Region:Global

Author(s):Geetanshi

Product Code:KRAA2364

Pages:82

Published On:August 2025

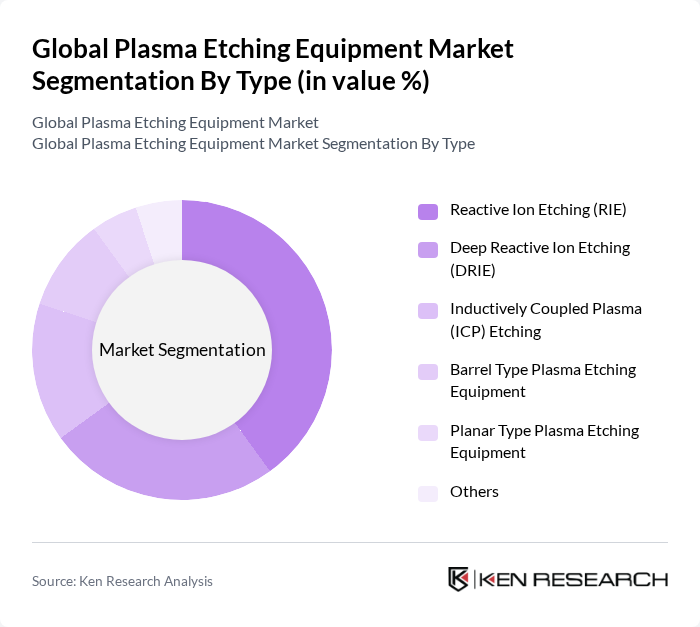

By Type:The plasma etching equipment market is segmented into various types, including Reactive Ion Etching (RIE), Deep Reactive Ion Etching (DRIE), Inductively Coupled Plasma (ICP) Etching, Barrel Type Plasma Etching Equipment, Planar Type Plasma Etching Equipment, and Others. Among these, Reactive Ion Etching (RIE) is the most dominant segment due to its widespread application in semiconductor manufacturing, where precision and control are critical. The demand for RIE is driven by the increasing complexity of integrated circuits and the need for high-resolution patterning. DRIE and ICP etching are also gaining traction for advanced packaging and MEMS fabrication, reflecting the industry's shift toward smaller geometries and higher performance devices .

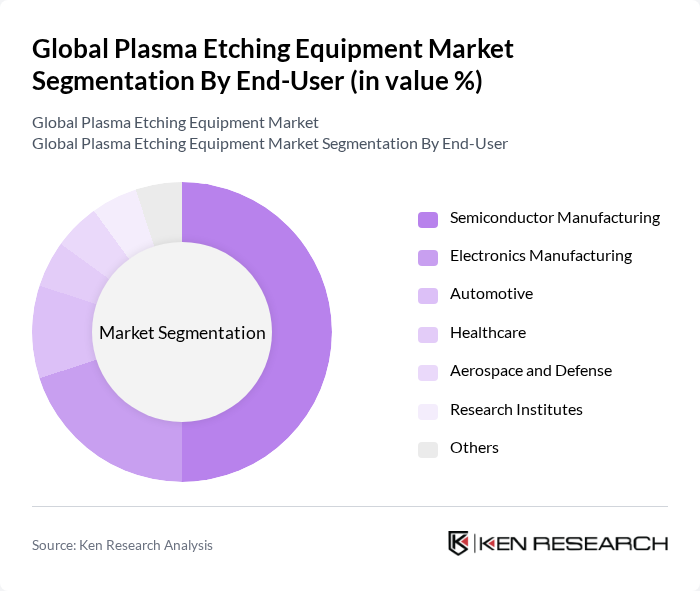

By End-User:The end-user segmentation includes Semiconductor Manufacturing, Electronics Manufacturing, Automotive, Healthcare, Aerospace and Defense, Research Institutes, and Others. The Semiconductor Manufacturing segment holds the largest share, driven by the rapid growth of the semiconductor industry and the increasing demand for advanced chips in consumer electronics, automotive applications, and IoT devices. The need for high-performance and energy-efficient semiconductors is propelling investments in plasma etching technologies. Electronics manufacturing and automotive sectors are also expanding their use of plasma etching for miniaturized, high-reliability components .

