Region:Global

Author(s):Dev

Product Code:KRAA2590

Pages:82

Published On:August 2025

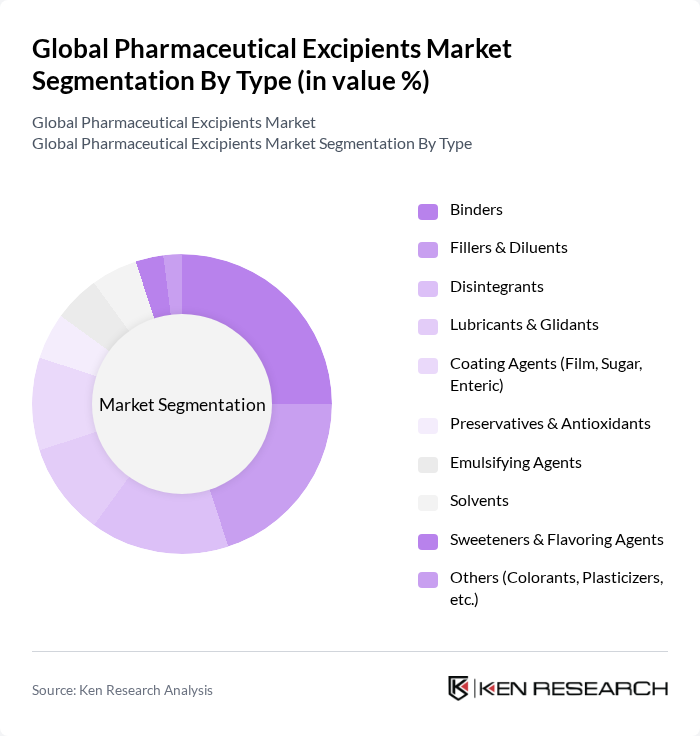

By Type:The market is segmented into various types of excipients, each serving a unique function in drug formulation. The major types include Binders, Fillers & Diluents, Disintegrants, Lubricants & Glidants, Coating Agents (Film, Sugar, Enteric), Preservatives & Antioxidants, Emulsifying Agents, Solvents, Sweeteners & Flavoring Agents, and Others (Colorants, Plasticizers, etc.). Among these,BindersandFillers & Diluentsremain dominant due to their critical roles in tablet formulation and overall drug stability .

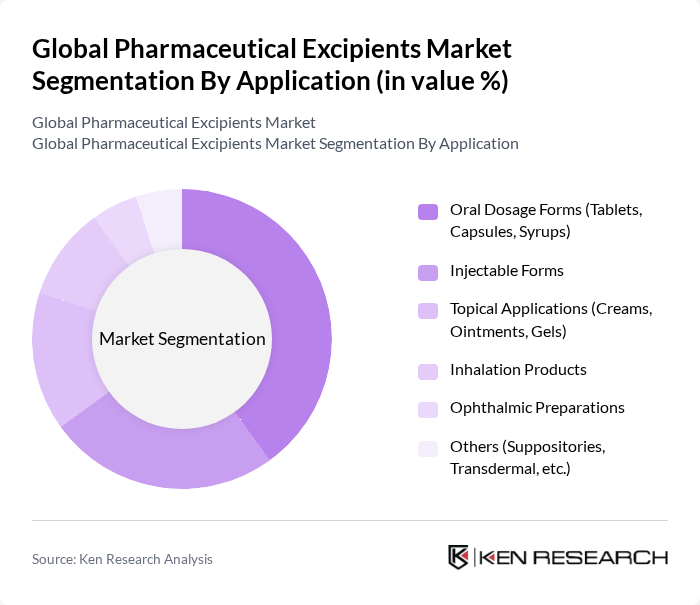

By Application:The applications of pharmaceutical excipients are diverse, including Oral Dosage Forms (Tablets, Capsules, Syrups), Injectable Forms, Topical Applications (Creams, Ointments, Gels), Inhalation Products, Ophthalmic Preparations, and Others (Suppositories, Transdermal, etc.).Oral Dosage Formsdominate the market due to their widespread use and the increasing demand for solid dosage forms, supported by the continued growth in generic and over-the-counter medications .

The Global Pharmaceutical Excipients Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Chemical Company, Ashland Global Holdings Inc., Evonik Industries AG, Croda International Plc, FMC Corporation, JRS Pharma, Merck KGaA, Roquette Frères, Signet Chemical Corporation Pvt. Ltd., Sensient Technologies Corporation, Ingredion Incorporated, Colorcon, Inc., Kerry Group plc, DFE Pharma, Wacker Chemie AG, Gattefossé, Shin-Etsu Chemical Co., Ltd., Associated British Foods plc, ADM (Archer Daniels Midland Company), Air Liquide, Actylis, Berkshire Hathaway Inc., Chemie Trade contribute to innovation, geographic expansion, and service delivery in this space .

The future of the pharmaceutical excipients market is poised for significant transformation, driven by technological advancements and evolving healthcare needs. The integration of artificial intelligence in drug formulation processes is expected to streamline production and enhance efficiency. Additionally, the growing emphasis on personalized medicine will necessitate the development of tailored excipients, fostering innovation. As regulatory landscapes evolve, companies that adapt to these changes will likely gain a competitive edge, positioning themselves favorably in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Binders Fillers & Diluents Disintegrants Lubricants & Glidants Coating Agents (Film, Sugar, Enteric) Preservatives & Antioxidants Emulsifying Agents Solvents Sweeteners & Flavoring Agents Others (Colorants, Plasticizers, etc.) |

| By Application | Oral Dosage Forms (Tablets, Capsules, Syrups) Injectable Forms Topical Applications (Creams, Ointments, Gels) Inhalation Products Ophthalmic Preparations Others (Suppositories, Transdermal, etc.) |

| By End-User | Pharmaceutical Manufacturers Contract Manufacturing Organizations (CMOs) Research & Academic Institutions Others (Biotech Companies, etc.) |

| By Distribution Channel | Direct Sales Distributors & Wholesalers Online Sales Others |

| By Region | North America (U.S., Canada) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of APAC) Latin America (Brazil, Mexico, Rest of LATAM) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Low Price Medium Price High Price |

| By Quality Standard | USP Grade EP Grade BP Grade JP Grade Others (Ph. Eur., IP, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Formulation Development | 100 | Formulation Scientists, R&D Managers |

| Excipients Procurement Strategies | 60 | Procurement Managers, Supply Chain Managers |

| Regulatory Compliance in Excipients | 50 | Regulatory Affairs Specialists, Quality Assurance Managers |

| Market Trends in Excipients | 70 | Market Analysts, Business Development Managers |

| Technological Innovations in Excipients | 40 | Product Development Scientists, Technology Managers |

The Global Pharmaceutical Excipients Market is valued at approximately USD 9.5 billion, based on a five-year historical analysis. This valuation reflects the increasing demand for advanced drug formulations and the growth of the pharmaceutical industry.