Region:Global

Author(s):Geetanshi

Product Code:KRAB0116

Pages:92

Published On:August 2025

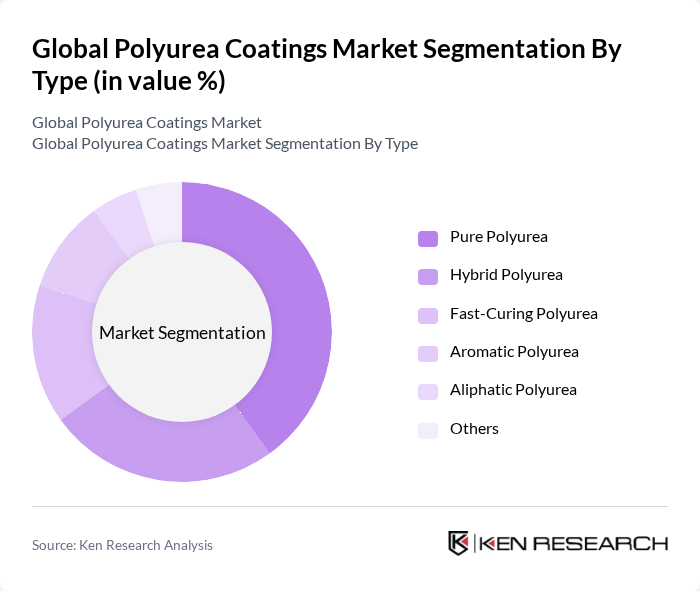

By Type:The polyurea coatings market is segmented into Pure Polyurea, Hybrid Polyurea, Fast-Curing Polyurea, Aromatic Polyurea, Aliphatic Polyurea, and Others. Among these, Pure Polyurea is gaining traction due to its rapid curing times, superior adhesion, and high resistance to chemicals and abrasion. Hybrid Polyurea is popular for balancing cost and performance, making it suitable for a wide range of industrial and commercial applications. The demand for Fast-Curing Polyurea is increasing as industries seek to minimize downtime and enhance operational efficiency.

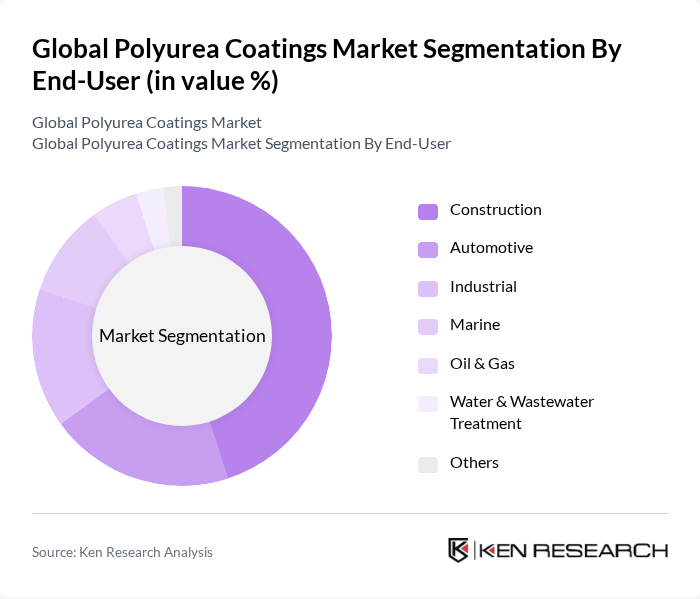

By End-User:The end-user segmentation includes Construction, Automotive, Industrial, Marine, Oil & Gas, Water & Wastewater Treatment, and Others. The Construction sector is the largest consumer of polyurea coatings, driven by the need for durable, waterproof, and long-lasting solutions in building and infrastructure applications. The Automotive industry is a significant contributor, utilizing polyurea for protective coatings on vehicles and components. The Oil & Gas sector is increasingly adopting these coatings for corrosion resistance and durability in harsh environments. Industrial and marine applications are also expanding due to the coatings' chemical and abrasion resistance.

The Global Polyurea Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Huntsman Corporation, PPG Industries, Inc., The Sherwin-Williams Company, RPM International Inc., Sika AG, Covestro AG, DuPont de Nemours, Inc., AkzoNobel N.V., Gaco Western (a Firestone Building Products company), Rhino Linings Corporation, VersaFlex Incorporated (a part of PPG Industries), Carboline Company, Tnemec Company, Inc., and Specialty Products, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polyurea coatings market appears promising, driven by increasing investments in infrastructure and a growing emphasis on sustainability. As industries continue to prioritize eco-friendly solutions, the demand for polyurea coatings is expected to rise significantly. Additionally, advancements in coating technologies will likely enhance performance characteristics, making polyurea an attractive option for a broader range of applications. This evolving landscape presents opportunities for manufacturers to innovate and expand their market presence.

| Segment | Sub-Segments |

|---|---|

| By Type | Pure Polyurea Hybrid Polyurea Fast-Curing Polyurea Aromatic Polyurea Aliphatic Polyurea Others |

| By End-User | Construction Automotive Industrial Marine Oil & Gas Water & Wastewater Treatment Others |

| By Application | Waterproofing Flooring Protective Coatings Lining Systems Roofing Tank & Pipeline Coatings Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Others |

| By Distribution Mode | Wholesale Retail E-commerce Direct Supply Others |

| By Price Range | Low Price Mid Price High Price |

| By Region | North America (U.S., Canada) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Australia, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Applications | 120 | Project Managers, Site Supervisors |

| Automotive Coatings Usage | 60 | Manufacturing Engineers, Quality Control Managers |

| Industrial Equipment Protection | 50 | Maintenance Managers, Operations Managers |

| Marine and Offshore Applications | 40 | Marine Engineers, Coating Specialists |

| Infrastructure and Civil Engineering | 70 | Civil Engineers, Infrastructure Planners |

The Global Polyurea Coatings Market is valued at approximately USD 1.4 billion, driven by increasing demand for advanced protective coatings across various sectors, including construction, automotive, and oil & gas.