Region:Global

Author(s):Rebecca

Product Code:KRAB0250

Pages:84

Published On:August 2025

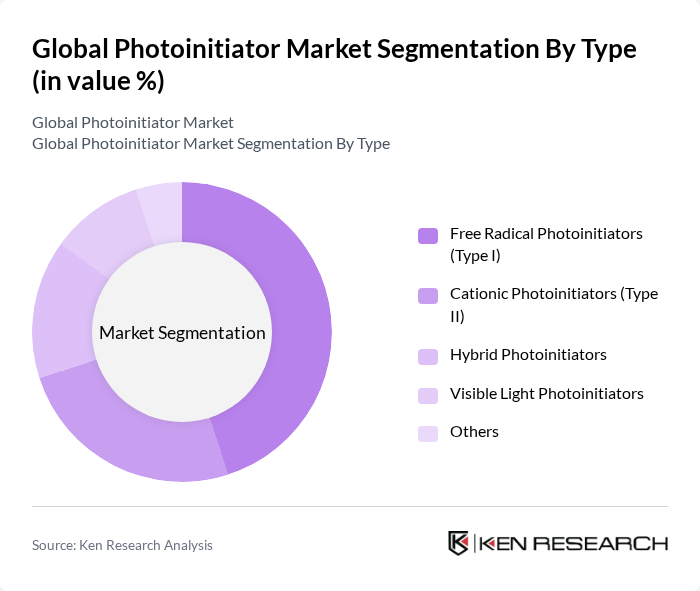

By Type:The market is segmented into Free Radical Photoinitiators (Type I), Cationic Photoinitiators (Type II), Hybrid Photoinitiators, Visible Light Photoinitiators, and Others.Free Radical Photoinitiatorsdominate the market due to their broad use in UV curing applications, especially in coatings and inks, owing to their effectiveness in initiating polymerization upon UV exposure.Cationic Photoinitiatorsare gaining traction in niche applications such as electronics and specialty coatings, whileVisible Light Photoinitiatorsare emerging in response to the demand for energy-efficient and low-toxicity solutions in biomedical and food-grade applications .

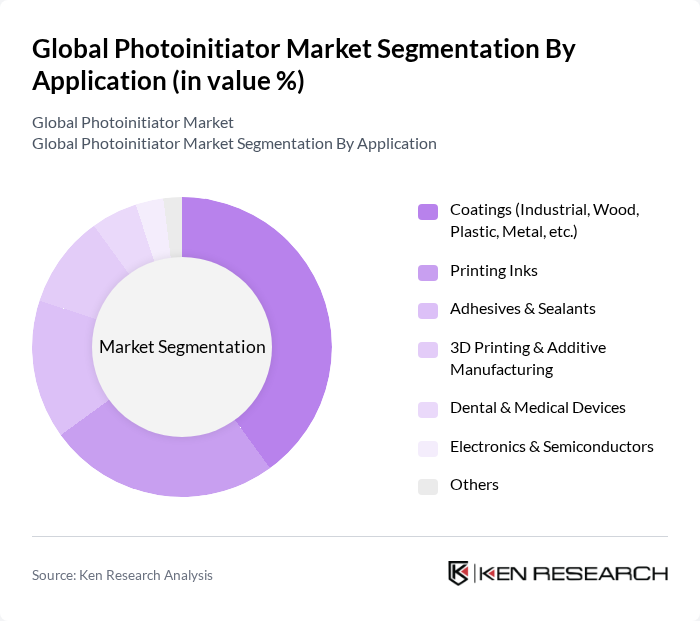

By Application:The applications of photoinitiators include Coatings (Industrial, Wood, Plastic, Metal, etc.), Printing Inks, Adhesives & Sealants, 3D Printing & Additive Manufacturing, Dental & Medical Devices, Electronics & Semiconductors, and Others.Coatingsrepresent the largest application segment, fueled by the rising adoption of UV-cured coatings in automotive, industrial, and consumer goods.Printing inksare a significant segment, reflecting the shift toward digital and high-speed printing technologies. The rapid expansion of3D printingand additive manufacturing is creating new growth avenues, while demand in dental, medical, and electronics applications is increasing due to the need for precision and biocompatibility .

The Global Photoinitiator Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, IGM Resins B.V., Sartomer (Arkema Group), Lambson Limited, Dymax Corporation, Arkema S.A., TOYO INK SC HOLDINGS CO., LTD., KURARAY CO., LTD., Hexion Inc., Eternal Materials Co., Ltd., Jinan Dazheng Chemical Co., Ltd., Shenzhen Mellow Hope Technology Co., Ltd., Jiangsu Kuaida Chemical Co., Ltd., Hubei Greenhome Fine Chemical Co., Ltd., and Wanhua Chemical Group Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the photoinitiator market appears promising, driven by technological advancements and increasing environmental awareness. Innovations in photoinitiator chemistry are expected to enhance performance and reduce environmental impact, aligning with the global shift towards sustainability. Additionally, the expansion into emerging markets, particularly in Asia-Pacific, is anticipated to provide new growth avenues as industries adopt UV-curable technologies to meet local demands and regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Free Radical Photoinitiators (Type I) Cationic Photoinitiators (Type II) Hybrid Photoinitiators Visible Light Photoinitiators Others |

| By Application | Coatings (Industrial, Wood, Plastic, Metal, etc.) Printing Inks Adhesives & Sealants D Printing & Additive Manufacturing Dental & Medical Devices Electronics & Semiconductors Others |

| By End-User | Automotive & Transportation Electronics & Electrical Packaging Construction Healthcare & Medical Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Product Form | Liquid Photoinitiators Solid Photoinitiators Powder Photoinitiators Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coatings Industry | 100 | Product Managers, Technical Directors |

| Adhesives and Sealants | 80 | Procurement Managers, R&D Specialists |

| 3D Printing Applications | 60 | Manufacturing Engineers, Product Development Managers |

| Cosmetics and Personal Care | 50 | Formulation Chemists, Brand Managers |

| Pharmaceuticals | 40 | Regulatory Affairs Specialists, Quality Control Managers |

The Global Photoinitiator Market is valued at approximately USD 2 billion, based on a five-year historical analysis. This valuation reflects the increasing demand for photoinitiators across various applications, including coatings, adhesives, and printing inks.