Region:Global

Author(s):Shubham

Product Code:KRAD0771

Pages:91

Published On:August 2025

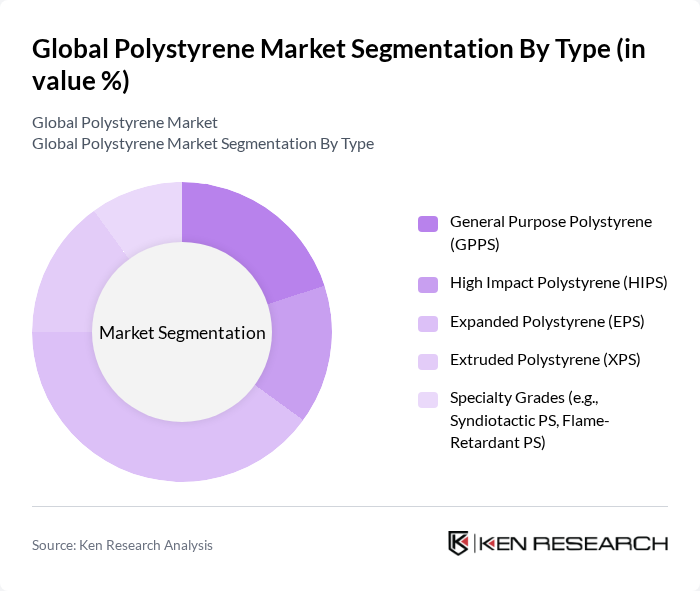

By Type:The polystyrene market is segmented into various types, including General Purpose Polystyrene (GPPS), High Impact Polystyrene (HIPS), Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), and Specialty Grades. Among these, Expanded Polystyrene (EPS) is the leading subsegment due to its lightweight, insulating properties, and extensive use in packaging and construction applications. The demand for EPS has surged, particularly in the construction sector, where it is used for insulation and lightweight structural components.

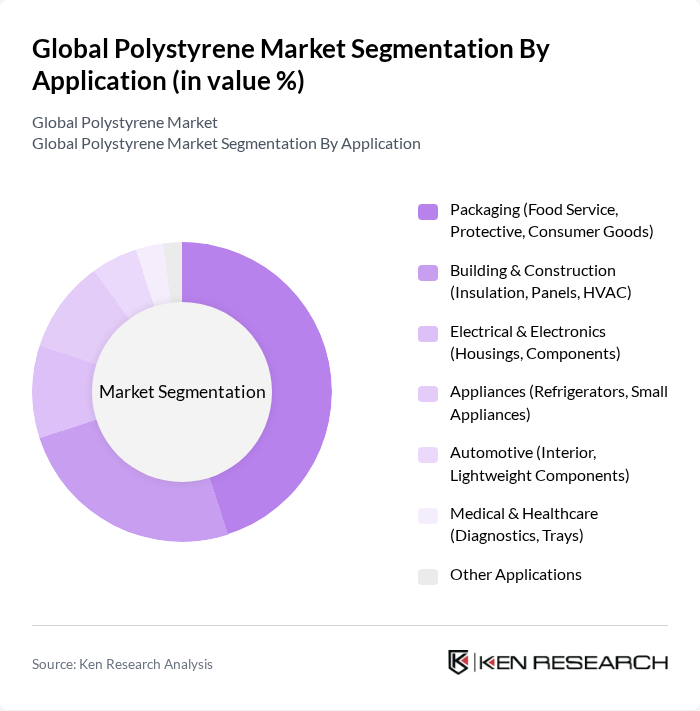

By Application:The applications of polystyrene are diverse, including packaging, building & construction, electrical & electronics, appliances, automotive, medical & healthcare, and other applications. The packaging segment is the most significant, driven by the growing demand for food service and protective packaging solutions. The rise in e-commerce and the need for sustainable packaging options have further propelled the growth of this segment.

The Global Polystyrene Market is characterized by a dynamic mix of regional and international players. Leading participants such as INEOS Styrolution Group GmbH, Trinseo PLC, TotalEnergies SE, Versalis S.p.A. (Eni), SABIC, LG Chem Ltd., LyondellBasell Industries N.V., Formosa Plastics Corporation, PS Japan Corporation, Supreme Petrochem Ltd., Chi Mei Corporation, BASF SE, NOVA Chemicals Corporation, Alpek, S.A.B. de C.V. (Styrenics unit), and Ravago Group (Styrenics & Distribution) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polystyrene market appears promising, driven by innovations in recycling technologies and a growing emphasis on sustainability. As governments and industries prioritize eco-friendly practices, the demand for recycled polystyrene is expected to rise. Additionally, the expansion of the automotive and construction sectors in emerging markets will further enhance growth opportunities. Companies that invest in sustainable production methods and strategic partnerships will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | General Purpose Polystyrene (GPPS) High Impact Polystyrene (HIPS) Expanded Polystyrene (EPS) Extruded Polystyrene (XPS) Specialty Grades (e.g., Syndiotactic PS, Flame-Retardant PS) |

| By Application | Packaging (Food Service, Protective, Consumer Goods) Building & Construction (Insulation, Panels, HVAC) Electrical & Electronics (Housings, Components) Appliances (Refrigerators, Small Appliances) Automotive (Interior, Lightweight Components) Medical & Healthcare (Diagnostics, Trays) Other Applications |

| By End-User | Packaging Converters & Brands Construction & Infrastructure Electrical & Electronics Manufacturers Appliances & White Goods Automotive OEMs & Tier-1s Healthcare Providers & Medical Device Firms |

| By Distribution Channel | Direct Sales (Producers to OEM/Converters) Authorized Distributors Traders & Resellers Online/B2B Platforms |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Commodity Grades Mid-Grade (Additive/Performance-Modified) Specialty/High-Performance Grades |

| By Product Form | Resin Pellets/Beads Foams (EPS, XPS) Sheets/Films Molded Parts & Preforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Insights | 140 | Product Managers, Supply Chain Analysts |

| Construction Material Usage | 110 | Architects, Project Managers |

| Consumer Goods Applications | 90 | Brand Managers, Product Development Teams |

| Automotive Component Manufacturing | 75 | Manufacturing Engineers, Procurement Specialists |

| Environmental Impact Assessments | 60 | Sustainability Consultants, Regulatory Affairs Managers |

The Global Polystyrene Market is valued at approximately USD 20 billion, driven primarily by demand in packaging and electrical & electronics sectors, as well as building and construction insulation applications.