The Global Plasma Etching Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Applied Materials, Inc., Lam Research Corporation, Tokyo Electron Limited, ASML Holding N.V., KLA Corporation, Hitachi High-Tech Corporation, Plasma-Therm, LLC, Oxford Instruments plc, SPTS Technologies Limited, Veeco Instruments Inc., Nissin Ion Equipment Co., Ltd., AIXTRON SE, CVD Equipment Corporation, Ultratech/Cambridge NanoTech, Riber S.A. contribute to innovation, geographic expansion, and service delivery in this space. These companies are recognized for their ongoing R&D investments and product launches targeting advanced semiconductor and microelectronics manufacturing .

The future of the plasma etching equipment market appears promising, driven by technological advancements and increasing demand across various sectors. As industries prioritize sustainable manufacturing practices, the integration of eco-friendly solutions will likely gain traction. Additionally, the rise of IoT and smart devices will further propel the need for precise etching techniques, ensuring that plasma etching remains a vital component in the manufacturing landscape. Companies that adapt to these trends will be well-positioned for success.

| Segment | Sub-Segments |

|---|---|

| By Type | Reactive Ion Etching (RIE) Deep Reactive Ion Etching (DRIE) Inductively Coupled Plasma (ICP) Etching Barrel Type Plasma Etching Equipment Planar Type Plasma Etching Equipment Others |

| By End-User | Semiconductor Manufacturing Electronics Manufacturing Automotive Healthcare Aerospace and Defense Research Institutes Others |

| By Application | Integrated Circuits (Logic and Memory) MEMS Devices Photovoltaics RFID (Radio Frequency Identification) CMOS Image Sensors Others |

| By Component | Etching Chambers Power Supplies Gas Delivery Systems Control Systems Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Fabrication Facilities | 100 | Process Engineers, Facility Managers |

| Plasma Etching Equipment Suppliers | 60 | Sales Directors, Product Managers |

| Research Institutions and Universities | 40 | Academic Researchers, Lab Managers |

| Electronics Manufacturing Services (EMS) | 50 | Operations Managers, Quality Assurance Leads |

| Industry Analysts and Consultants | 40 | Market Analysts, Technology Consultants |

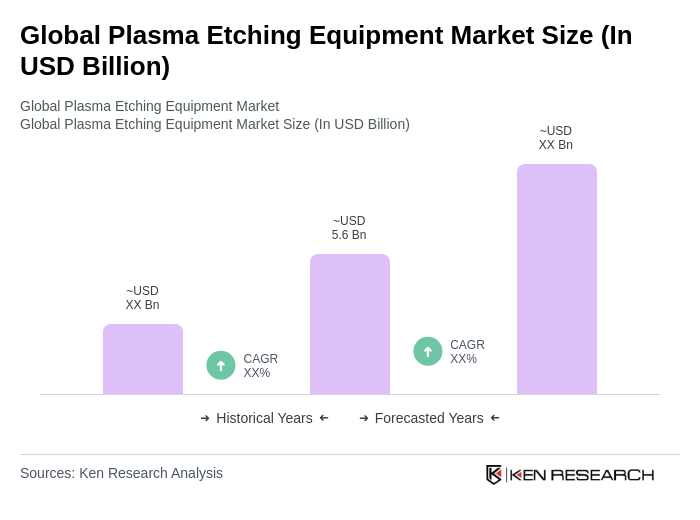

The Global Plasma Etching Equipment Market is valued at approximately USD 5.6 billion, driven by the increasing demand for semiconductor devices and advancements in electronics manufacturing technologies.