Region:Global

Author(s):Dev

Product Code:KRAB0620

Pages:82

Published On:August 2025

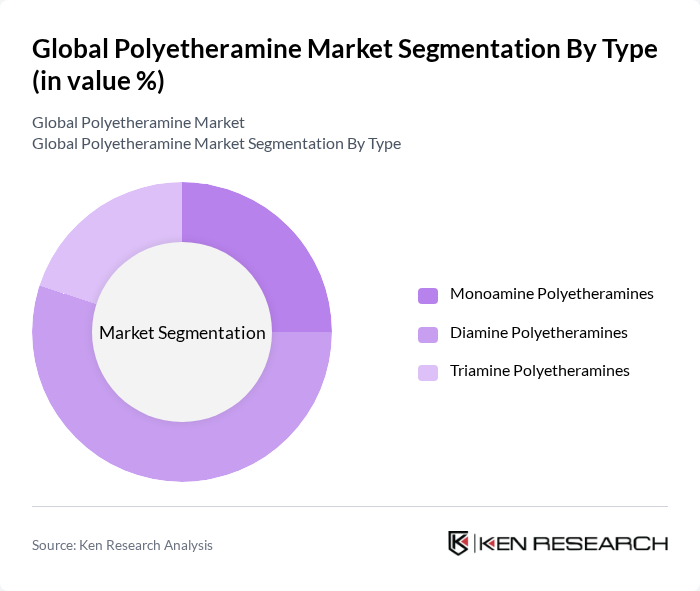

By Type:The polyetheramine market is segmented into three main types: Monoamine Polyetheramines, Diamine Polyetheramines, and Triamine Polyetheramines. Diamine Polyetheramines lead the market, driven by their extensive use as curing agents in epoxy formulations, which are favored for their superior mechanical strength, flexibility, and chemical resistance. The growing demand for high-performance composites and adhesives in construction, automotive, and wind energy applications is accelerating the growth of this segment. Monoamine and Triamine Polyetheramines also hold notable shares, with Monoamines used in fuel additives and Triamines in specialty resins and coatings .

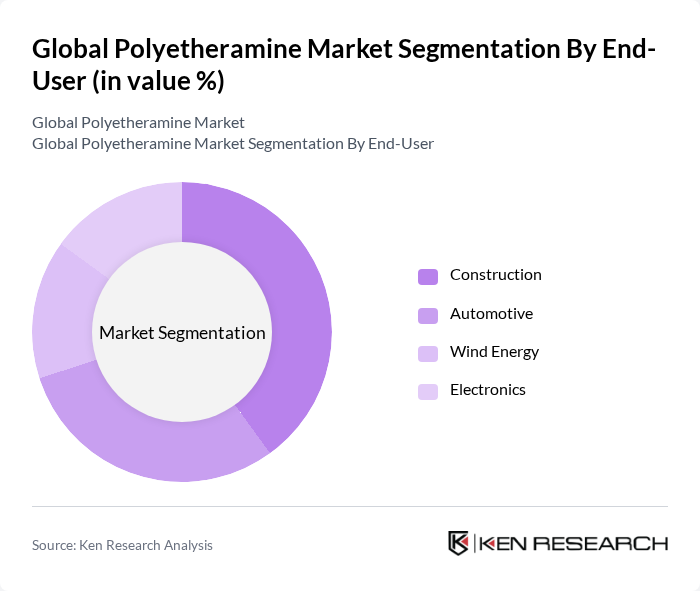

By End-User:The end-user segmentation includes Construction, Automotive, Wind Energy, and Electronics. The Construction sector is the largest end-user, underpinned by the rising demand for durable, high-performance materials in infrastructure and building projects. The automotive industry is a major consumer, utilizing polyetheramines in coatings, adhesives, and composites for lightweighting and enhanced durability. Wind Energy and Electronics are growing segments, benefiting from the adoption of advanced composites and specialty resins in turbine blades and electronic encapsulants, respectively .

The Global Polyetheramine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Huntsman Corporation, BASF SE, Evonik Industries AG, Dow Inc., Air Products and Chemicals, Inc., AkzoNobel N.V., Mitsubishi Gas Chemical Company, Inc., Hexion Inc., Wuxi Acryl Technology Co., Ltd., Solvay S.A., Yangzhou Chenhua New Material Co., Ltd., Olin Corporation, Momentive Performance Materials Inc., Clariant AG, Jiangsu Yinyan Specialty Chemicals Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polyetheramine market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in bio-based polyetheramines are expected to gain traction, aligning with global trends towards eco-friendly products. Additionally, the increasing demand for high-performance materials in various industries, including aerospace and renewable energy, will likely create new avenues for growth. Strategic partnerships among manufacturers and research institutions will further enhance product development and market penetration.

| Segment | Sub-Segments |

|---|---|

| By Type | Monoamine Polyetheramines Diamine Polyetheramines Triamine Polyetheramines |

| By End-User | Construction Automotive Wind Energy Electronics |

| By Application | Epoxy Coatings Adhesives & Sealants Composites Fuel Additives Polyurea |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, U.K., Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-based Pricing |

| By Others | Specialty Applications Niche Markets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coatings Industry Applications | 100 | Product Development Managers, Technical Directors |

| Adhesives and Sealants Market | 80 | Procurement Managers, R&D Specialists |

| Composite Materials Sector | 70 | Manufacturing Engineers, Quality Control Managers |

| Polymer Modification Applications | 60 | Application Engineers, Product Managers |

| Emerging Applications in Energy Sector | 40 | Energy Sector Analysts, Research Scientists |

The Global Polyetheramine Market is valued at approximately USD 1.5 billion, driven by increasing demand in various sectors such as coatings, adhesives, and composites, particularly in automotive and construction industries.