Region:Global

Author(s):Shubham

Product Code:KRAC0738

Pages:98

Published On:August 2025

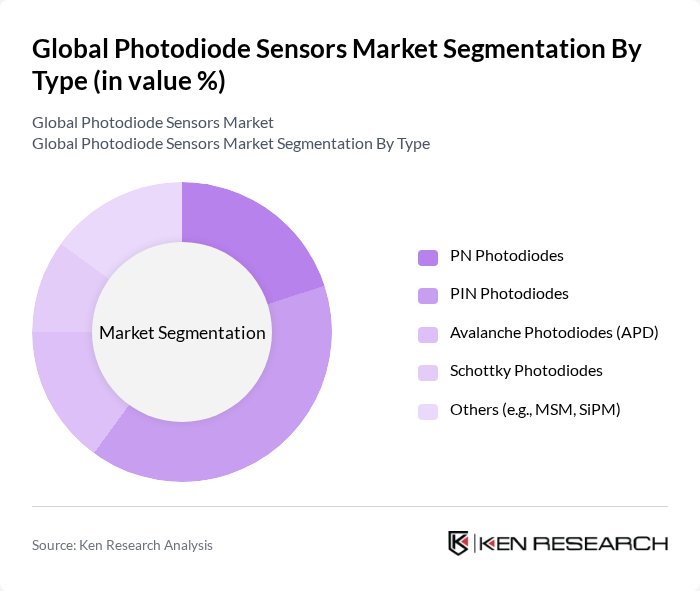

By Type:The photodiode sensors market is segmented into various types, including PN Photodiodes, PIN Photodiodes, Avalanche Photodiodes (APD), Schottky Photodiodes, and Others (e.g., MSM, SiPM). PIN Photodiodes are widely adopted due to high sensitivity, low noise, and broad use in optical communication, LiDAR receivers, and instrumentation requiring linear response and high bandwidth.

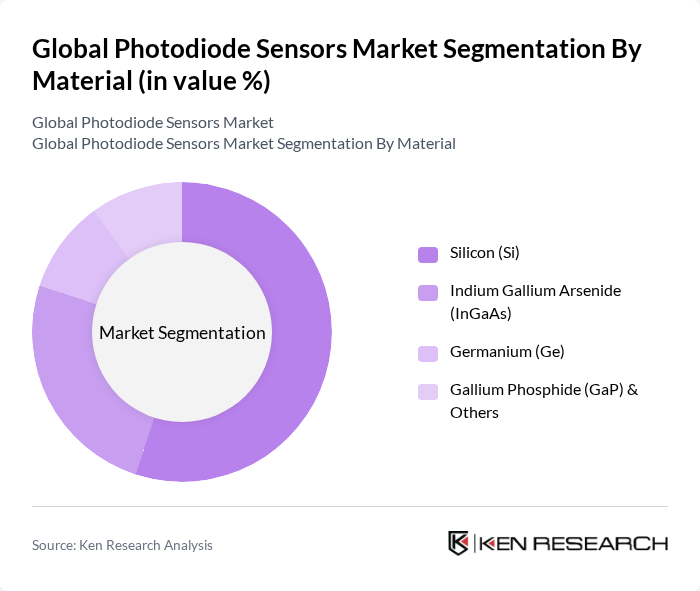

By Material:The materials used in photodiode sensors include Silicon (Si), Indium Gallium Arsenide (InGaAs), Germanium (Ge), and Gallium Phosphide (GaP) & Others. Silicon-based photodiodes dominate on cost-effectiveness, mature CMOS compatibility, and strong presence in consumer electronics and telecom access gear; InGaAs is preferred for near?infrared telecom bands and precision instruments.

The Global Photodiode Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hamamatsu Photonics K.K., ams-OSRAM AG, Vishay Intertechnology, Inc., First Sensor AG (a TE Connectivity company), LITE-ON Technology Corporation, STMicroelectronics N.V., Texas Instruments Incorporated, Analog Devices, Inc., onsemi (ON Semiconductor Corporation), Teledyne Technologies Incorporated, Panasonic Holdings Corporation, Sharp Corporation, Infineon Technologies AG, KYOCERA SLD Laser, Inc. (for specialized photonic sensing), Broadcom Inc., Excelitas Technologies Corp., ROHM Co., Ltd., KODENSHI Corp., EVERLIGHT Electronics Co., Ltd., Thorlabs, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the photodiode sensors market appears promising, driven by technological advancements and increasing integration with IoT devices. As industries continue to embrace automation and smart technologies, the demand for high-performance sensors is expected to rise. Additionally, the focus on energy efficiency and sustainability will likely propel innovations in sensor design and application. Companies that adapt to these trends and invest in R&D will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | PN Photodiodes PIN Photodiodes Avalanche Photodiodes (APD) Schottky Photodiodes Others (e.g., MSM, SiPM) |

| By Material | Silicon (Si) Indium Gallium Arsenide (InGaAs) Germanium (Ge) Gallium Phosphide (GaP) & Others |

| By Wavelength Range | Ultra Violet (UV) Spectrum Visible Spectrum Near Infrared (NIR) Spectrum Infrared (IR) Spectrum |

| By Application | Optical Communication & Datacom Imaging & Light/Color Sensing LiDAR, ToF, and Range Finding Medical Diagnostics & Pulse Oximetry Industrial Safety, Machine Vision & Barcode Scanning Environmental & Radiation Monitoring Security & Surveillance Others |

| By End-Use Industry | Consumer Electronics Telecommunications Automotive (ADAS, LiDAR) Industrial Automation & Robotics Healthcare Aerospace & Defense Others |

| By Sales Channel | Direct Sales (OEM) Distributors/Value-Added Resellers Online (Manufacturer & Distributor E-commerce) Others |

| By Price Range | Low Range Mid Range High Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Applications | 150 | Product Managers, R&D Engineers |

| Automotive Sensor Integration | 100 | Automotive Engineers, Procurement Managers |

| Industrial Automation Solutions | 80 | Operations Managers, Technical Directors |

| Telecommunications Infrastructure | 70 | Network Engineers, Project Managers |

| Medical Device Applications | 60 | Biomedical Engineers, Regulatory Affairs Specialists |

The Global Photodiode Sensors Market is valued at approximately USD 580 million, based on a five-year historical analysis. This valuation reflects the market's growth driven by various applications in telecommunications, healthcare, and industrial automation.