Region:Global

Author(s):Shubham

Product Code:KRAA1894

Pages:97

Published On:August 2025

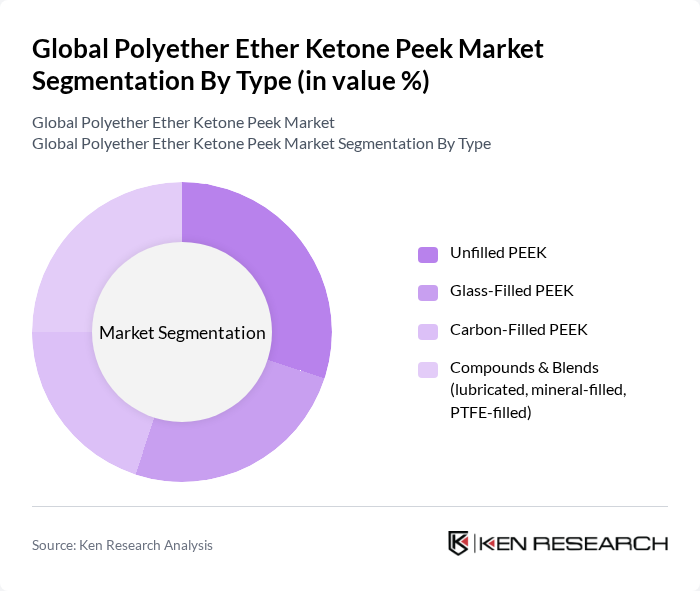

By Type:

The PEEK market is significantly influenced by the Unfilled PEEK segment, which is widely used in various applications due to its excellent mechanical properties and thermal stability. This segment is favored in industries such as aerospace and automotive, where high-performance materials are essential. The increasing demand for lightweight and durable materials in these sectors has led to a surge in the adoption of Unfilled PEEK, making it the leading subsegment in the market.

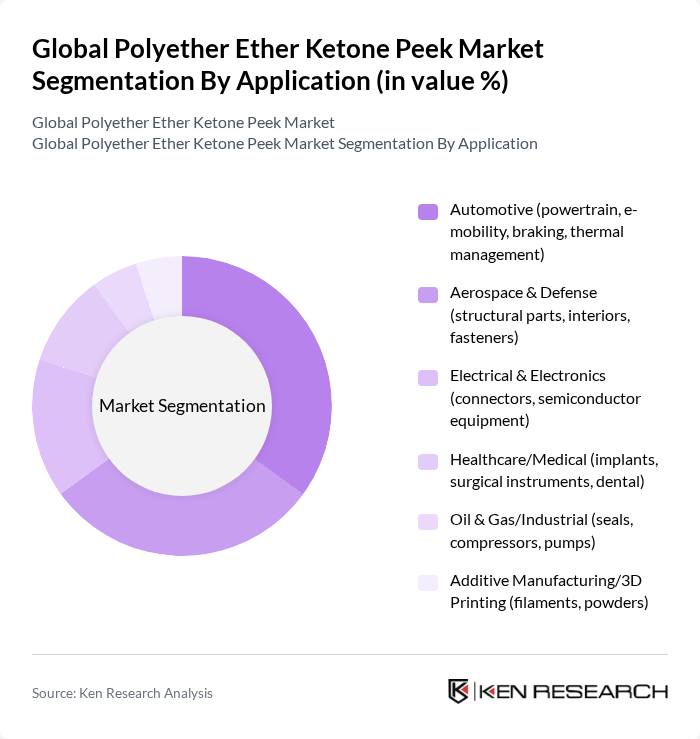

By Application:

The Automotive application segment is the largest in the PEEK market, driven by the increasing demand for lightweight and high-performance materials in vehicle manufacturing. PEEK's excellent thermal and chemical resistance makes it ideal for powertrain components and thermal management systems. As the automotive industry shifts towards electric vehicles, the demand for PEEK in e-mobility applications is also expected to rise, further solidifying its position as the leading application segment.

The Global Polyether Ether Ketone Peek Market is characterized by a dynamic mix of regional and international players. Leading participants such as Victrex plc, Solvay S.A., Evonik Industries AG, BASF SE, RTP Company, Kingfa Science & Technology Co., Ltd., Celanese Corporation, Ensinger GmbH, SABIC, Avient Corporation, Mitsubishi Chemical Group Corporation, Toray Industries, Inc., Teijin Limited, Arkema S.A., Panjin Zhongrun High Performance Polymers Co., Ltd., Jilin Zhongyan High Performance Plastic Co., Ltd., Invibio Ltd., Foster Corporation, Aon3D, 3DXTECH (Applied Chemical Technology, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PEEK market appears promising, driven by technological advancements and increasing applications across various industries. The focus on sustainability is likely to spur innovations in recycling and manufacturing processes, enhancing the material's appeal. Additionally, as emerging markets continue to develop, the demand for high-performance materials will rise, creating new opportunities for PEEK. Strategic partnerships among manufacturers and research institutions will further accelerate the development of novel applications, ensuring PEEK remains at the forefront of material science.

| Segment | Sub-Segments |

|---|---|

| By Type | Unfilled PEEK Glass-Filled PEEK Carbon-Filled PEEK Compounds & Blends (lubricated, mineral-filled, PTFE-filled) |

| By Application | Automotive (powertrain, e-mobility, braking, thermal management) Aerospace & Defense (structural parts, interiors, fasteners) Electrical & Electronics (connectors, semiconductor equipment) Healthcare/Medical (implants, surgical instruments, dental) Oil & Gas/Industrial (seals, compressors, pumps) Additive Manufacturing/3D Printing (filaments, powders) |

| By End-User | OEMs (automotive, aerospace, medical device manufacturers) Tier-1/Tier-2 Component Suppliers Contract Manufacturers & Machining/Extrusion Processors Semiconductor & Electronics Manufacturers Oil & Gas Operators and Service Companies |

| By Distribution Channel | Direct Sales (resin producers to OEMs/Tiers) Authorized Distributors & Compounders E-commerce/Online Technical Distributors |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Premium (medical/aerospace grades) Mid-Range (industrial/automotive grades) Economy (regrind/reprocessed grades) |

| By Others | Custom Compounds & Color-Matched Grades Niche Applications (coatings, wire & cable, membranes) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Applications | 110 | Materials Engineers, Aerospace Product Managers |

| Automotive Components | 85 | Design Engineers, Procurement Managers |

| Medical Devices | 65 | Regulatory Affairs Specialists, Product Development Leads |

| Electronics Industry | 90 | Manufacturing Engineers, Supply Chain Analysts |

| Industrial Applications | 60 | Operations Managers, Quality Control Supervisors |

The Global Polyether Ether Ketone (PEEK) market is valued at approximately USD 1.0 billion, driven by increasing demand for high-performance materials across various industries, including aerospace, automotive, healthcare, and electrical/electronics.