Region:Global

Author(s):Shubham

Product Code:KRAD0633

Pages:87

Published On:August 2025

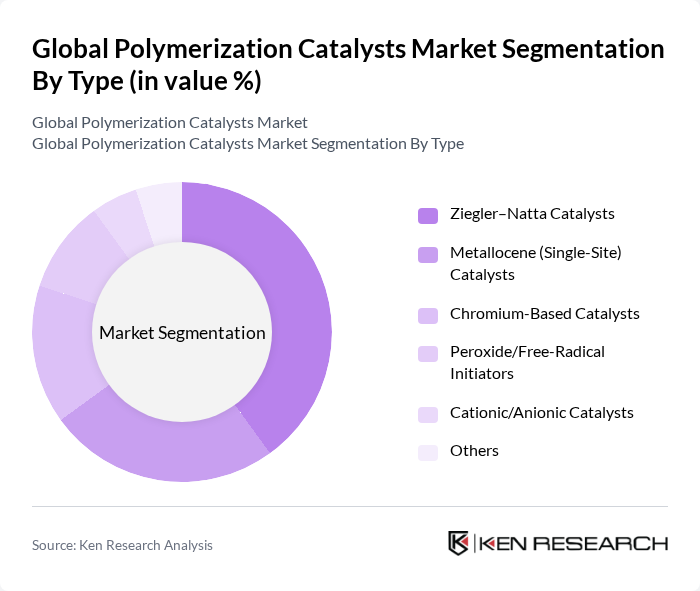

By Type:The market is segmented into various types of catalysts, including Ziegler–Natta Catalysts, Metallocene (Single-Site) Catalysts, Chromium-Based Catalysts, Peroxide/Free-Radical Initiators, Cationic/Anionic Catalysts, and Others. Among these, Ziegler–Natta Catalysts dominate large-scale polyolefin production (notably polypropylene and polyethylene) due to established technology, broad grade capability, and cost-effectiveness, with metallocenes increasingly used for performance PE/PP grades requiring narrow molecular weight distribution and comonomer control.

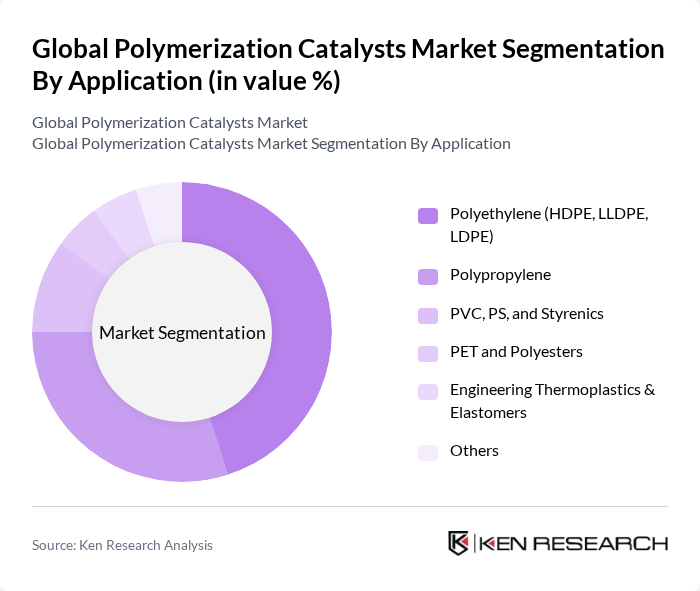

By Application:The applications of polymerization catalysts include Polyethylene (HDPE, LLDPE, LDPE), Polypropylene, PVC, PS, and Styrenics, PET and Polyesters, Engineering Thermoplastics & Elastomers, and Others. Polyethylene remains the leading application segment given its scale in films, rigid packaging, pipes, and consumer goods, with polypropylene as the second-largest driven by packaging, automotive components, and fibers; styrenics, PVC, and PET use distinct catalyst/initiator systems but represent smaller shares relative to polyolefins.

The Global Polymerization Catalysts Market is characterized by a dynamic mix of regional and international players. Leading participants such as LyondellBasell Industries N.V., W. R. Grace & Co., Univation Technologies, LLC, BASF SE, Clariant AG, Mitsui Chemicals, Inc., Sinopec (China Petrochemical Corporation), SABIC, INEOS Group Holdings S.A., Dow Inc., Evonik Industries AG, Chevron Phillips Chemical Company LLC, Tosoh Corporation, Solvay S.A., Arkema S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the polymerization catalysts market is promising, driven by a growing emphasis on sustainability and technological innovation. As industries increasingly adopt eco-friendly practices, the demand for sustainable catalysts is expected to rise, fostering new product development. Additionally, the integration of digital technologies in production processes will enhance efficiency and reduce costs. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for companies aiming to thrive in the evolving polymerization catalysts sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Ziegler–Natta Catalysts Metallocene (Single?Site) Catalysts Chromium-Based Catalysts Peroxide/Free-Radical Initiators Cationic/Anionic Catalysts Others |

| By Application | Polyethylene (HDPE, LLDPE, LDPE) Polypropylene PVC, PS, and Styrenics PET and Polyesters Engineering Thermoplastics & Elastomers Others |

| By End-User | Packaging Automotive & Transportation Construction & Infrastructure Electrical & Electronics Consumer Goods & Textiles Others |

| By Distribution Channel | Direct (Producer to Polymer Manufacturer) Authorized Distributors Online/Platform-Based Procurement Traders/Agents Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Standard Premium |

| By Product Form | Powder Granules/Pellets Liquid/Slurry Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Polymer Manufacturing Sector | 120 | Production Managers, Process Engineers |

| Catalyst Supply Chain | 90 | Supply Chain Managers, Procurement Specialists |

| Research & Development in Polymers | 70 | R&D Directors, Chemical Engineers |

| End-User Industries (Automotive, Packaging) | 110 | Product Development Managers, Quality Assurance Heads |

| Regulatory and Compliance Experts | 50 | Regulatory Affairs Managers, Compliance Officers |

The Global Polymerization Catalysts Market is valued at approximately USD 3.1 billion, reflecting a historical analysis over five years. This valuation is supported by demand from key sectors such as packaging, automotive, and construction, where polyolefins like polyethylene and polypropylene are predominantly used.