Region:Global

Author(s):Dev

Product Code:KRAD0567

Pages:85

Published On:August 2025

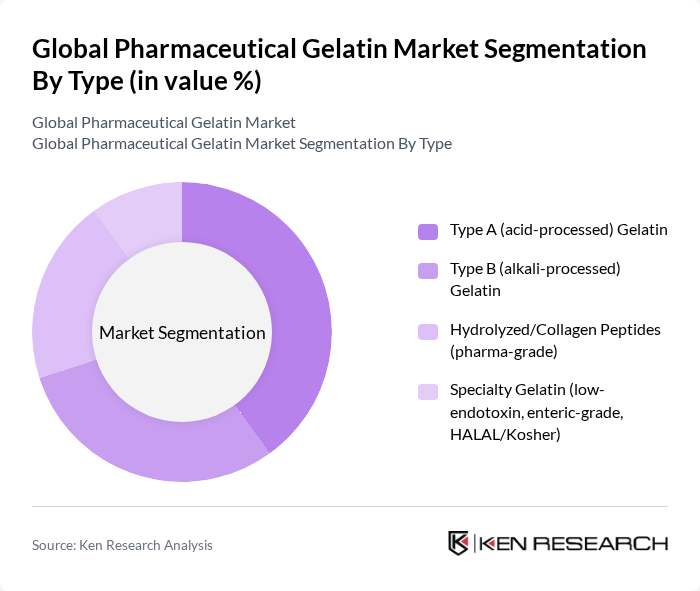

By Type:The market is segmented into various types of gelatin, including Type A (acid-processed) Gelatin, Type B (alkali-processed) Gelatin, Hydrolyzed/Collagen Peptides (pharma-grade), and Specialty Gelatin (low-endotoxin, enteric-grade, HALAL/Kosher). Among these, Type A Gelatin is the most widely used due to its superior gelling properties and compatibility with various pharmaceutical formulations. The demand for Hydrolyzed Gelatin is also increasing, driven by the growing trend of health supplements and functional foods.

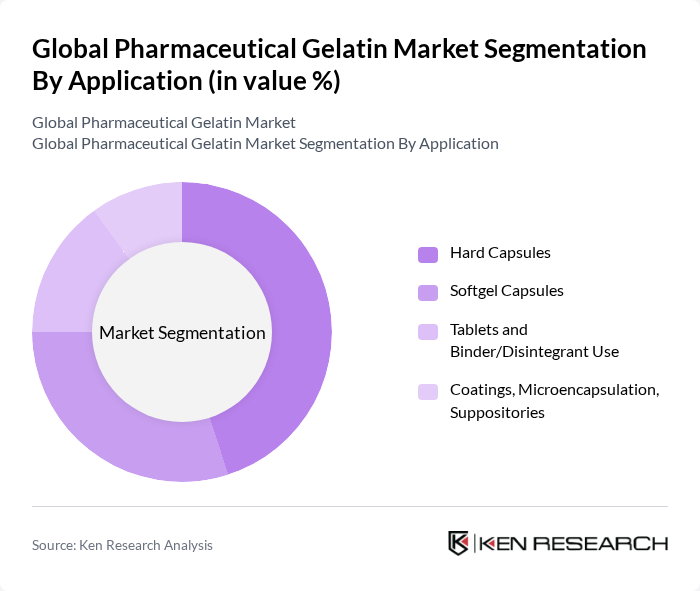

By Application:The applications of gelatin in the pharmaceutical sector include Hard Capsules, Softgel Capsules, Tablets and Binder/Disintegrant Use, and Coatings, Microencapsulation, Suppositories. Hard Capsules are the leading application segment, favored for their ease of use and ability to mask unpleasant tastes. The Softgel Capsules segment is also witnessing significant growth due to the increasing preference for liquid formulations among consumers.

The Global Pharmaceutical Gelatin Market is characterized by a dynamic mix of regional and international players. Leading participants such as GELITA AG, PB Leiner (part of Tessenderlo Group), Rousselot (Darling Ingredients), Nitta Gelatin Inc., Weishardt Group, Italgelatine S.p.A., Ewald-Gelatine GmbH, Geltech/Intertaste Gelatin Solutions LLC, Gelnex (Darling Ingredients), Sterling Gelatin (Agarwal Group), Trobas Gelatina, H.E. Schade GmbH, Juncà Gelatines S.A., Am Food Chemical Co., Ltd., Nippi Inc. (Nippi Gelatin Division) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceutical gelatin market appears promising, driven by technological advancements and increasing health awareness. Innovations in gelatin production methods are expected to enhance product quality and reduce costs, while the growing trend towards plant-based alternatives may open new avenues for market expansion. Additionally, the rise of e-commerce platforms is likely to facilitate broader distribution channels, making gelatin products more accessible to consumers and healthcare providers alike, thereby fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Type A (acid-processed) Gelatin Type B (alkali-processed) Gelatin Hydrolyzed/Collagen Peptides (pharma-grade) Specialty Gelatin (low-endotoxin, enteric-grade, HALAL/Kosher) |

| By Application | Hard Capsules Softgel Capsules Tablets and Binder/Disintegrant Use Coatings, Microencapsulation, Suppositories |

| By End-User | Pharmaceutical Manufacturers Nutraceutical and Dietary Supplement Companies Capsule OEMs/CMOs (empty capsule producers) Contract Development & Manufacturing Organizations (CDMOs) |

| By Source | Bovine Porcine Fish/Marine Poultry/Other |

| By Formulation | Powder Granules Sheets/Films Concentrates and Blends (functionalized gelatin) |

| By Distribution Channel | Direct (Manufacturers to Pharma/Nutra) Authorized Distributors/Traders Online B2B (e-procurement portals) Others |

| By Price Range | Economy (industrial/pharma threshold grade) Mid-Range (standard pharma-grade) Premium (low-endotoxin/traceability-certified) Specialty (HALAL/Kosher/low-crosslinking) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Gelatin Applications | 120 | R&D Managers, Product Development Scientists |

| Gelatin Sourcing and Procurement | 100 | Procurement Officers, Supply Chain Managers |

| Quality Control in Gelatin Production | 80 | Quality Assurance Managers, Compliance Officers |

| Market Trends in Biopharmaceuticals | 70 | Market Analysts, Business Development Executives |

| Regulatory Impact on Gelatin Use | 60 | Regulatory Affairs Specialists, Legal Advisors |

The Global Pharmaceutical Gelatin Market is valued at approximately USD 1.3 billion, driven by increasing demand for gelatin in pharmaceutical applications, particularly for capsules and tablets, as well as dietary supplements.