Region:Global

Author(s):Dev

Product Code:KRAA3012

Pages:90

Published On:August 2025

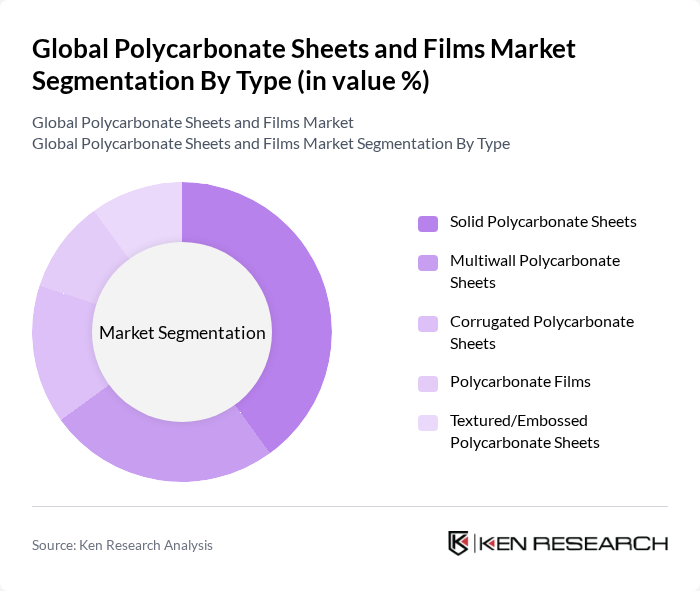

By Type:The market is segmented into Solid Polycarbonate Sheets, Multiwall Polycarbonate Sheets, Corrugated Polycarbonate Sheets, Polycarbonate Films, and Textured/Embossed Polycarbonate Sheets. Solid Polycarbonate Sheets lead the market, widely used in construction and safety applications for their durability and clarity. Multiwall Polycarbonate Sheets are gaining popularity due to their insulation properties, especially in greenhouse and skylight applications .

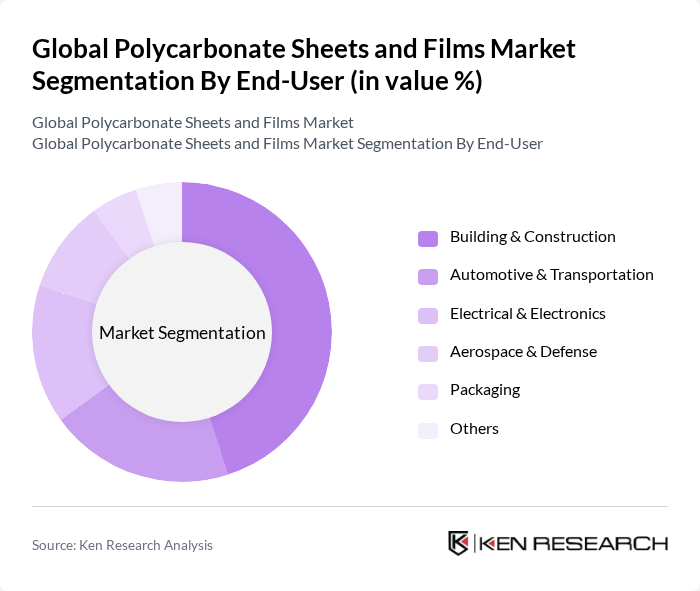

By End-User:The end-user segments include Building & Construction, Automotive & Transportation, Electrical & Electronics, Aerospace & Defense, Packaging, and Others. Building & Construction remains the dominant sector, driven by demand for lightweight, durable, and weather-resistant materials. The Automotive & Transportation sector is significant, with polycarbonate materials used in glazing, headlamp lenses, and interior components. Electrical & Electronics is also a key segment, leveraging polycarbonate’s insulation and optical properties .

The Global Polycarbonate Sheets and Films Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC, Covestro AG, Teijin Limited, Mitsubishi Gas Chemical Company, Inc., Palram Industries Ltd., Bayer MaterialScience AG (now Covestro AG), 3M Company, Excelite, Plazit Polygal Group, Gallina India Pvt. Ltd., Lotte Chemical Corporation, Trinseo S.A., I??k Plastik, Exolon Group, Koscon Industrial S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polycarbonate sheets and films market appears promising, driven by a growing emphasis on sustainability and innovation. As industries increasingly adopt lightweight materials for energy efficiency, the demand for polycarbonate is expected to rise. Furthermore, advancements in manufacturing processes will likely enhance product quality and reduce costs, making polycarbonate more accessible. The integration of these materials in renewable energy applications, such as solar panels, will also contribute to market growth, aligning with global sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Solid Polycarbonate Sheets Multiwall Polycarbonate Sheets Corrugated Polycarbonate Sheets Polycarbonate Films Textured/Embossed Polycarbonate Sheets |

| By End-User | Building & Construction Automotive & Transportation Electrical & Electronics Aerospace & Defense Packaging Others |

| By Application | Roofing & Glazing Signage & Displays Greenhouses Safety & Security Applications Optical Media Others |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Retail Others |

| By Thickness | Less than 5 mm –10 mm –20 mm Above 20 mm |

| By Color | Clear Colored/Tinted Frosted/Matte Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Russia, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Applications | 120 | Architects, Project Managers |

| Automotive Sector Usage | 90 | Product Engineers, Procurement Managers |

| Electronics and Consumer Goods | 60 | Product Designers, Supply Chain Managers |

| Retail and Distribution Channels | 50 | Retail Managers, Distribution Coordinators |

| Industrial Applications | 70 | Operations Managers, Quality Control Specialists |

The Global Polycarbonate Sheets and Films Market is valued at approximately USD 3.7 billion, reflecting a significant demand for lightweight, durable, and optically clear materials across various sectors, including construction, automotive, and electronics.