Global Polyethylene Naphthalate Market Overview

- The Global Polyethylene Naphthalate Market is valued at USD 1.25 billion, based on a five-year historical analysis. This growth is primarily driven by the rising demand for high-performance polymers in packaging, electronics, and automotive sectors. The versatility of polyethylene naphthalate, recognized for its superior thermal stability, dimensional stability, and barrier properties, continues to make it a preferred material among manufacturers, supporting its expanding market size.

- Key players in this market include countries such asthe United States, Germany, and Japan, which maintain dominance due to advanced manufacturing capabilities, robust industrial infrastructure, and the presence of major chemical companies. These regions benefit from strong supply chains and technological expertise, enabling them to meet the growing demand for polyethylene naphthalate across diverse applications.

- TheEuropean Union’s Directive (EU) 2019/904 on the reduction of the impact of certain plastic products on the environment, issued by the European Parliament and Council, sets binding requirements for recyclable materials in packaging. This regulation encourages the adoption of polyethylene naphthalate due to its recyclability and sustainability profile, promoting its use in packaging and other industries while supporting environmental objectives.

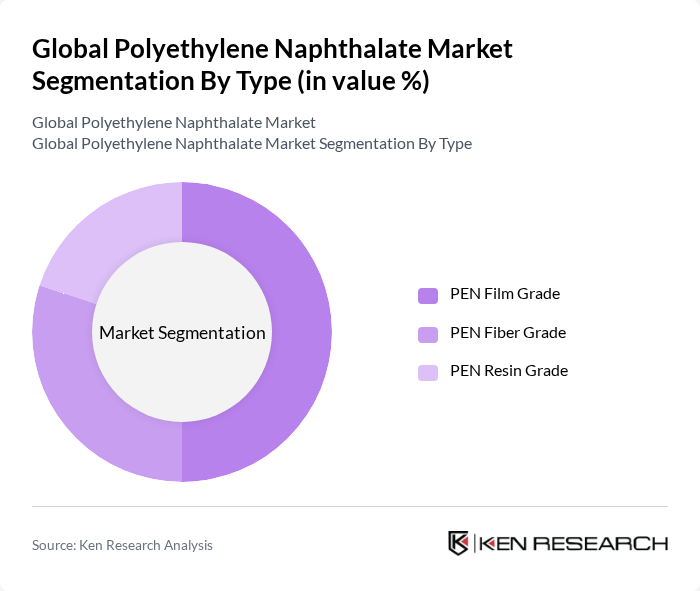

Global Polyethylene Naphthalate Market Segmentation

By Type:The market is segmented into three main types:PEN Film Grade,PEN Fiber Grade, andPEN Resin Grade. Each type serves distinct applications, with tailored properties for specific industry needs. PEN Film Grade is widely used in packaging for its outstanding barrier and thermal properties. PEN Fiber Grade is preferred in textiles for durability and dimensional stability. PEN Resin Grade finds applications in electronics and automotive sectors, where high performance and reliability are required.

By End-User:The end-user segmentation includesPackaging,Electronics & Electrical Components,Textiles, andAutomotive & Industrial. The Packaging sector is the largest consumer of polyethylene naphthalate, driven by demand for lightweight, durable, and recyclable materials. Electronics follows closely, leveraging PEN for its thermal stability and electrical insulation. Textiles and Automotive sectors also contribute significantly, utilizing PEN’s strength, durability, and resistance to environmental factors.

Global Polyethylene Naphthalate Market Competitive Landscape

The Global Polyethylene Naphthalate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teijin Limited, Toyobo Co., Ltd., SKC Co., Ltd., SASA Polyester Sanayi A.?., Indorama Ventures Public Company Limited, Kolon Plastics Inc., DuPont Teijin Films Ltd., Toray Monofilament Co., Ltd., Nan Ya Plastics Corporation, Lotte Chemical Corporation, Mitsubishi Gas Chemical Company, Inc., BASF SE, DAK Americas LLC, JBF Industries Ltd., PPI Adhesive Products, SMP Corporation, GTS Flexible, FE Thin Films, Covestro AG, Formosa Plastics Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Global Polyethylene Naphthalate Market Industry Analysis

Growth Drivers

- Increasing Demand for High-Performance Materials:The global demand for high-performance materials is projected to reach 1.5 million tons in future, driven by industries such as automotive and electronics. The automotive sector alone is expected to account for approximately 30% of this demand, as manufacturers seek lightweight and durable materials to enhance fuel efficiency and performance. This trend is supported by a projected 3% annual growth in the automotive industry, emphasizing the need for advanced materials like polyethylene naphthalate (PEN).

- Expansion of End-Use Industries:The expansion of end-use industries, particularly in packaging and electronics, is a significant growth driver. The global packaging industry is anticipated to grow to USD 1 trillion in future, with a notable shift towards sustainable materials. Electronics manufacturing is also on the rise, with an expected increase in production value to USD 2.5 trillion. This growth creates a robust demand for polyethylene naphthalate, which offers superior barrier properties and thermal stability, essential for these applications.

- Technological Advancements in Production:Technological advancements in the production of polyethylene naphthalate are enhancing efficiency and reducing costs. Innovations such as continuous polymerization processes are expected to increase production capacity by 20% in future. Additionally, the introduction of advanced recycling technologies is projected to reduce waste by 15%, aligning with sustainability goals. These advancements not only improve profitability but also meet the rising demand for high-quality materials in various applications.

Market Challenges

- Fluctuating Raw Material Prices:The volatility in raw material prices poses a significant challenge for the polyethylene naphthalate market. The price of naphthalene, a key raw material, has fluctuated between USD 1,200 and USD 1,500 per ton in recent periods, impacting production costs. This instability can lead to unpredictable pricing for end products, making it difficult for manufacturers to maintain profit margins. As a result, companies may face challenges in pricing strategies and overall market competitiveness.

- Stringent Regulatory Frameworks:Stringent regulatory frameworks regarding environmental protection and chemical safety are increasingly challenging for manufacturers. Compliance costs are expected to rise by 10% in future due to new regulations in major markets, including the EU and North America. These regulations require extensive testing and certification processes, which can delay product launches and increase operational costs. Companies must invest significantly in compliance measures, impacting their overall profitability and market agility.

Global Polyethylene Naphthalate Market Future Outlook

The future outlook for the polyethylene naphthalate market appears promising, driven by increasing applications in high-growth sectors such as renewable energy and electronics. As industries continue to prioritize sustainability, the demand for advanced materials that meet environmental standards is expected to rise. Furthermore, innovations in production techniques and strategic collaborations among key players will likely enhance market dynamics, fostering growth and expanding the potential for polyethylene naphthalate in various applications.

Market Opportunities

- Growth in Renewable Energy Applications:The renewable energy sector is projected to grow significantly, with investments expected to reach USD 500 billion in future. This growth presents opportunities for polyethylene naphthalate in applications such as solar panels and wind turbine components, where its durability and lightweight properties are advantageous. Companies that innovate in this space can capture a share of this expanding market.

- Emerging Markets Expansion:Emerging markets, particularly in Asia-Pacific, are experiencing rapid industrialization, with a projected GDP growth rate of approximately 5% in future for the region. This economic growth is driving demand for advanced materials in various sectors, including packaging and automotive. Companies that strategically enter these markets can leverage the increasing demand for polyethylene naphthalate, positioning themselves for long-term success.