Region:Global

Author(s):Rebecca

Product Code:KRAA1463

Pages:92

Published On:August 2025

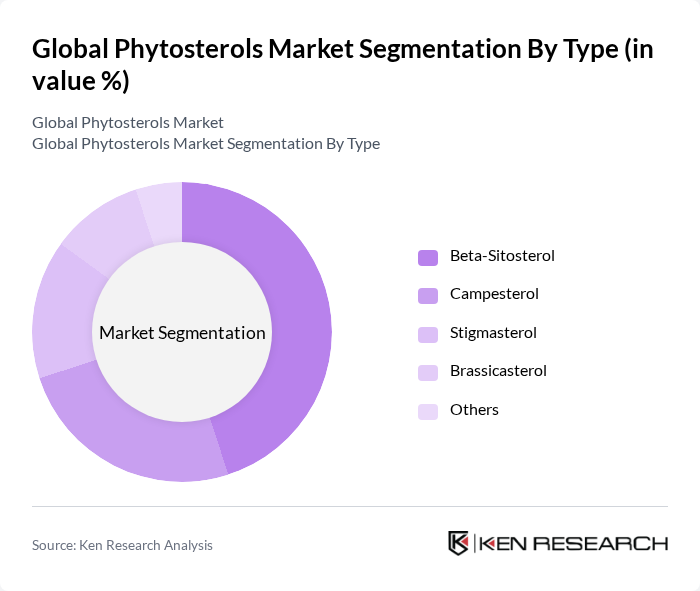

By Type:The market is segmented into Beta-Sitosterol, Campesterol, Stigmasterol, Brassicasterol, and Others. Beta-Sitosterol remains the most dominant sub-segment, attributed to its extensive use in dietary supplements and functional foods. Consumer preference for natural ingredients and heightened awareness of the health benefits of Beta-Sitosterol, particularly in cholesterol management, underpin its market leadership .

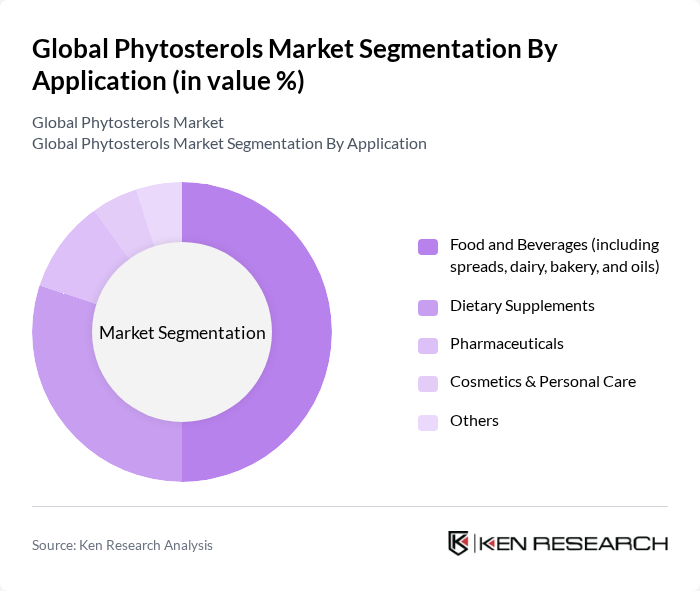

By Application:Phytosterols are applied across Food and Beverages, Dietary Supplements, Pharmaceuticals, Cosmetics & Personal Care, and Others. The Food and Beverages segment holds the largest share, driven by the increasing incorporation of phytosterols in functional foods and spreads aimed at cholesterol management. The trend toward health-conscious eating and demand for fortified food products are key factors propelling this segment’s growth. Dietary supplements and pharmaceuticals also represent significant application areas, reflecting the expanding role of phytosterols in preventive nutrition and metabolic health .

The Global Phytosterols Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Incorporated, BASF SE, DuPont de Nemours, Inc., Archer Daniels Midland Company, Bunge Limited, DSM Nutritional Products AG, Ingredion Incorporated, Kemin Industries, Inc., Unilever PLC, Raisio Group plc, Sabinsa Corporation, Lipofoods S.L.U., Arboris LLC, Matrix Fine Sciences Pvt. Ltd., Pharmachem Laboratories, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the phytosterols market appears promising, driven by increasing health consciousness and a shift towards plant-based diets. Innovations in extraction technologies are expected to enhance product quality and reduce costs, making phytosterols more accessible. Additionally, collaborations with food manufacturers will likely expand the range of applications, further integrating phytosterols into mainstream food products. As regulatory frameworks evolve to support health claims, the market is poised for significant growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Beta-Sitosterol Campesterol Stigmasterol Brassicasterol Others |

| By Application | Food and Beverages (including spreads, dairy, bakery, and oils) Dietary Supplements Pharmaceuticals Cosmetics & Personal Care Others |

| By End-User | Food Manufacturers Nutraceutical Companies Pharmaceutical Companies Cosmetic & Personal Care Companies Others |

| By Distribution Channel | Direct Sales Online Retail Distributors/Wholesalers Pharmacies/Drugstores Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Medium Price High Price |

| By Product Form | Powder Liquid Granules Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Industry Applications | 100 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Sector Insights | 80 | Regulatory Affairs Managers, R&D Scientists |

| Cosmetics and Personal Care | 60 | Formulation Chemists, Brand Managers |

| Health and Wellness Market | 70 | Nutritionists, Health Coaches |

| Consumer Awareness and Trends | 50 | Market Researchers, Consumer Behavior Analysts |

The Global Phytosterols Market is valued at approximately USD 1.75 billion, reflecting a significant growth trend driven by increasing consumer awareness of health benefits, particularly in lowering LDL cholesterol and supporting heart health.