Region:Global

Author(s):Dev

Product Code:KRAD0492

Pages:90

Published On:August 2025

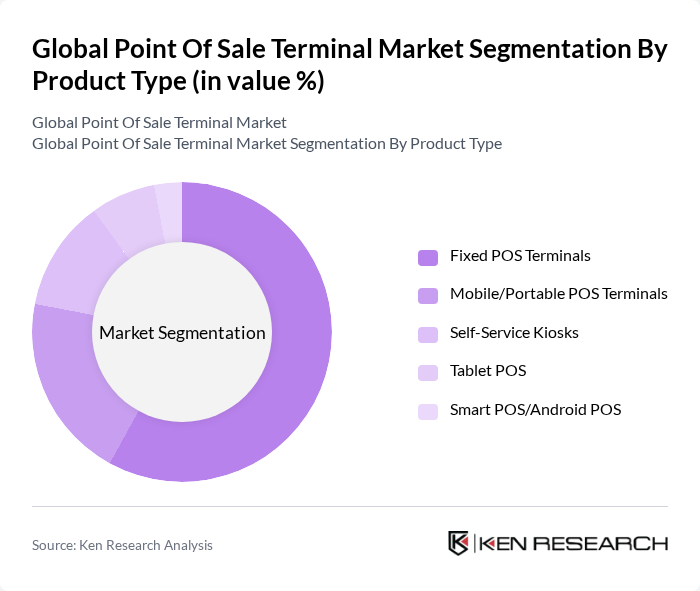

By Product Type:The product type segmentation includes Fixed POS Terminals, Mobile/Portable POS Terminals, Self-Service Kiosks, Tablet POS, and Smart POS/Android POS. Among these, Fixed POS Terminals dominate the market due to their reliability and extensive use in retail environments; fixed systems accounted for over half of revenues in recent measurements. However, Mobile/Portable POS Terminals are gaining traction as businesses seek flexibility and mobility in payment processing, especially among SMBs adopting tablet and smartphone-based solutions due to lower deployment costs. The trend towards self-service solutions is also on the rise, particularly in fast-food and retail sectors, as they enhance customer experience and reduce wait times.

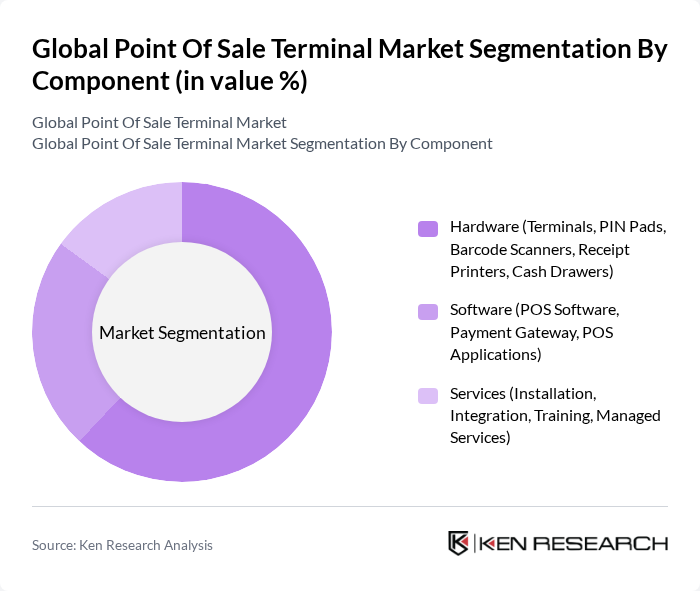

By Component:The component segmentation includes Hardware, Software, and Services. Hardware, which encompasses terminals, PIN pads, barcode scanners, receipt printers, and cash drawers, holds the largest market share due to the essential nature of these devices in transaction processing and the upgrading of legacy systems. Software solutions, including POS software, payment gateways, and applications, are increasingly important as businesses seek to integrate their payment systems with other operational tools, with growing emphasis on cloud-based platforms and analytics. Services such as installation, integration, training, and managed services are also critical, ensuring effective deployment and lifecycle management for POS systems.

The Global Point Of Sale Terminal Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ingenico (Worldline), Verifone, Block, Inc. (Square), Clover (Fiserv), PAX Technology, Diebold Nixdorf, NCR Voyix (formerly NCR Corporation), Toast, Inc., PayPal/Zettle, Adyen N.V., Shopify POS, Fiserv (First Data), Worldline, SumUp, Lightspeed Commerce contribute to innovation, geographic expansion, and service delivery in this space.

The future of the POS terminal market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As businesses increasingly adopt cloud-based solutions, the integration of AI and machine learning will enhance transaction efficiency and customer insights. Additionally, the focus on omnichannel retailing will necessitate seamless integration between online and offline sales channels, creating a more cohesive shopping experience for consumers. These trends will shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fixed POS Terminals Mobile/Portable POS Terminals Self-Service Kiosks Tablet POS Smart POS/Android POS |

| By Component | Hardware (Terminals, PIN Pads, Barcode Scanners, Receipt Printers, Cash Drawers) Software (POS Software, Payment Gateway, POS Applications) Services (Installation, Integration, Training, Managed Services) |

| By Deployment Mode | On-Premise Cloud |

| By Payment Acceptance Technology | Contact-based (EMV chip & magstripe) Contactless (NFC, QR) Biometric-enabled |

| By End-Use Industry | Retail (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores) Restaurants & Hospitality (FSR, QSR, Cafés, Bars) Healthcare Transportation & Logistics Entertainment & Ticketing Others |

| By Sales Channel | Direct (OEM/ISV) Distributors/Resellers Online System Integrators |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Large Retail Chains | 120 | IT Managers, Operations Directors |

| Small to Medium Enterprises (SMEs) | 110 | Business Owners, Financial Officers |

| Hospitality Sector | 90 | Restaurant Managers, Hotel Operations Heads |

| Healthcare Facilities | 70 | Administrative Managers, IT Coordinators |

| eCommerce Platforms | 80 | eCommerce Managers, Payment Processing Specialists |

The Global Point Of Sale Terminal Market is valued at approximately USD 113 billion, reflecting significant growth driven by the increasing adoption of digital payment solutions and the rise of e-commerce, particularly in emerging markets.