Region:Global

Author(s):Shubham

Product Code:KRAA1931

Pages:98

Published On:August 2025

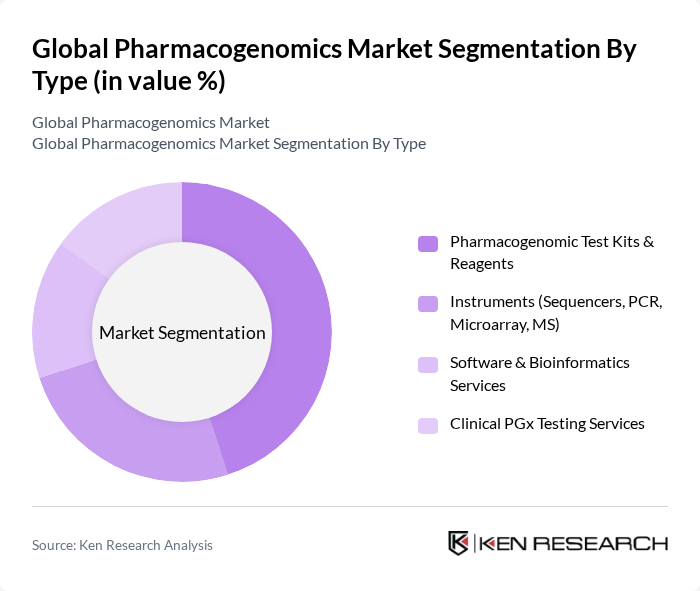

By Type:The market is segmented into various types, including Pharmacogenomic Test Kits & Reagents, Instruments (Sequencers, PCR, Microarray, MS), Software & Bioinformatics Services, and Clinical PGx Testing Services. Among these, Pharmacogenomic Test Kits & Reagents are leading the market due to their essential role in enabling personalized medicine, supporting high-volume genotyping of actionable genes (e.g., CYP2D6, CYP2C19, SLCO1B1), and improving therapeutic outcomes through rapid, standardized workflows in clinical labs .

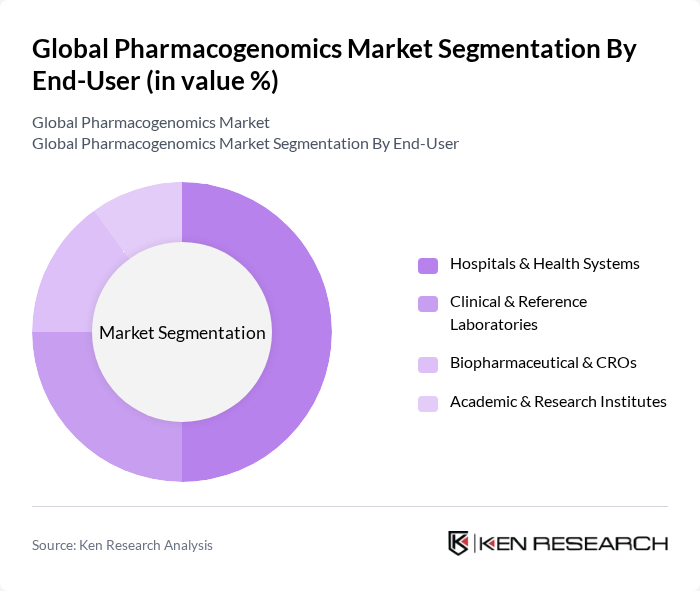

By End-User:The end-user segmentation includes Hospitals & Health Systems, Clinical & Reference Laboratories, Biopharmaceutical & CROs, and Academic & Research Institutes. Hospitals & Health Systems are the dominant end-users, driven by the increasing adoption of personalized medicine, formulary stewardship programs leveraging CPIC/PharmGKB guidance, and integration of PGx into EHR clinical decision support for medication optimization .

The Global Pharmacogenomics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Illumina, Inc., F. Hoffmann-La Roche Ltd, Agilent Technologies, Inc., QIAGEN N.V., Myriad Genetics, Inc., Siemens Healthineers AG, Abbott Laboratories, Genomictree, Inc., Revvity, Inc. (formerly PerkinElmer), BGI Genomics Co., Ltd., Eurofins Scientific SE, Personalis, Inc., Foundation Medicine, Inc., Invitae Corporation, Natera, Inc., Color Health, Inc. (formerly Color Genomics), OneOme, LLC, 23andMe Holding Co., OPKO Health, Inc. (GeneDx) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the pharmacogenomics market appears promising, driven by technological advancements and increasing healthcare investments. As healthcare systems prioritize personalized medicine, the integration of pharmacogenomics into clinical workflows is expected to accelerate. Additionally, the collaboration between technology firms and biopharmaceutical companies will likely enhance the development of innovative testing platforms, further expanding the market's reach and effectiveness in treating chronic diseases and optimizing drug therapies.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmacogenomic Test Kits & Reagents Instruments (Sequencers, PCR, Microarray, MS) Software & Bioinformatics Services Clinical PGx Testing Services |

| By End-User | Hospitals & Health Systems Clinical & Reference Laboratories Biopharmaceutical & CROs Academic & Research Institutes |

| By Application | Oncology Cardiology Psychiatry/Neurology Infectious Diseases & Pain Management |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Distribution Channel | Direct (Enterprise/Provider Contracts) Channel Partners & Distributors Online (eCommerce, Digital Ordering) Group Purchasing Organizations (GPOs) |

| By Pricing Model | Per-Test Fee Subscription/SaaS (Software & Decision Support) Bundled Panels/Pathways Value-Based/Outcome-Linked Pricing |

| By Research Type | Clinical Implementation & Utility Studies Preclinical/Discovery PGx Translational & Real-World Evidence Health Economics & Outcomes Research (HEOR) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmacogenomic Testing Laboratories | 100 | Laboratory Directors, Genetic Counselors |

| Pharmaceutical Companies | 80 | Product Managers, R&D Heads |

| Healthcare Providers | 120 | Physicians, Pharmacists |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Patients and Advocacy Groups | 70 | Patient Advocates, Community Health Workers |

The Global Pharmacogenomics Market is valued at approximately USD 9.6 billion, reflecting steady growth driven by the adoption of precision medicine and advancements in genomic technologies, including next-generation sequencing and PCR-based assays.