Region:Global

Author(s):Geetanshi

Product Code:KRAA0149

Pages:92

Published On:August 2025

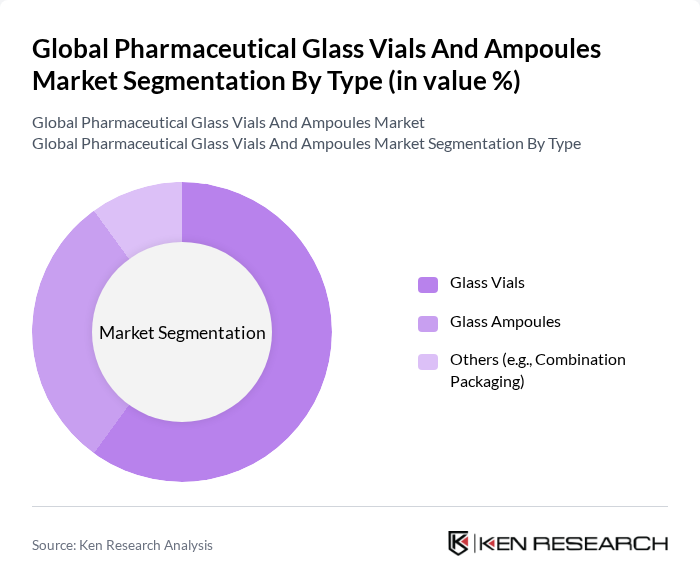

By Type:The market is segmented into three main types: Glass Vials, Glass Ampoules, and Others (e.g., Combination Packaging). Among these, Glass Vials dominate the market due to their versatility and widespread use in storing a variety of pharmaceuticals, including vaccines and injectable drugs. The preference for vials is driven by their ability to provide a sterile environment and their compatibility with various drug formulations. Glass Ampoules are also significant, particularly for single-use applications, while the Others category includes innovative packaging solutions that cater to specific market needs .

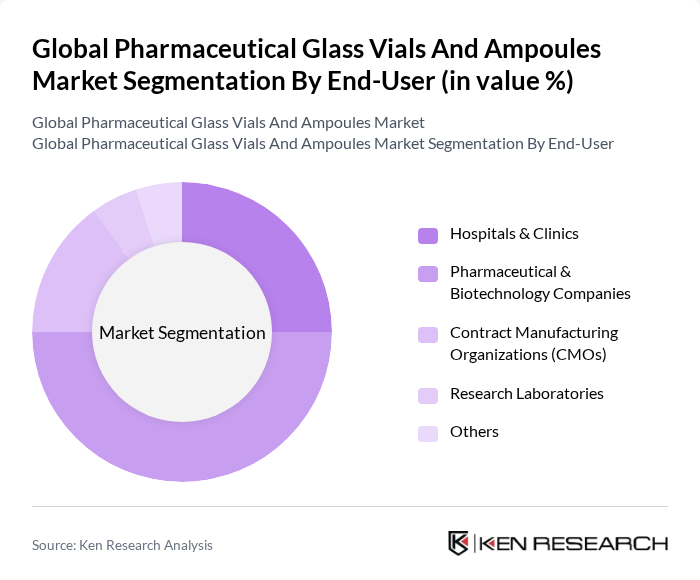

By End-User:The end-user segmentation includes Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, Contract Manufacturing Organizations (CMOs), Research Laboratories, and Others. Pharmaceutical & Biotechnology Companies hold the largest share due to their extensive use of glass vials and ampoules for drug development and distribution. Hospitals and clinics also represent a significant portion of the market, driven by the increasing number of injectable treatments and the need for safe storage solutions. CMOs and research laboratories are growing segments as they require specialized packaging for various drug formulations .

The Global Pharmaceutical Glass Vials And Ampoules Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schott AG, Gerresheimer AG, Nipro Corporation, Bormioli Pharma, SGD Pharma, West Pharmaceutical Services, Inc., Stevanato Group, Piramal Glass, Shandong Pharmaceutical Glass Co., Ltd., Stölzle-Oberglas GmbH, Corning Incorporated, DWK Life Sciences GmbH, Arab Pharmaceutical Glass Co., Koa Glass Co., Ltd., Shandong Huapeng Glass Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceutical glass vials and ampoules market appears promising, driven by the increasing demand for biopharmaceuticals and the adoption of innovative packaging solutions. As companies invest in sustainable practices and smart technologies, the market is likely to witness significant transformations. Furthermore, the ongoing expansion of the pharmaceutical industry in emerging markets will create new opportunities for growth, enhancing the overall landscape of glass packaging solutions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Glass Vials Glass Ampoules Others (e.g., Combination Packaging) |

| By End-User | Hospitals & Clinics Pharmaceutical & Biotechnology Companies Contract Manufacturing Organizations (CMOs) Research Laboratories Others |

| By Material Type | Type I Borosilicate Glass Type II & III Soda-Lime Glass Others (e.g., Aluminosilicate Glass) |

| By Capacity | Less than 2ml ml to 5ml ml to 10ml More than 10ml |

| By Application | Vaccines Injectable Drugs (Biologics, Small Molecules) Diagnostic Agents Others (e.g., Nutraceuticals, Veterinary Drugs) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Market Dynamics | Supply Chain Dynamics Demand Dynamics Competitive Dynamics Regulatory Dynamics |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing | 100 | Production Managers, Quality Control Officers |

| Glass Vial Suppliers | 60 | Sales Directors, Product Managers |

| Regulatory Compliance | 50 | Regulatory Affairs Specialists, Compliance Managers |

| Research & Development | 40 | R&D Directors, Formulation Scientists |

| Market Research Analysts | 40 | Market Analysts, Business Development Managers |

The Global Pharmaceutical Glass Vials and Ampoules Market is valued at approximately USD 10 billion, driven by the increasing demand for injectable drugs, chronic disease prevalence, and advancements in glass manufacturing technologies.