Region:Global

Author(s):Geetanshi

Product Code:KRAD0080

Pages:88

Published On:August 2025

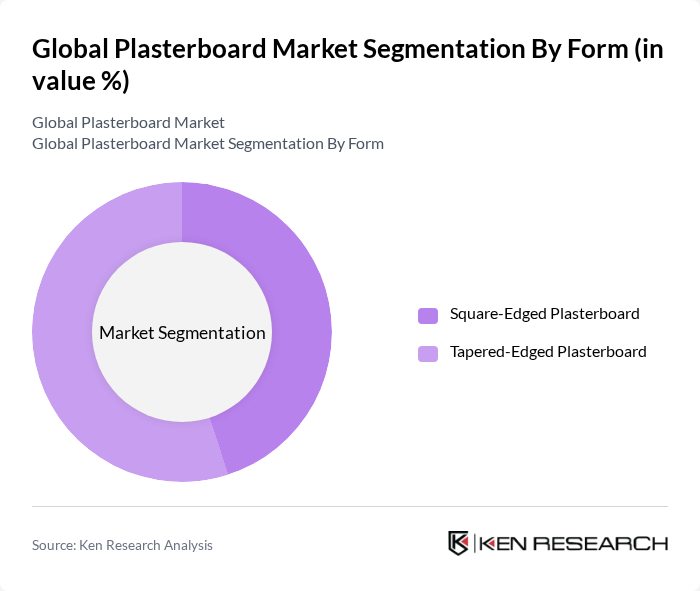

By Form:The plasterboard market is segmented into two primary forms: Square-Edged Plasterboard and Tapered-Edged Plasterboard. Square-edged plasterboard is commonly used for its straightforward installation and finishing, making it a popular choice for residential applications. Tapered-edged plasterboard is preferred for its ability to create seamless joints, which is essential for high-quality finishes in commercial and high-end residential projects. The demand for tapered-edged plasterboard is increasing due to its superior aesthetic appeal and enhanced performance in sound insulation applications .

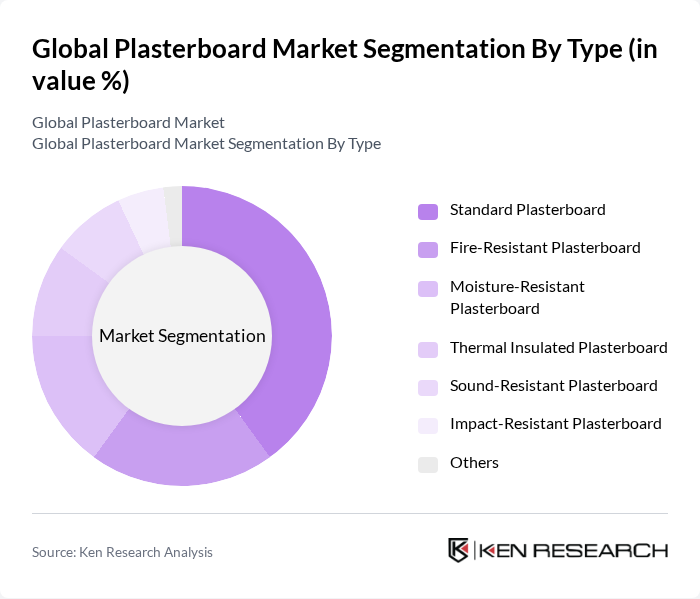

By Type:The plasterboard market is categorized into several types, including Standard Plasterboard, Fire-Resistant Plasterboard, Moisture-Resistant Plasterboard, Thermal Insulated Plasterboard, Sound-Resistant Plasterboard, Impact-Resistant Plasterboard, and Others. Standard Plasterboard holds the largest market share due to its versatility and cost-effectiveness. Fire-resistant plasterboard is gaining traction in commercial buildings where safety regulations are stringent. The increasing focus on energy efficiency and moisture control is driving the demand for thermal insulated and moisture-resistant types, particularly in regions with extreme weather conditions. Sound-resistant and impact-resistant plasterboards are also seeing increased adoption in both residential and commercial segments, driven by growing requirements for acoustic comfort and durability .

The Global Plasterboard Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saint-Gobain S.A., USG Corporation, Knauf Gips KG, Boral Limited, Gypsum Management and Supply, Inc. (GMS), National Gypsum Company, Holcim Ltd (formerly LafargeHolcim), Etex Group NV, Siniat S.A. (an Etex company), Georgia-Pacific LLC, CertainTeed (a Saint-Gobain brand), PABCO Gypsum, Continental Building Products (now part of Saint-Gobain), ACG Materials (now part of Arcosa Specialty Materials), and Tarmac Building Products Limited contribute to innovation, geographic expansion, and service delivery in this space .

The future of the plasterboard market in None appears promising, driven by ongoing urbanization and a shift towards sustainable construction practices. As governments implement stricter building codes and promote eco-friendly materials, the demand for innovative plasterboard solutions is expected to rise. Additionally, advancements in manufacturing technologies will enhance product performance, making plasterboard a preferred choice in modern construction. The market is poised for growth as it adapts to these evolving trends and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Form | Square-Edged Plasterboard Tapered-Edged Plasterboard |

| By Type | Standard Plasterboard Fire-Resistant Plasterboard Moisture-Resistant Plasterboard Thermal Insulated Plasterboard Sound-Resistant Plasterboard Impact-Resistant Plasterboard Others |

| By End-Use Sector | Residential Non-Residential |

| By Application | Interior Walls Ceilings Partitions Decorative Elements |

| By Distribution Channel | Direct Sales Distributors Online Retail |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Brand | National Brands Private Labels International Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 120 | Project Managers, Contractors |

| Commercial Building Developments | 90 | Architects, Developers |

| Plasterboard Distribution Channels | 60 | Distributors, Retail Managers |

| Industrial Applications of Plasterboard | 50 | Facility Managers, Engineers |

| Regulatory Compliance in Construction | 40 | Compliance Officers, Safety Managers |

The Global Plasterboard Market is valued at approximately USD 27 billion, driven by the increasing demand for lightweight construction materials and sustainable building practices, alongside the expansion of the construction industry in emerging economies.