Region:Global

Author(s):Shubham

Product Code:KRAC0880

Pages:98

Published On:August 2025

Market.png)

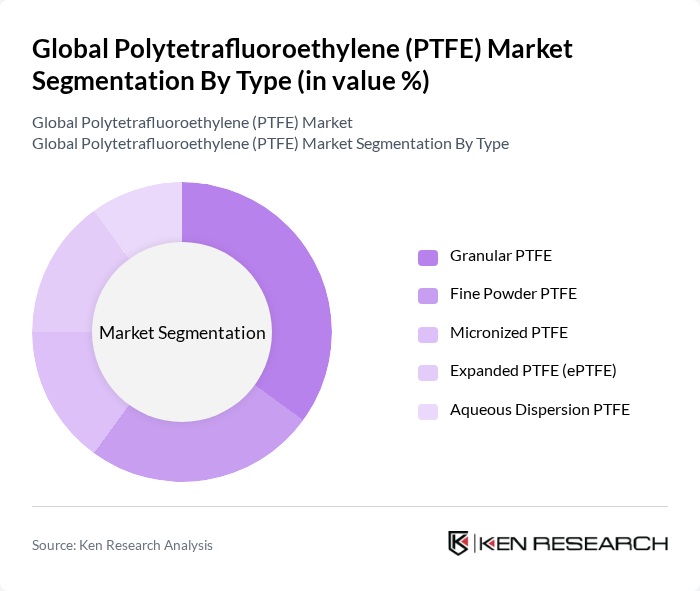

By Type:The PTFE market is segmented into Granular PTFE, Fine Powder PTFE, Micronized PTFE, Expanded PTFE (ePTFE), and Aqueous Dispersion PTFE.Granular PTFEis widely used for its versatility in molding and extrusion applications.Fine Powder PTFEis favored for its excellent flow and lubricating properties, making it suitable for coatings and lubricants.Micronized PTFEis increasingly adopted in specialized applications such as inks, greases, and elastomers.Expanded PTFE (ePTFE)features a unique porous structure, ideal for filtration, insulation, and medical devices.Aqueous Dispersion PTFEis primarily used in coatings, paints, and textile finishes .

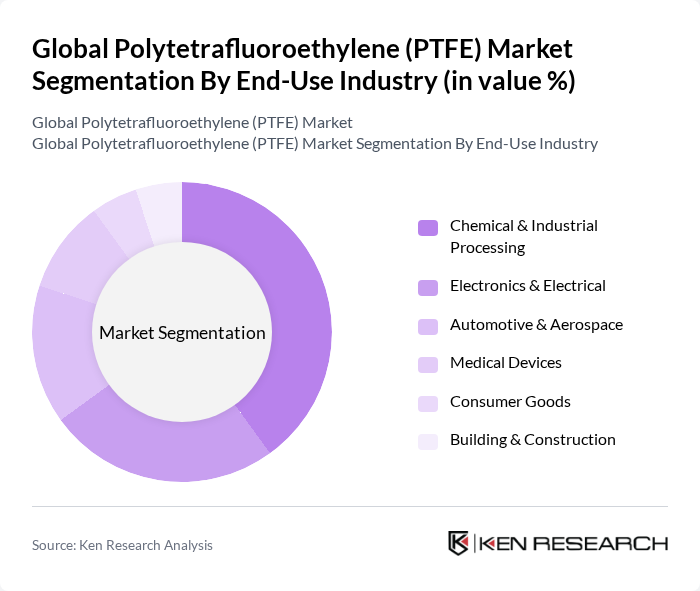

By End-Use Industry:The PTFE market is segmented by end-use industries, including Chemical & Industrial Processing, Electronics & Electrical, Automotive & Aerospace, Medical Devices, Consumer Goods, and Building & Construction.Chemical & Industrial Processingremains the largest consumer, driven by PTFE’s resistance to aggressive chemicals and high temperatures. TheElectronics & Electricalsector utilizes PTFE for insulation in wires, cables, and circuit boards due to its superior dielectric properties.Automotive & Aerospaceindustries increasingly rely on PTFE for lightweight, high-performance components such as seals, gaskets, and fuel hoses.Medical Devicesbenefit from PTFE’s biocompatibility and inertness, whileConsumer GoodsandBuilding & Constructionsectors use PTFE in nonstick coatings and architectural membranes .

The Global Polytetrafluoroethylene (PTFE) Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Chemours Company, Daikin Industries, Ltd., Solvay S.A., 3M Company, AGC Inc., Saint-Gobain S.A., Honeywell International Inc., Klinger Ltd., W. L. Gore & Associates, Inc., Polyfluor Plastics B.V., AFT Fluorotec Ltd., Entegris, Inc., Fluorotherm Polymers, Inc., Zhejiang Juhua Co., Ltd., Shandong Dongyue Polymer Material Co., Ltd., Gujarat Fluorochemicals Limited, Jiangsu Meilan Chemical Co., Ltd., HaloPolymer OJSC, Chenguang Research Institute of Chemical Industry, Shanghai 3F New Materials Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PTFE market appears promising, driven by technological advancements and increasing applications across various industries. Innovations in manufacturing processes are expected to reduce production costs and enhance material properties, making PTFE more accessible. Additionally, the expansion into emerging markets, particularly in Asia-Pacific, is anticipated to create new growth avenues. As industries increasingly prioritize sustainability, the development of eco-friendly PTFE alternatives will likely gain traction, further shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Granular PTFE Fine Powder PTFE Micronized PTFE Expanded PTFE (ePTFE) Aqueous Dispersion PTFE |

| By End-Use Industry | Chemical & Industrial Processing Electronics & Electrical Automotive & Aerospace Medical Devices Consumer Goods Building & Construction |

| By Application | Coatings Seals and Gaskets Insulation (Wires & Cables) Films Pipes & Tubes Membranes (Filtration) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, ASEAN, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Low Price Medium Price High Price |

| By Product Form | Sheets Rods Films Pipes Membranes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Applications | 60 | Materials Engineers, Procurement Managers |

| Automotive Sealing Solutions | 50 | Product Development Engineers, Quality Assurance Managers |

| Electronics Insulation Materials | 45 | Manufacturing Engineers, Supply Chain Analysts |

| Chemical Processing Industry | 55 | Process Engineers, Safety Compliance Officers |

| Medical Device Manufacturing | 40 | Regulatory Affairs Specialists, R&D Managers |

The Global Polytetrafluoroethylene (PTFE) Market is valued at approximately USD 3.6 billion, driven by increasing demand for high-performance materials across various industries, including chemicals, electronics, and automotive.