Region:Global

Author(s):Dev

Product Code:KRAA3084

Pages:98

Published On:August 2025

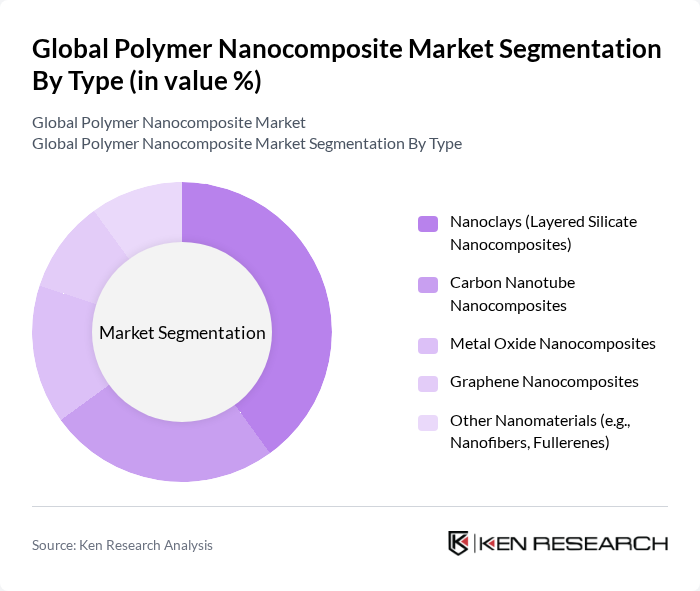

By Type:The market is segmented into Nanoclays (Layered Silicate Nanocomposites), Carbon Nanotube Nanocomposites, Metal Oxide Nanocomposites, Graphene Nanocomposites, and Other Nanomaterials (e.g., Nanofibers, Fullerenes). Nanoclays are the most widely used due to their cost-effectiveness, ease of processing, and excellent mechanical properties, making them ideal for packaging, automotive, and construction applications. Carbon nanotube and graphene nanocomposites are gaining traction for their superior electrical and thermal conductivity, supporting advanced electronics and energy storage solutions. Metal oxide nanocomposites are valued for their enhanced barrier and flame-retardant properties, while other nanomaterials such as nanofibers and fullerenes are utilized in specialty biomedical and filtration applications.

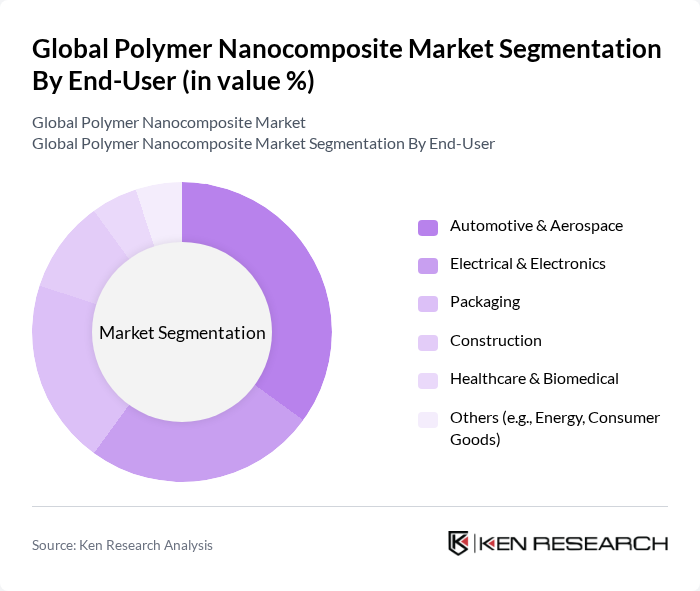

By End-User:The end-user segments include Automotive & Aerospace, Electrical & Electronics, Packaging, Construction, Healthcare & Biomedical, and Others (e.g., Energy, Consumer Goods). Automotive & Aerospace remains the leading end-user, driven by the need for lightweight materials to improve fuel efficiency, reduce emissions, and enhance safety. Electrical & Electronics is a major segment due to rising demand for miniaturized, heat-resistant components in consumer electronics and semiconductors. Packaging applications leverage nanocomposites for improved barrier properties and sustainability, while construction utilizes them for durability and fire resistance. Healthcare & Biomedical applications are expanding with innovations in drug delivery, implants, and diagnostic devices, and other sectors such as energy and consumer goods are adopting nanocomposites for enhanced performance and environmental compliance.

The Global Polymer Nanocomposite Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Evonik Industries AG, Arkema S.A., Mitsubishi Chemical Corporation, Nanocyl S.A., RTP Company, 3M Company, Huntsman Corporation, Avient Corporation, Cabot Corporation, Solvay S.A., LG Chem Ltd., SABIC, and Toray Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polymer nanocomposite market appears promising, driven by ongoing innovations and increasing applications across various sectors. As industries prioritize sustainability, the shift towards bio-based and eco-friendly materials is expected to accelerate. Additionally, advancements in smart materials will likely enhance functionality, leading to broader adoption. The integration of nanocomposites in emerging technologies, such as electric vehicles and renewable energy systems, will further bolster market growth, creating a dynamic landscape for stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Nanoclays (Layered Silicate Nanocomposites) Carbon Nanotube Nanocomposites Metal Oxide Nanocomposites Graphene Nanocomposites Other Nanomaterials (e.g., Nanofibers, Fullerenes) |

| By End-User | Automotive & Aerospace Electrical & Electronics Packaging Construction Healthcare & Biomedical Others (e.g., Energy, Consumer Goods) |

| By Application | Coatings & Paints Structural Composites Films & Membranes Adhesives & Sealants Flame Retardants Others |

| By Distribution Channel | Direct Sales (Manufacturers to OEMs) Distributors & Wholesalers Online Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Development Engineers, Procurement Managers |

| Electronics Sector | 60 | Design Engineers, Quality Assurance Managers |

| Construction Materials | 50 | Project Managers, Material Scientists |

| Packaging Solutions | 70 | Packaging Engineers, Supply Chain Analysts |

| Consumer Goods | 55 | Product Managers, Marketing Directors |

The Global Polymer Nanocomposite Market is valued at approximately USD 11.7 billion, driven by the increasing demand for lightweight and high-performance materials across various sectors, including automotive, aerospace, and electronics.