Region:Global

Author(s):Rebecca

Product Code:KRAD0172

Pages:80

Published On:August 2025

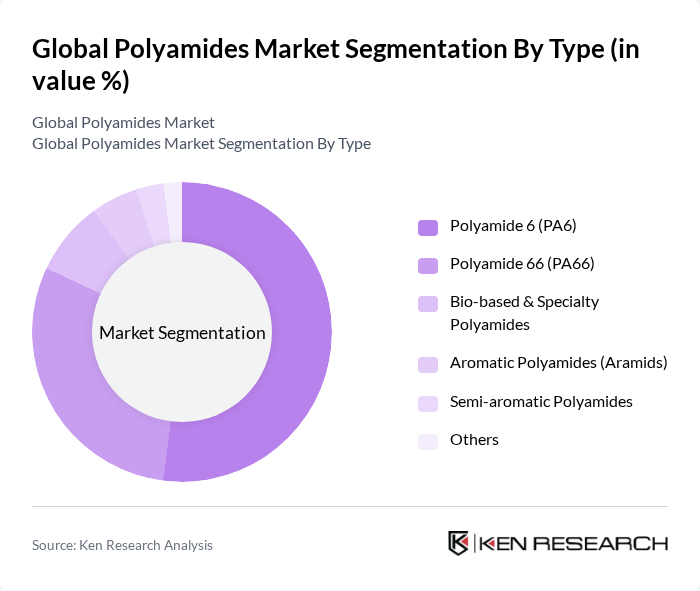

By Type:The polyamides market is segmented into various types, including Polyamide 6 (PA6), Polyamide 66 (PA66), Bio-based & Specialty Polyamides, Aromatic Polyamides (Aramids), Semi-aromatic Polyamides, and Others. Among these, Polyamide 6 and Polyamide 66 are the most widely used due to their excellent mechanical properties and thermal stability, making them suitable for a range of applications from automotive to textiles.

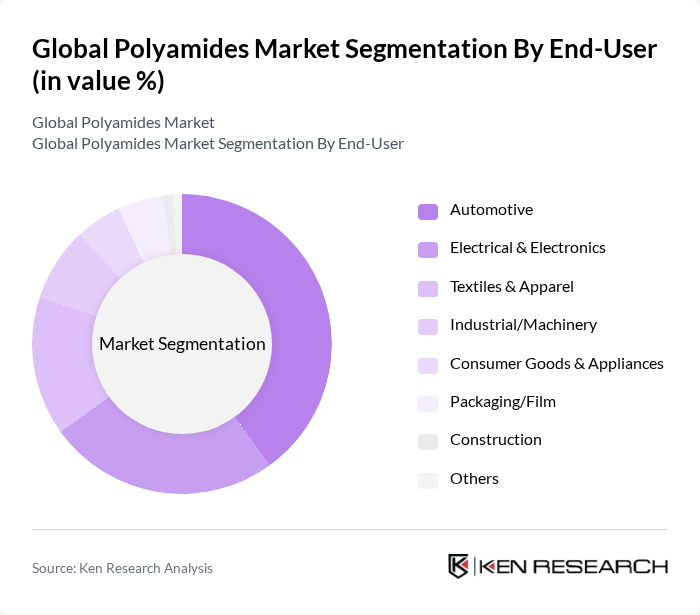

By End-User:The end-user segments for polyamides include Automotive, Electrical & Electronics, Textiles & Apparel, Industrial/Machinery, Consumer Goods & Appliances, Packaging/Film, Construction, and Others. The automotive sector is the largest consumer of polyamides, driven by the need for lightweight materials that enhance fuel efficiency and reduce emissions. Electrical & electronics follow closely, benefiting from polyamides' insulation and heat resistance. Textiles and packaging industries also contribute significantly, leveraging polyamides' durability, elasticity, and barrier properties .

The Global Polyamides Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Evonik Industries AG, Solvay S.A., LANXESS AG, Ascend Performance Materials LLC, DSM Engineering Materials (now part of Envalior), Mitsubishi Engineering-Plastics Corporation, Toray Industries, Inc., Kordsa Teknik Tekstil A.?., Honeywell International Inc., Saudi Basic Industries Corporation (SABIC), Teijin Limited, Arkema S.A., Koninklijke DSM N.V. (now part of Envalior) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polyamides market appears promising, with a strong emphasis on sustainability and innovation. As industries increasingly prioritize eco-friendly materials, the demand for bio-based polyamides is expected to rise significantly. Additionally, advancements in recycling technologies will likely enhance the circular economy within the polyamides sector, allowing for more sustainable production practices. These trends, combined with the expansion into emerging markets, will create new avenues for growth and development in the polyamides industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyamide 6 (PA6) Polyamide 66 (PA66) Bio-based & Specialty Polyamides Aromatic Polyamides (Aramids) Semi-aromatic Polyamides Others |

| By End-User | Automotive Electrical & Electronics Textiles & Apparel Industrial/Machinery Consumer Goods & Appliances Packaging/Film Construction Others |

| By Application | Engineering Plastics Fibers Films and Coatings Wire & Cable Industrial Carpet Staple Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, ASEAN, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Low Price Medium Price High Price |

| By Product Form | Granules Powders Sheets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Polyamide Applications | 100 | Product Engineers, Procurement Managers |

| Textile Industry Usage | 70 | Textile Manufacturers, R&D Specialists |

| Consumer Goods Sector Insights | 60 | Brand Managers, Supply Chain Analysts |

| Electronics and Electrical Applications | 85 | Design Engineers, Quality Assurance Managers |

| Polyamide Recycling Initiatives | 50 | Sustainability Managers, Environmental Compliance Officers |

The Global Polyamides Market is valued at approximately USD 42.5 billion, reflecting a robust growth trajectory driven by increasing demand for lightweight and high-performance materials across various industries, including automotive, electronics, textiles, and packaging.