Region:Global

Author(s):Dev

Product Code:KRAB0516

Pages:91

Published On:August 2025

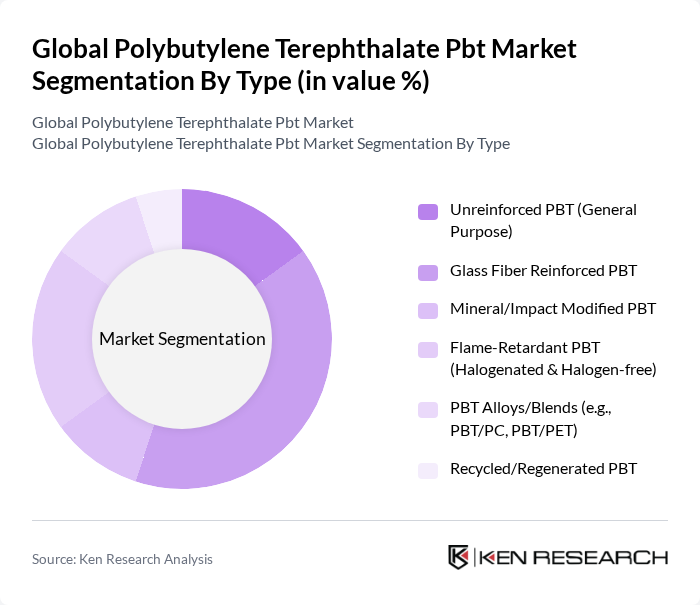

By Type:The PBT market is segmented into various types, including Unreinforced PBT (General Purpose), Glass Fiber Reinforced PBT, Mineral/Impact Modified PBT, Flame-Retardant PBT (Halogenated & Halogen-free), PBT Alloys/Blends (e.g., PBT/PC, PBT/PET), and Recycled/Regenerated PBT. Glass Fiber Reinforced PBT holds the largest share owing to higher stiffness/strength, creep resistance, and heat deflection temperature, making it the preferred grade for under?the?hood automotive and E/E connectors and housings. Adoption is reinforced by OEM lightweighting and miniaturization in E/E components.

By Processing Method:The processing methods for PBT include Injection Molding, Extrusion, Blow Molding, and 3D Printing and Others. Injection Molding leads given cycle-time efficiency, high precision for thin-wall E/E connectors, and scalability for automotive components and consumer electronics. Extrusion is used for profiles, film, and compound production; blow molding remains niche for select hollow parts.

The Global Polybutylene Terephthalate Pbt Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Celanese Corporation, SABIC, LANXESS AG, Mitsubishi Engineering-Plastics Corporation, Toray Industries, Inc., Covestro AG, Chang Chun Group, Entec Polymers (A Ravago Company), Solvay S.A., RTP Company, Teijin Limited, Hyundai Engineering Plastics Co., Ltd., Polyplastics Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PBT market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in production processes are expected to enhance efficiency and reduce waste, while the increasing focus on eco-friendly materials will likely lead to the development of bio-based PBT alternatives. Additionally, the expansion of e-commerce platforms for material supply is anticipated to streamline distribution channels, making PBT more accessible to various industries, thus fostering growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Unreinforced PBT (General Purpose) Glass Fiber Reinforced PBT Mineral/Impact Modified PBT Flame-Retardant PBT (Halogenated & Halogen-free) PBT Alloys/Blends (e.g., PBT/PC, PBT/PET) Recycled/Regenerated PBT |

| By Processing Method | Injection Molding Extrusion Blow Molding D Printing and Others |

| By Application | Electrical & Electronics (Connectors, Switches, Housings) Automotive (Under-the-hood, EV Components, Exterior/Interior) Industrial and Machinery Consumer Appliances and Power Tools Packaging and Others |

| By End-User | Automotive OEMs and Tier Suppliers Electrical & Electronics Manufacturers Industrial Equipment Manufacturers Consumer Durables Manufacturers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Commodity Grades Engineering/Performance Grades Specialty Grades (FR, High CTI, Low Warpage) |

| By Product Form | Pellets/Granules Compounds/Masterbatches Sheets/Profiles Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 120 | Product Engineers, Procurement Managers |

| Electronics Manufacturing | 90 | Design Engineers, Supply Chain Managers |

| Consumer Goods Sector | 80 | Brand Managers, Product Development Specialists |

| Industrial Applications | 70 | Operations Managers, Quality Control Analysts |

| Research & Development | 60 | R&D Directors, Polymer Scientists |

The Global Polybutylene Terephthalate (PBT) market is valued at approximately USD 3.3 billion, with estimates indicating a market size in the low-to-mid USD 3 billion range for recent periods, reflecting strong demand across various industries.