Region:Global

Author(s):Shubham

Product Code:KRAC0705

Pages:83

Published On:August 2025

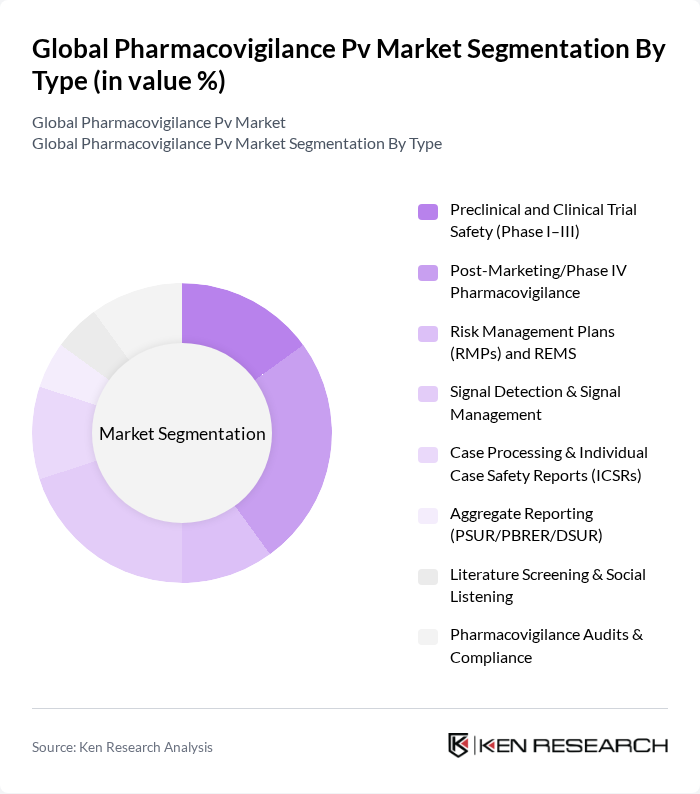

By Type:The market is segmented into various types, including Preclinical and Clinical Trial Safety, Post-Marketing/Phase IV Pharmacovigilance, Risk Management Plans (RMPs) and REMS, Signal Detection & Signal Management, Case Processing & Individual Case Safety Reports (ICSRs), Aggregate Reporting, Literature Screening & Social Listening, and Pharmacovigilance Audits & Compliance. Each of these segments plays a crucial role in ensuring drug safety and regulatory compliance.

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Firms, Contract Research Organizations (CROs), Contract Safety Organizations (CSOs)/BPOs, Regulatory Authorities & Public Health Agencies, and Medical Device and Combination Product Manufacturers. Each of these end-users has unique needs and requirements for pharmacovigilance services.

The Global Pharmacovigilance Pv Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, Oracle Corporation, Cognizant Technology Solutions, Parexel, Wipro, IBM, Syneos Health, Medpace, IQVIA, PPD (Thermo Fisher Scientific), Clario (formerly ERT), ArisGlobal, Veeva Systems, Ennov, AB Cube, United BioSource LLC (UBC), ICON plc, Labcorp, Capgemini, Genpact contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmacovigilance market is poised for significant transformation, driven by technological advancements and evolving regulatory landscapes. As organizations increasingly adopt AI and machine learning, the efficiency of data analysis and risk management will improve, enabling proactive safety monitoring. Additionally, the shift towards patient-centric approaches will enhance engagement and transparency, fostering trust in drug safety. These trends indicate a dynamic market environment that prioritizes innovation and patient welfare in pharmacovigilance practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Preclinical and Clinical Trial Safety (Phase I–III) Post-Marketing/Phase IV Pharmacovigilance Risk Management Plans (RMPs) and REMS Signal Detection & Signal Management Case Processing & Individual Case Safety Reports (ICSRs) Aggregate Reporting (PSUR/PBRER/DSUR) Literature Screening & Social Listening Pharmacovigilance Audits & Compliance |

| By End-User | Pharmaceutical Companies Biotechnology Firms Contract Research Organizations (CROs) Contract Safety Organizations (CSOs)/BPOs Regulatory Authorities & Public Health Agencies Medical Device and Combination Product Manufacturers |

| By Service Type | Case Intake, Triage & Data Management Medical Review & Benefit–Risk Assessment Signal Detection, Analytics & AI/ML Services Aggregate Reporting & Medical Writing QPPV/Local Safety Officer (LSO) and Consulting PV Systems Implementation & Hosting (e.g., Argus, ArisG) Compliance, Audit & Inspection Readiness Training & Managed Services |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Cloud-Based PV Platforms On-Premise PV Solutions Hybrid Deployment AI/ML and NLP for Signal & Case Automation RPA and Workflow Orchestration |

| By Application | Drug Safety Monitoring & ADR Management Signal Detection & Risk Assessment Regulatory Compliance & Reporting Patient Support and Real-World Evidence (RWE) Generation |

| By Policy Support | Government Initiatives (FDA, EMA, MHRA, PMDA, NMPA, WHO) International Standards (ICH E2A–E2F, GVP Modules) Funding & Incentive Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Companies | 150 | Pharmacovigilance Managers, Regulatory Affairs Specialists |

| Clinical Research Organizations (CROs) | 100 | Clinical Trial Managers, Safety Officers |

| Healthcare Providers | 80 | Pharmacists, Physicians, Nurses |

| Regulatory Bodies | 50 | Regulatory Inspectors, Compliance Officers |

| Technology Providers in Pharmacovigilance | 70 | Product Managers, Data Analysts |

The Global Pharmacovigilance Pv Market is valued at approximately USD 8.5 billion, driven by increasing drug safety emphasis, regulatory compliance, and the rising incidence of adverse drug reactions (ADRs).