Region:Global

Author(s):Shubham

Product Code:KRAD0790

Pages:80

Published On:August 2025

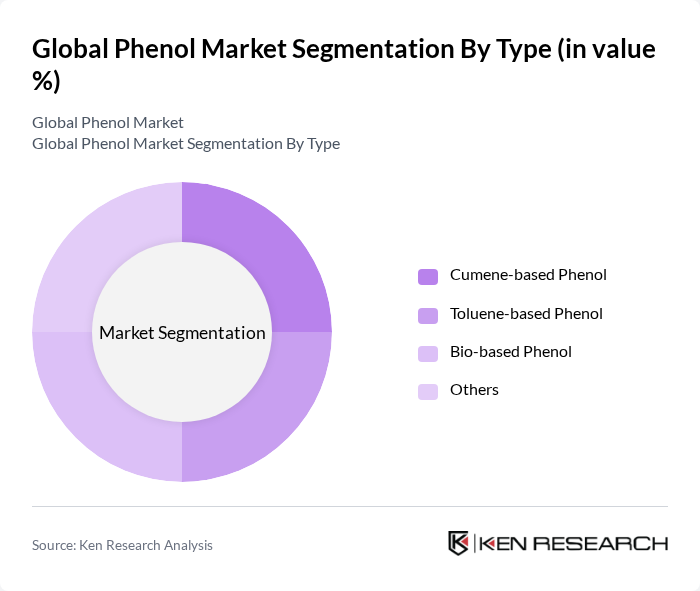

By Type:The phenol market is segmented into Cumene-based Phenol, Toluene-based Phenol, Bio-based Phenol, and Others.Cumene-based Phenolremains the most widely used type due to its cost-effectiveness and high yield in industrial production processes. Toluene-based Phenol is gaining traction for specialty chemical applications, whileBio-based Phenolis emerging as a sustainable alternative, driven by environmental concerns and regulatory pressures for greener solutions.

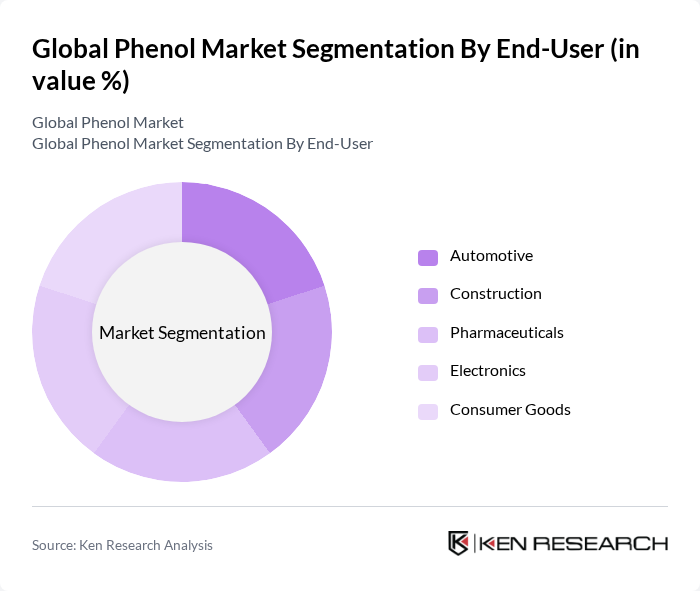

By End-User:The end-user segments include Automotive, Construction, Pharmaceuticals, Electronics, Consumer Goods, and Others. Theautomotive sectoris the largest consumer of phenolic resins, driven by the need for lightweight and durable materials. The construction industry closely follows, utilizing phenol in adhesives, insulation, and coatings. Pharmaceuticals and electronics are significant growth areas, reflecting expanding applications in medical formulations and electronic components.

The Global Phenol Market is characterized by a dynamic mix of regional and international players. Leading participants such as INEOS Phenol, Mitsui Chemicals, Inc., Royal Dutch Shell plc, Solvay S.A., Mitsubishi Chemical Corporation, Formosa Chemicals & Fibre Corp., LG Chem Ltd., SABIC, Honeywell International Inc., UPM-Kymmene Corporation, Repsol S.A., Deepak Nitrite Limited, ALTIVIA Chemicals, Sasol Chemicals, Domo Chemicals contribute to innovation, geographic expansion, and service delivery in this space.

The future of the phenol market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt eco-friendly practices, the demand for bio-based phenol is expected to rise significantly. Additionally, the automotive sector's expansion, particularly in electric vehicles, will likely create new applications for phenolic materials. Companies that invest in innovative production methods and sustainable practices will be well-positioned to capitalize on these emerging trends and meet evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Cumene-based Phenol Toluene-based Phenol Bio-based Phenol Others |

| By End-User | Automotive Construction Pharmaceuticals Electronics Consumer Goods Others |

| By Application | Bisphenol A Phenolic Resins Caprolactam Alkyl Phenols Pharmaceuticals Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-based Pricing |

| By Product Form | Liquid Phenol Solid Phenol Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Phenolic Resins Market | 120 | Product Managers, R&D Directors |

| Adhesives and Sealants Sector | 90 | Procurement Managers, Application Engineers |

| Pharmaceutical Applications | 60 | Quality Control Managers, Regulatory Affairs Specialists |

| Automotive Industry Usage | 70 | Supply Chain Managers, Production Supervisors |

| Coatings and Paints Segment | 50 | Formulation Chemists, Marketing Managers |

The Global Phenol Market is valued at approximately USD 26 billion, driven by increasing demand for phenolic resins in various industries, including automotive, construction, and electronics, as well as advancements in production technologies and the rise of bio-based phenol alternatives.