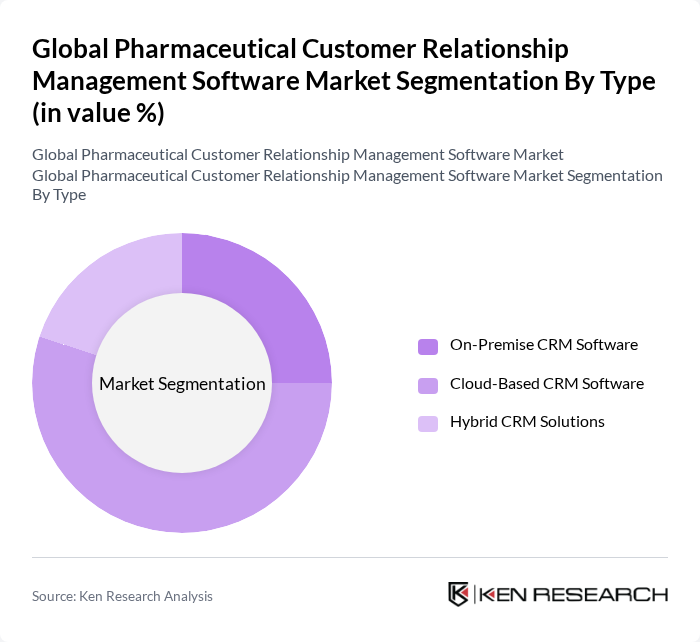

By Type:The market is segmented into three main types: On-Premise CRM Software, Cloud-Based CRM Software, and Hybrid CRM Solutions. Each type addresses different operational needs and preferences of pharmaceutical companies. The Cloud-Based CRM Software segment is currently dominating the market due to its flexibility, scalability, and cost-effectiveness, allowing companies to manage customer relationships efficiently without heavy upfront investments in infrastructure. The adoption of cloud-based solutions is further accelerated by the need for remote access, integration with other digital health platforms, and enhanced data security features .

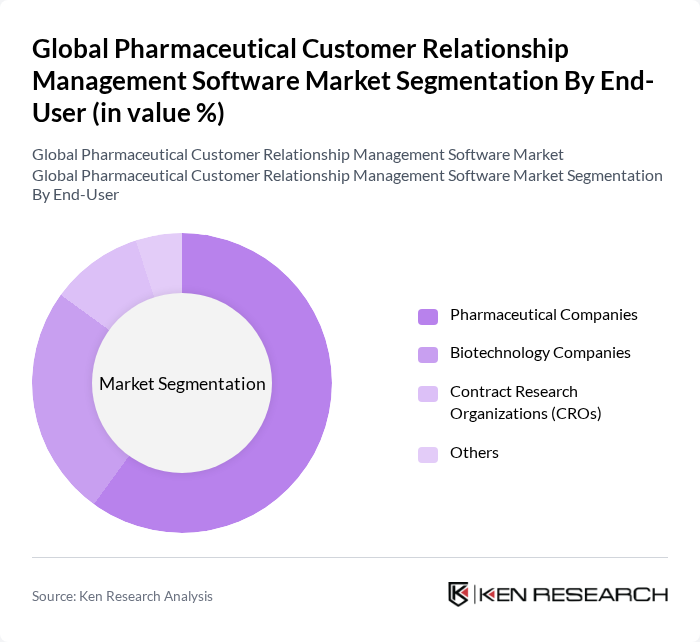

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Companies, Contract Research Organizations (CROs), and Others. Pharmaceutical Companies are the leading end-users, driven by their need for comprehensive customer management solutions to enhance sales and marketing efforts, improve customer engagement, and ensure compliance with regulatory requirements. Biotechnology companies and CROs are increasingly adopting CRM solutions to manage complex stakeholder relationships and streamline operational workflows .

The Global Pharmaceutical Customer Relationship Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce.com, Inc., SAP SE, Oracle Corporation, Microsoft Corporation, Veeva Systems Inc., Kapture CRM, Medsimo Technologies, Actis Sales Technologies, Synergistix Inc., SoftDent, Keap, Zendesk, Inc., SPOTIO, Pipeliner CRM, and Ontraport contribute to innovation, geographic expansion, and service delivery in this space .

The future of the pharmaceutical CRM software market is poised for significant evolution, driven by technological advancements and changing consumer expectations. As the industry increasingly embraces artificial intelligence and machine learning, CRM solutions will become more sophisticated, enabling predictive analytics and personalized customer interactions. Furthermore, the integration of mobile technologies will enhance accessibility, allowing pharmaceutical companies to engage with healthcare professionals and patients more effectively, ultimately improving service delivery and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premise CRM Software Cloud-Based CRM Software Hybrid CRM Solutions |

| By End-User | Pharmaceutical Companies Biotechnology Companies Contract Research Organizations (CROs) Others |

| By Application | Sales Force Automation Marketing Campaign Management Medical Representative Management Sample Tracking Regulatory Compliance Management Customer Service Management |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, U.K., Italy, Spain, Russia, Netherlands, Rest of Europe) Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of Middle East & Africa) |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium Model |

| By Others | Niche Solutions Custom-Built Software Legacy Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 120 | CRM Managers, IT Directors |

| Pharmaceutical Distributors | 90 | Sales Managers, Operations Heads |

| Healthcare Providers | 70 | Pharmacy Managers, Clinical Coordinators |

| Regulatory Bodies | 40 | Compliance Officers, Policy Makers |

| Pharmaceutical Marketing Agencies | 60 | Marketing Directors, Digital Strategy Managers |

The Global Pharmaceutical Customer Relationship Management Software Market is valued at approximately USD 4.3 billion, reflecting a significant growth trajectory driven by the need for effective customer engagement and digital transformation in the pharmaceutical sector.