Region:Global

Author(s):Rebecca

Product Code:KRAA1411

Pages:87

Published On:August 2025

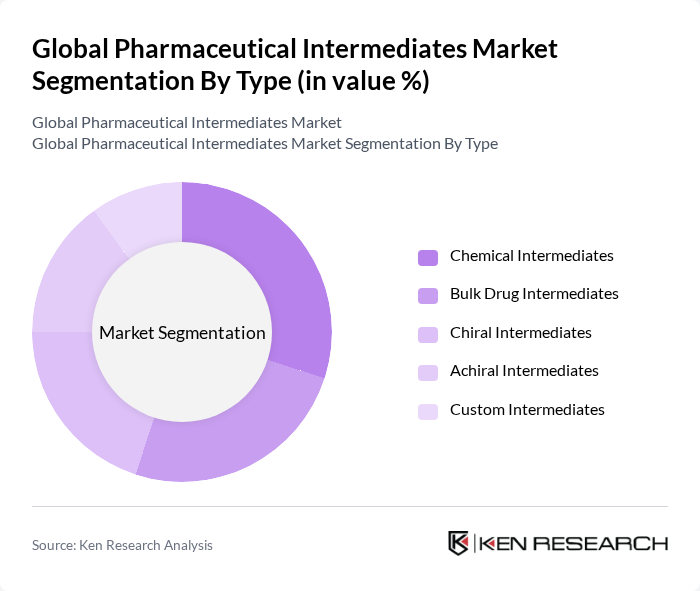

By Type:The market is segmented into various types of intermediates, including Chemical Intermediates, Bulk Drug Intermediates, Chiral Intermediates, Achiral Intermediates, and Custom Intermediates. Each type serves a specific purpose in the pharmaceutical manufacturing process, catering to different therapeutic areas and drug formulations. Chemical Intermediates are widely used in the synthesis of APIs and finished dosage forms. Bulk Drug Intermediates are essential for large-scale drug production, while Chiral and Achiral Intermediates enable the creation of enantiomerically pure and racemic compounds, respectively. Custom Intermediates are tailored to meet specific requirements for novel drug development and specialty therapeutics.

The Chemical Intermediates segment is currently dominating the market due to its extensive application in the synthesis of various pharmaceuticals. The increasing demand for high-quality chemical intermediates, driven by the rise in chronic diseases and the need for innovative drug formulations, has led to significant investments in this area. Additionally, advancements in chemical synthesis technologies and process optimization have further enhanced the efficiency and yield of chemical intermediates, making them a preferred choice among pharmaceutical manufacturers.

By Category:The market is categorized into Branded Drug Intermediates and Generic Drug Intermediates. This segmentation reflects the different market dynamics and consumer preferences associated with branded versus generic pharmaceuticals. Branded Drug Intermediates are typically used in the development of patented medicines, requiring higher quality standards and regulatory compliance. Generic Drug Intermediates are essential for the production of cost-effective alternatives to branded drugs, supporting healthcare affordability and access.

The Branded Drug Intermediates segment leads the market, primarily due to the higher profit margins associated with branded pharmaceuticals. Pharmaceutical companies invest significantly in research and development to create innovative drugs, which in turn drives the demand for high-quality branded intermediates. The strong brand loyalty among consumers and healthcare providers further supports the dominance of this segment in the market. However, the Generic Drug Intermediates segment is experiencing rapid growth, driven by patent expirations and the expanding global demand for affordable medications.

The Global Pharmaceutical Intermediates Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Merck KGaA, Pfizer Inc., Novartis AG, Teva Pharmaceutical Industries Ltd., Aurobindo Pharma Ltd., Sun Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd., Cipla Ltd., Sandoz International GmbH, Lonza Group AG, Evonik Industries AG, Hovione, Cambrex Corporation, WuXi AppTec, Divi's Laboratories Ltd., Sanofi S.A., Boehringer Ingelheim GmbH, Zhejiang NHU Co., Ltd., Asahi Kasei Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceutical intermediates market appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt green chemistry practices, the demand for eco-friendly intermediates is expected to rise. Additionally, the integration of digital technologies in supply chains will enhance efficiency and transparency, allowing for better tracking and management of pharmaceutical intermediates. These trends will likely shape the market landscape, fostering innovation and competitiveness in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Intermediates Bulk Drug Intermediates Chiral Intermediates Achiral Intermediates Custom Intermediates |

| By Category | Branded Drug Intermediates Generic Drug Intermediates |

| By Application | Analgesics Anti-inflammatory Drugs Cardiovascular Drugs Anti-diabetic Drugs Antimicrobial Drugs Anti-cancer Drugs Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Contract Manufacturing Organizations (CMOs) Contract Research Organizations (CROs) Research Laboratories Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Regulatory Compliance | FDA Approved EMA Approved Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Active Pharmaceutical Ingredients (APIs) | 120 | Production Managers, Quality Control Analysts |

| Intermediates for Biopharmaceuticals | 90 | R&D Directors, Regulatory Affairs Specialists |

| Synthetic Intermediates | 70 | Procurement Officers, Supply Chain Managers |

| Contract Manufacturing Organizations (CMOs) | 60 | Operations Managers, Business Development Executives |

| Market Trends and Innovations | 50 | Market Analysts, Product Managers |

The Global Pharmaceutical Intermediates Market is valued at approximately USD 47 billion, reflecting a robust growth trajectory driven by the increasing demand for generic drugs and advancements in drug development technologies.