Region:Global

Author(s):Rebecca

Product Code:KRAA2840

Pages:82

Published On:August 2025

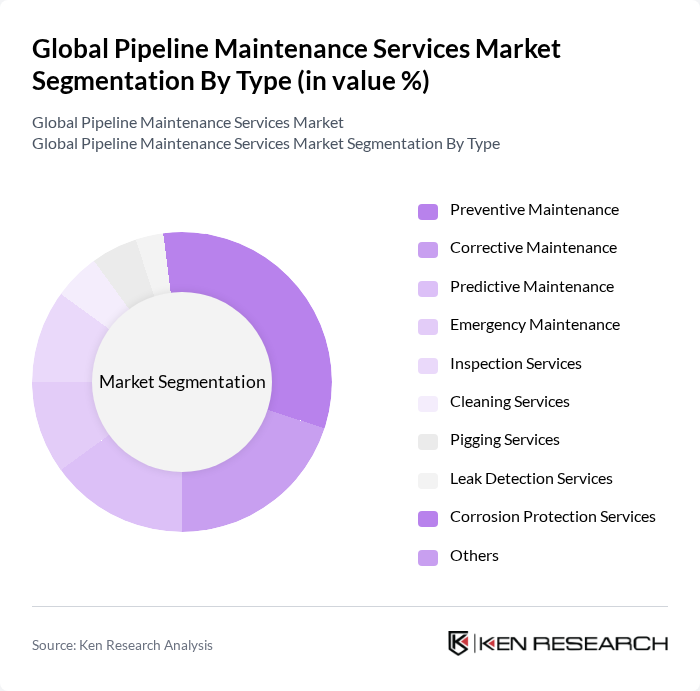

By Type:The market is segmented into various types of maintenance services, including preventive, corrective, predictive, emergency maintenance, inspection services, cleaning services, pigging services, leak detection services, corrosion protection services, and others. Among these,preventive maintenanceis gaining traction due to its cost-effectiveness and ability to extend the lifespan of pipeline systems. The increasing focus on minimizing downtime and enhancing operational efficiency, along with the adoption of digital monitoring and predictive analytics, is driving the demand for preventive maintenance services .

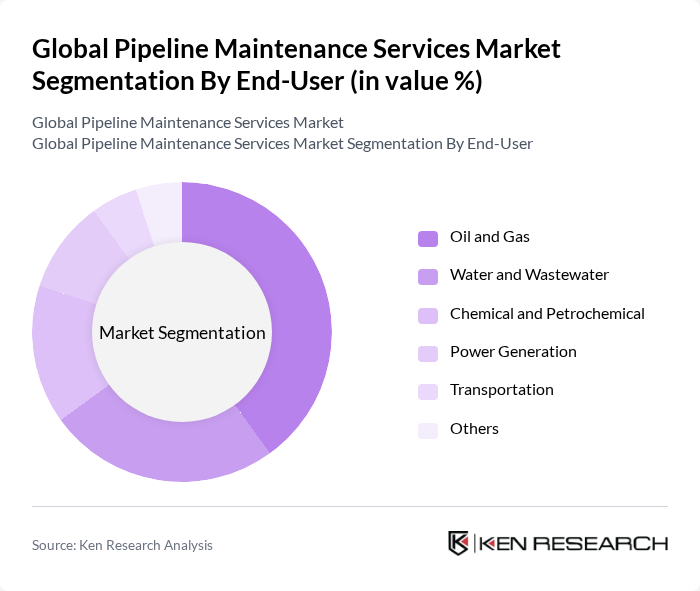

By End-User:The end-user segmentation includes oil and gas, water and wastewater, chemical and petrochemical, power generation, transportation, and others. Theoil and gas sectoris the largest consumer of pipeline maintenance services due to the extensive network of pipelines and the critical need for safety and compliance. Increasing exploration and production activities, as well as regulatory requirements for operational integrity, are driving the demand for maintenance services in this sector .

The Global Pipeline Maintenance Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger Limited, Halliburton Company, Baker Hughes Company, Aegion Corporation, T.D. Williamson, Inc., Intertek Group plc, Applus+, Team Industrial Services, Inc., EnerMech Ltd., Mistras Group, Inc., Enbridge Inc., TC Energy Corporation, Energy Transfer LP, National Grid plc, Veolia Environnement S.A., STATS Group, Dacon Inspection Services Co. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of pipeline maintenance services in None is poised for transformation, driven by technological advancements and regulatory pressures. As companies increasingly adopt digital solutions, such as predictive maintenance and IoT integration, operational efficiencies are expected to improve significantly. Furthermore, the focus on sustainability will likely shape service offerings, compelling organizations to innovate and adapt to evolving environmental standards. This dynamic landscape presents both challenges and opportunities for stakeholders in the pipeline maintenance sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Preventive Maintenance Corrective Maintenance Predictive Maintenance Emergency Maintenance Inspection Services Cleaning Services Pigging Services Leak Detection Services Corrosion Protection Services Others |

| By End-User | Oil and Gas Water and Wastewater Chemical and Petrochemical Power Generation Transportation Others |

| By Service Type | Inspection and Monitoring Services Repair and Maintenance Services Cleaning and Pigging Services Leak Detection Services Corrosion Protection Services Maintenance Management Services Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Technology | Automated Inspection Technologies Remote Monitoring Technologies Data Analytics Tools Robotics and Drones Cathodic Protection Systems Others |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts Time and Materials Contracts Others |

| By Investment Source | Private Investments Public Funding Joint Ventures Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Pipeline Maintenance | 100 | Maintenance Managers, Operations Directors |

| Gas Pipeline Integrity Services | 80 | Integrity Engineers, Safety Officers |

| Water Pipeline Rehabilitation | 60 | Project Managers, Environmental Engineers |

| Pipeline Inspection Technologies | 50 | Technology Developers, R&D Managers |

| Regulatory Compliance in Pipeline Maintenance | 70 | Compliance Officers, Regulatory Affairs Managers |

The Global Pipeline Maintenance Services Market is valued at approximately USD 25 billion, driven by the increasing demand for efficient pipeline operations and regular maintenance to prevent leaks and failures, alongside rising investments in infrastructure development across various sectors.