Region:Global

Author(s):Geetanshi

Product Code:KRAB0068

Pages:81

Published On:August 2025

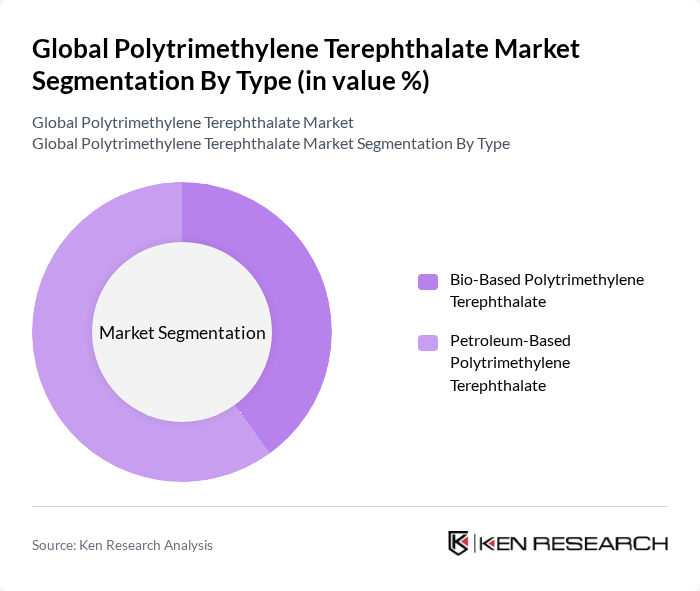

By Type:The market is segmented into two primary types: Bio-Based Polytrimethylene Terephthalate and Petroleum-Based Polytrimethylene Terephthalate. The bio-based segment is gaining traction due to increasing consumer preference for sustainable products and regulatory support for bio-based plastics. The petroleum-based segment remains significant due to its established production processes and lower costs.

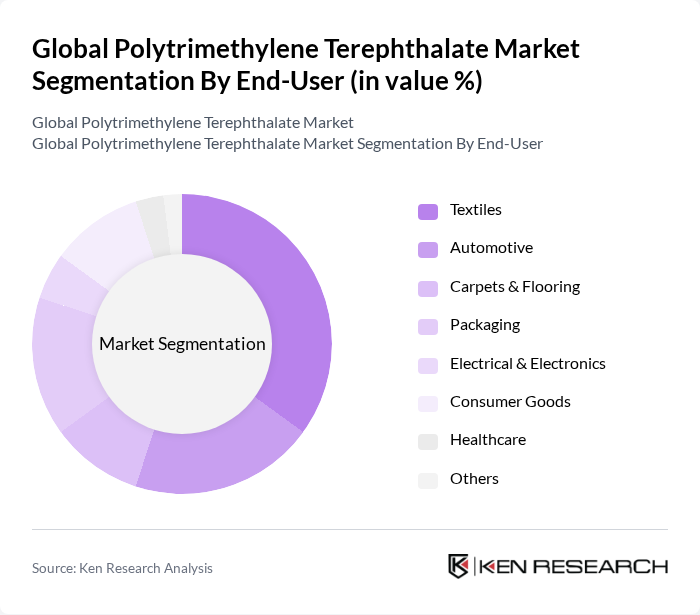

By End-User:The end-user segmentation includes Textiles, Automotive, Carpets & Flooring, Packaging, Electrical & Electronics, Consumer Goods, Healthcare, and Others. The textiles segment is the largest due to the high demand for sustainable fibers and the superior performance characteristics of PTT in apparel and home textiles. The automotive sector is rapidly adopting polytrimethylene terephthalate for lightweight and durable interior components. Carpets & flooring benefit from PTT’s resilience and stain resistance, while packaging is driven by the need for recyclable and bio-based solutions. Electrical & electronics, consumer goods, and healthcare represent emerging segments as PTT’s versatility gains recognition.

The Global Polytrimethylene Terephthalate Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuPont de Nemours, Inc., BASF SE, Teijin Limited, Eastman Chemical Company, Toray Industries, Inc., INVISTA S.à r.l., Mitsubishi Chemical Corporation, Reliance Industries Limited, Far Eastern New Century Corporation, Indorama Ventures Public Company Limited, Celanese Corporation, Lenzing AG, SABIC, Kordsa Teknik Tekstil A.?., DAK Americas LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PTT market appears promising, driven by increasing consumer awareness of sustainability and the ongoing transition towards circular economy practices. As industries adopt more eco-friendly materials, PTT is likely to see expanded applications, particularly in textiles and automotive sectors. Additionally, the focus on reducing carbon footprints will encourage innovations in production processes, further enhancing PTT's appeal as a sustainable alternative in various applications, ensuring its relevance in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Bio-Based Polytrimethylene Terephthalate Petroleum-Based Polytrimethylene Terephthalate |

| By End-User | Textiles Automotive Carpets & Flooring Packaging Electrical & Electronics Consumer Goods Healthcare Others |

| By Application | Apparel & Sportswear Home Furnishings Engineering Plastics Industrial Applications D Printing Filaments Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | North America Europe Asia-Pacific South America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Granules Sheets Pellets Fibers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Industry Applications | 100 | Textile Manufacturers, Product Development Managers |

| Automotive Sector Utilization | 70 | Automotive Engineers, Procurement Specialists |

| Packaging Solutions | 80 | Packaging Designers, Supply Chain Managers |

| Consumer Goods Sector | 60 | Brand Managers, Product Line Directors |

| Research and Development Insights | 50 | R&D Scientists, Innovation Managers |

The Global Polytrimethylene Terephthalate Market is valued at approximately USD 950 million, reflecting a significant growth trend driven by the increasing demand for sustainable materials across various industries, particularly textiles and packaging.