Region:Global

Author(s):Dev

Product Code:KRAA1639

Pages:96

Published On:August 2025

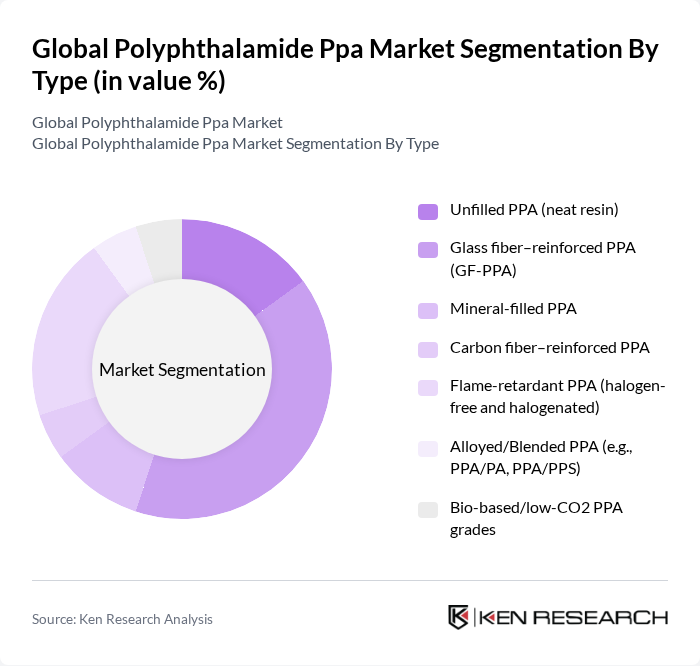

By Type:The polyphthalamide market is segmented into various types, including Unfilled PPA (neat resin), Glass fiber–reinforced PPA (GF-PPA), Mineral-filled PPA, Carbon fiber–reinforced PPA, Flame-retardant PPA (halogen-free and halogenated), Alloyed/Blended PPA (e.g., PPA/PA, PPA/PPS), and Bio-based/low-CO2 PPA grades. Among these, Glass fiber–reinforced PPA (GF-PPA) is the leading subsegment due to its superior mechanical properties and thermal stability, making it ideal for automotive and electrical applications .

By End-User:The end-user segmentation includes Automotive & Transportation, Electrical & Electronics, Industrial & Energy (machinery, oil & gas, fluid handling), Consumer Goods & Appliances, Healthcare & Medical Devices, and Others. The Automotive & Transportation sector is the dominant segment, driven by the increasing demand for lightweight materials that enhance fuel efficiency and reduce emissions in vehicles; PPA’s high heat resistance and chemical durability also underpin fast growth in miniaturized E&E connectors, LED housings, and high-voltage EV components .

The Global Polyphthalamide PPA Market is characterized by a dynamic mix of regional and international players. Leading participants such as Solvay S.A. (Amodel PPA), DuPont de Nemours, Inc. (Zytel HTN), Arkema S.A. (Kepstan and specialty PPA compounds), Evonik Industries AG, and BASF SE (Ultramid Advanced PA) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polyphthalamide market appears promising, driven by technological advancements and increasing applications across various industries. The automotive and electronics sectors are expected to lead the demand, with innovations in lightweight materials and smart technologies. Additionally, the focus on sustainability will likely push manufacturers to explore eco-friendly production methods. As awareness grows, the adoption of PPA is anticipated to rise, creating a more competitive landscape and fostering collaborations among industry players.

| Segment | Sub-Segments |

|---|---|

| By Type | Unfilled PPA (neat resin) Glass fiber–reinforced PPA (GF-PPA) Mineral-filled PPA Carbon fiber–reinforced PPA Flame-retardant PPA (halogen-free and halogenated) Alloyed/Blended PPA (e.g., PPA/PA, PPA/PPS) Bio-based/low-CO2 PPA grades |

| By End-User | Automotive & Transportation Electrical & Electronics Industrial & Energy (machinery, oil & gas, fluid handling) Consumer Goods & Appliances Healthcare & Medical Devices Others |

| By Application | Automotive components (under?the?hood, fuel/EV thermal, connectors) E&E components (connectors, LED housings, breakers, sockets) Fluid handling (pumps, valves, fittings, gears) Industrial equipment (compressors, bearings, structural parts) Consumer electronics & appliance parts Oil & gas seals, gaskets, and tubing Others |

| By Distribution Channel | Direct sales (producers to OEMs/molders) Authorized distributors & compounders Online/marketplace sales (specialty resin platforms) Regional resin traders Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Standard grades Specialty/high-performance grades Custom-compounded grades |

| By Product Form | Pellets/Granules Powders Precompounded concentrates (masterbatch) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 120 | Product Engineers, Procurement Managers |

| Electronics Manufacturing | 90 | Design Engineers, Supply Chain Analysts |

| Aerospace Components | 60 | Quality Assurance Managers, R&D Directors |

| Industrial Applications | 70 | Operations Managers, Technical Sales Representatives |

| Consumer Goods | 50 | Product Development Managers, Marketing Executives |

The Global Polyphthalamide PPA Market is valued at approximately USD 1.65 billion, with estimates suggesting it could reach between USD 1.65 billion and USD 1.7 billion, driven primarily by demand in the automotive and electrical/electronics sectors.