Region:Global

Author(s):Dev

Product Code:KRAA1616

Pages:86

Published On:August 2025

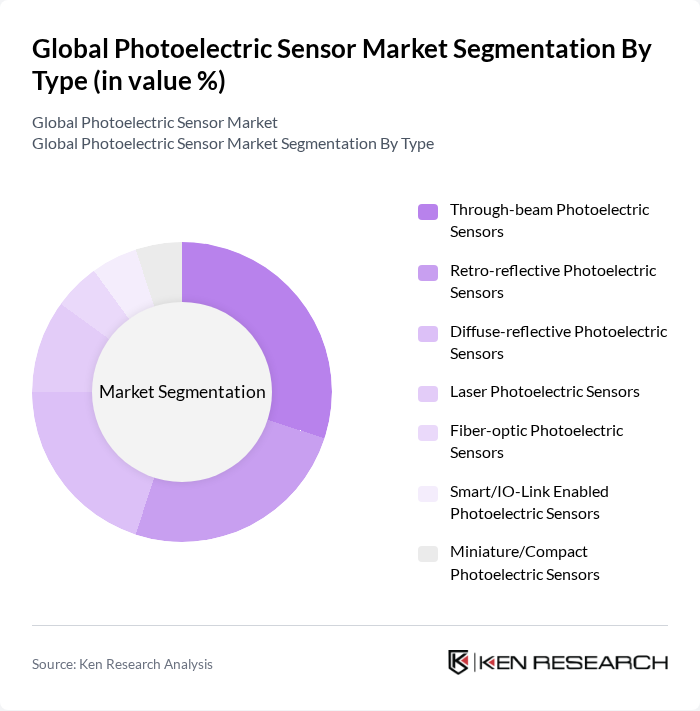

By Type:The photoelectric sensor market is segmented into various types, including Through-beam, Retro-reflective, Diffuse-reflective, Laser, Fiber-optic, Smart/IO-Link Enabled, and Miniature/Compact photoelectric sensors. Each type serves distinct applications across industries, with specific advantages in detection range, accuracy, and installation flexibility. The Through-beam and Retro-reflective sensors are particularly popular due to their reliability and ease of use in various environments.

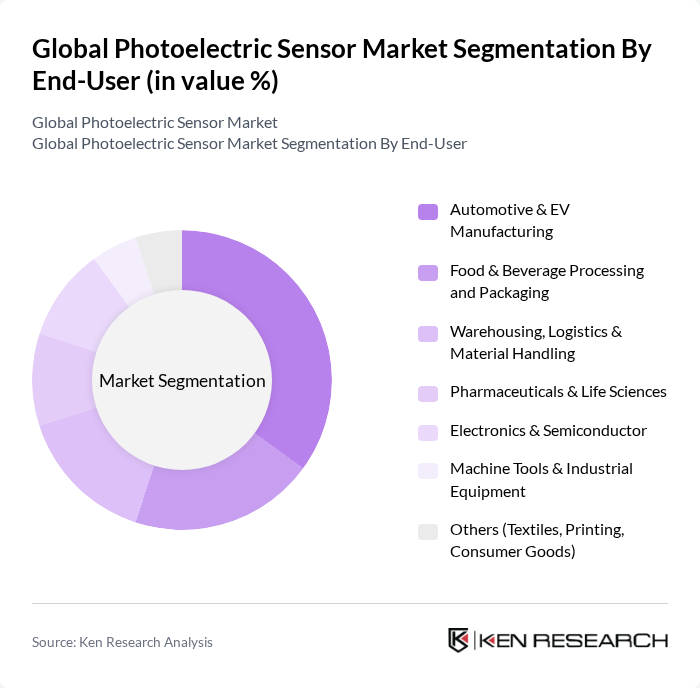

By End-User:The end-user segmentation of the photoelectric sensor market includes Automotive & EV Manufacturing, Food & Beverage Processing and Packaging, Warehousing, Logistics & Material Handling, Pharmaceuticals & Life Sciences, Electronics & Semiconductor, Machine Tools & Industrial Equipment, and Others. The automotive sector is a significant contributor, driven by the increasing adoption of automation and smart technologies in vehicle manufacturing and assembly processes.

The Global Photoelectric Sensor Market is characterized by a dynamic mix of regional and international players. Leading participants such as OMRON Corporation, SICK AG, Keyence Corporation, Banner Engineering Corp., Pepperl+Fuchs SE, Balluff GmbH, ifm electronic gmbh, Leuze electronic GmbH + Co. KG, Autonics Corporation, SensoPart Industriesensorik GmbH, Contrinex AG, Sick Optic Electronic (China) Co., Ltd., Panasonic Holdings Corporation, Schneider Electric SE (Telemecanique Sensors), Rockwell Automation, Inc. (Allen?Bradley), Eaton Corporation plc, Sick Sensor Intelligence (USA), Inc., Leuze Electronic Trading (Shanghai) Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the photoelectric sensor market appears promising, driven by technological advancements and increasing automation across various industries. As companies continue to prioritize efficiency and safety, the integration of photoelectric sensors into smart manufacturing and IoT applications is expected to rise. Additionally, the growing emphasis on energy efficiency and sustainability will likely lead to innovations in eco-friendly sensor designs, further enhancing their appeal in the market. Overall, the sector is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Through-beam Photoelectric Sensors Retro-reflective Photoelectric Sensors Diffuse-reflective Photoelectric Sensors Laser Photoelectric Sensors Fiber-optic Photoelectric Sensors Smart/IO-Link Enabled Photoelectric Sensors Miniature/Compact Photoelectric Sensors |

| By End-User | Automotive & EV Manufacturing Food & Beverage Processing and Packaging Warehousing, Logistics & Material Handling Pharmaceuticals & Life Sciences Electronics & Semiconductor Machine Tools & Industrial Equipment Others (Textiles, Printing, Consumer Goods) |

| By Application | Object & Presence Detection Counting, Sorting & Positioning Quality Inspection & Measurement Safety Perimeter and Guarding Assist Level, Distance & Web Edge Detection Conveyor & Packaging Line Automation Others |

| By Output & Connectivity | Discrete (PNP/NPN) Output Analog (4–20 mA/0–10 V) Output IO-Link/Industrial Ethernet Enabled Wireless/Remote Monitoring |

| By Sensing Range | Short Range (< 1 m) Medium Range (1–10 m) Long Range (> 10 m) |

| By Price Band | Entry/Low Mid Premium/High |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Automation Applications | 150 | Automation Engineers, Production Managers |

| Packaging Industry Utilization | 100 | Packaging Technologists, Quality Control Managers |

| Robotics and Machine Vision | 80 | Robotics Engineers, System Integrators |

| Safety and Security Systems | 70 | Safety Officers, Facility Managers |

| Consumer Electronics Applications | 90 | Product Development Managers, Electronics Engineers |

The Global Photoelectric Sensor Market is valued at approximately USD 2 billion, driven by increasing automation in various sectors such as manufacturing, automotive, and logistics, alongside the integration of IIoT technologies for enhanced operational efficiency.