Region:Global

Author(s):Dev

Product Code:KRAD0415

Pages:87

Published On:August 2025

By Type:The market is segmented into various types of phosphate chemical reagents, each serving distinct applications across industries. The dominant sub-segment is Orthophosphates, which are widely used in food and beverage applications due to their emulsifying and leavening properties. Polyphosphates also hold a significant share, particularly in water treatment and detergents, owing to their effectiveness in corrosion control and scale prevention. The demand for Ammonium Phosphates is driven by the agricultural sector, where they are essential for fertilizer production. Overall, the diverse applications of these reagents contribute to their market leadership.

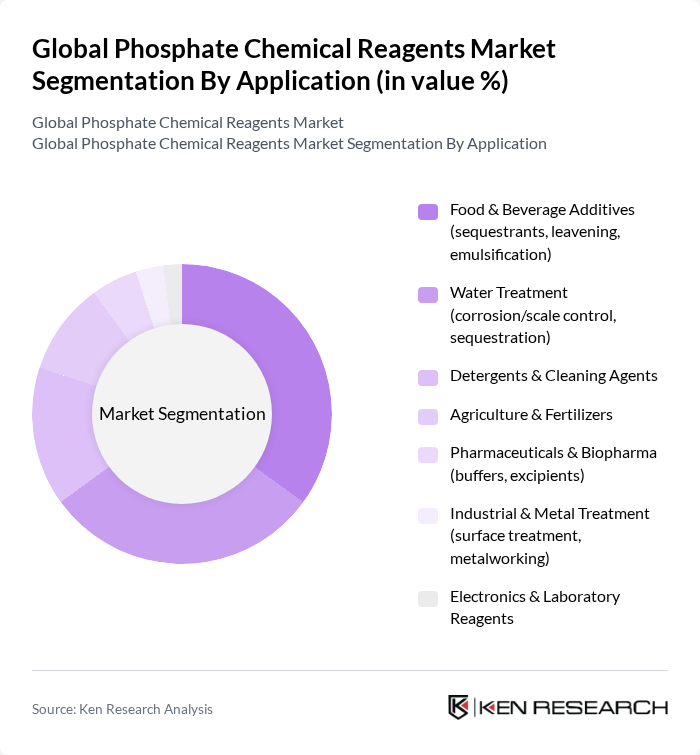

By Application:The applications of phosphate chemical reagents span across various industries, with Food & Beverage Additives being the leading segment. This is due to the increasing demand for processed foods and beverages that require emulsifiers and leavening agents. Water Treatment follows closely, driven by the need for effective corrosion and scale control in municipal and industrial systems. The Agriculture & Fertilizers segment is also significant, as phosphate fertilizers are crucial for enhancing crop yields. The diverse applications of these reagents highlight their importance in multiple sectors.

The Global Phosphate Chemical Reagents Market is characterized by a dynamic mix of regional and international players. Leading participants such as Solvay S.A., Innophos Holdings, Inc., Prayon S.A., ICL Group Ltd., Thermo Fisher Scientific Inc., Merck KGaA (Sigma-Aldrich), Avantor, Inc., Hawkins, Inc., Haifa Group, Yara International ASA, The Mosaic Company, OCP Group, PhosAgro PJSC, EuroChem Group AG, AAT Bioquest, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the phosphate chemical reagents market appears promising, driven by a growing emphasis on sustainable agricultural practices and technological innovations. As environmental regulations tighten, manufacturers are likely to invest in eco-friendly production methods and develop biodegradable alternatives. Additionally, the expansion of e-commerce platforms for chemical sales is expected to enhance market accessibility, allowing for greater distribution and customer engagement. These trends indicate a dynamic market landscape that will adapt to evolving consumer preferences and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Orthophosphates (e.g., Monosodium, Disodium, Trisodium Phosphate) Polyphosphates (e.g., Sodium Hexametaphosphate, Tetrasodium Pyrophosphate) Ammonium Phosphates (MAP, DAP, Ammonium Polyphosphate) Potassium Phosphates (MKP, DKP, TKP) Calcium and Magnesium Phosphates Organophosphate Reagents (Extraction/Analytical use) Others (Specialty phosphate buffers and salts) |

| By Application | Food & Beverage Additives (sequestrants, leavening, emulsification) Water Treatment (corrosion/scale control, sequestration) Detergents & Cleaning Agents Agriculture & Fertilizers Pharmaceuticals & Biopharma (buffers, excipients) Industrial & Metal Treatment (surface treatment, metalworking) Electronics & Laboratory Reagents |

| By End-User | Food & Beverage Manufacturers Municipal & Industrial Water Utilities Detergent and Home/Industrial Care Producers Agrochemical & Fertilizer Producers Pharmaceutical & Biotechnology Companies Electronics, Labs & Research Institutions Others |

| By Distribution Channel | Direct/Bulk Sales (contract, tenders) Distributors & Chemical Blenders Online B2B Platforms Retail/Lab Supply Outlets Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Commodity Grade (bulk) Technical/Industrial Grade Food/Pharma/Reagent Grade (high-purity) Specialty High-Performance |

| By Packaging Type | Bulk (railcar, tanker) Bags (25–50 kg) Drums/IBCs Small Packs (lab-scale) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Fertilizers | 150 | Agronomists, Farm Managers |

| Food Processing Additives | 100 | Food Technologists, Quality Control Managers |

| Water Treatment Chemicals | 80 | Environmental Engineers, Water Quality Managers |

| Industrial Applications | 70 | Production Managers, Chemical Engineers |

| Research and Development | 60 | R&D Directors, Product Development Specialists |

The Global Phosphate Chemical Reagents Market is valued at approximately USD 5 billion, based on a five-year historical analysis. This valuation reflects the increasing demand for phosphate reagents across various industries, including food processing, water treatment, and agriculture.